Trump Won. Markets Reacted. Then they Changed Their Mind. But Why?

Our Mission Going Forward:

- To do what the MSM Does Not

- Ask the questions that demand fact searching

- Shun Error, but not at the expense of Seeking Truth.

Our First Two Projects:

- We will be looking at the Clinton Foundation's incoming donations over the next 6 months side by side with the same period last year- H/T Robby Norbert

- Because we are sure that it will remove any conjecture that the Clintons aren't running a true charity!

- We will be looking closely at previous GDP releases pre-election and subsequent revisions post elections

- Because we are sure that the complete lack of negative quarters pre-elections is completely genuine

- We already smell the smoke. The fire will be next.

- Soren K & Vince Lanci. (time stamped)

This is about the markets. We promise we will get to it.

First a Brief Rant

"We have nothing nice to say right now,"

Bernie Sanders when asked to comment by CNN

Hey Experts, You're Fired

Idiots nominated the only person who might lose to Trump. They called Clinton a democrat. Vote for her because she's a woman! She will be the first woman president! Are you kidding me? The operative word in that statement is SHE, as in Hillary felt it was due her. Cry me a river Rachel Maddow, who at one point I respected.

Normally we'd throw a phone at an intern or break a keyboard... but ranting will have to suffice. Ironically, we will make much more money as traders now. But that does not make us happy given the collective ignorance of the populace and its blind faith in self interested leaders.

We are angry. Angry at the press for ignoring its responsibility. Angry at pollsters who don't even know their own science. The Banks who sell the public on impulse decisions and take their money. We are angry at readers who continue to believe the nonsense on TV. Angry that democrats ( which 2 of us are) fail to recognize their own biases as "Bitter-Clingers" to their own ideas. Very angry that their children are vested in the outcome of the election.

That schools are involving themselves in it.

Are you F#$king kidding me? The Parents that preached ideologies to their kids should be hung ( for a little bit... just enough to make them say "sorry"). My own 2 grade daughter had a vested interest in Hillary winning, when she should have been taught the policy differences. Whatever happened to Civics class by the way? The schools that feel it is incumbent upon them to step in should have their precious tenure rules removed.

That instead of reassessing why people are wrong, they are satisfied with scapegoating: Russians, Deplorables, Electoral College, Trump or whomever. Have we turned into a country where two idealogies exist and there is no room for thought? Rachel Maddow actually cried on the air. What is going on here? Do you have that much of your identities vested in someone that you can't seperate yourself from them?

Liberalism: A Good Idea Corrupted

They say that a good idea (and business) lasts 3 generations. The first one creates the idea. The second expands the idea. The 3rd presides over its collapse as the idea becomes hollow, dogmatic, and maladaptive. Look at the Dems now, 3 generations into the ideals of globalism and liberalism. Great ideas hollowed out by greed and ignorance to the spirit of the idea. They actually picked Clinton over the person who exemplified their own ideas.

The Tao on Dogma (aka Kool-aid)

When the Way is lost, there is goodness.When goodness is lost, there is morality.When morality is lost, there is ritual.Ritual is the husk of true faith,the beginning of chaos.

Anything that ends in -ISM should be abolished

On the Right you have Bitter Clingers to God and Guns. The GOP has perverted individual responsibility to the point where the human contract is void. Meanwhile they impoverish their middle class voter base.

On the Left: Those who actually drink the kool-aid that pedigree means you are smarter than someone else. That the nanny state will protect you. That you are entitled to things. That would be a "Bitter-Clinger" as well.

Make no mistake. The system is broken. Let the demolition commence. Ignore your responsibility to the voter, you get Trump. Deal with it. He won't be the reason the country falters. We've been on the titanic headed for an iceberg for years. The pilot cannot change course. Dems: shut up and take your medicine. GOP- you have relinquished your right to call yourselves fiscally conservative. Congrats, you have a spender as Potus. Deal with it.

Now, how do we channel the anger towards improving things?

Popcorn Break is Over

We have been content to sit back and watch the last 2 days before making any meaningful statements on the markets during the election. As traders, we had portfolios to manage. If we are not writing we are trading. As older traders we also like to be speculatively flat going into events. We chose to wait to say something until we have something constructive to say.

We hope you find the following helpful. Short on graphics, but long on distilled observations, this is what traders think when they are not pulling their hair out and throwing phones at interns. The following is our take on what happened, and what will likely happen in a general sense.

Authors- Soren K, V. Lanci, WS Banker, and Dinsdale P.

The Last Two Days Were Amateur Hour

The first 48 hours of market behavior were bizarre to say the least. Stocks plummeted only to rally to new all time highs. Gold spiked $50 higher to once again back off. Bonds rallied then slipped the most in years. And the Dollar plummeted then rallied. “Why?” is a question to ask of the educated investor.

What struck us was how much activity actually took place during the election itself.

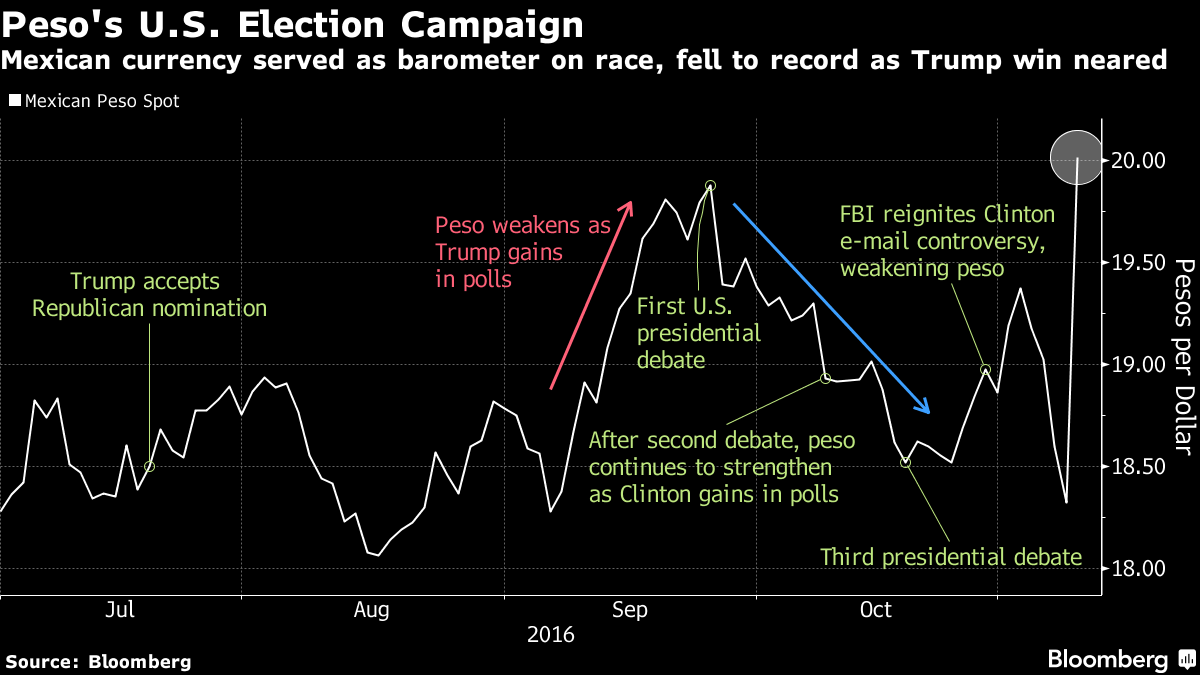

The Peso is the poster child of irrational market movement during the election.

"You'd think that given how much was on the line in this vote, that traders would be a little more sophisticated about their approach to this, and yet it seemed shockingly simplistic. Clinton leading in the raw votes: risk on! Clinton losing in the raw votes: risk off!"

Their is No Cure for Stupidity

Do you think people magically will learn their lesson after that night? Think again. Keep your powder dry and wait for extreme moves. Then pick your spots. Trump's lack of a cohesive tactical plan will give you many chances to buy dips and sell rallies in stocks. But Gold? We think steady as she goes. Start looking at weekly and monthly charts. Dailies mean nothing now. If you can, get a job on a Central Bank desk, they will be buying more.

Sheeple Placed Bets, Investors Waited

Markets reacted as real time barometers. Why? We think that there are far too many people playing markets like casinos. Not only do they think markets are betting vehicles, they are betting on exit liquidity being there. Ever have to sell a house TOMORROW? Good luck with that. Stock liquidity is what we call Non-Continuous now. Simply put, you can sell unless you want to. Gaps, fading bids as you try to sell, fake liquidity will all continue to be the hallmark of a market dominated by front running algorithms.And that is made worse by lemming- like behavior of funds.

Some culpability lies with the ease of putting in orders these days. Hitting a button gets you long. Hitting another gets you short. It looked like a bunch of children at a grocery market checkout aisle, impulsively loading candy, gum, and chocolate into the cart while their mom kept taking it out.

Bitter -Clingers on Both sides of the Aisle

We also suspect investors who happened to be Democrats actually believed the end of the world was coming and sold stocks on that absolutely brain-damaged concept. Flow algorithms front-ran the orders and the snowball effect happened. On the political right investors thought it was a good idea to buy Gold. Enablers enabled too. For all their knowledge and talent, certain authors did the investment community a disservice pushing their “End of the World, Buy Gold Now” newsletter for what? To make a buck on the downstream investor who are easily influenced when not educated on the implications of their decisions. People’s fears were preyed upon. Buy the book, but burn the newsletter.

Meanwhile, Carl Icahn left Trump’s Celebration and invested $1BB in stocks after the swoon. Who's the idiot now?

The Fed Shake Out- December will be Muy Importante

- Banks, bonds and healthcare all had big moves yesterday as the winners and losers from the change of guard were sorted.

- December Fed Hike is mixed. The case for a hike is both politically motivated (Obama is a lame duck and can't stop the Fed) and market-wise given the bounce. But external factors like Brexit, the Italian referendum and the French vote all will play a part.- Shitstorm ahead

- Trump's policies will be inflationary, there may be a need for more rate rises than previously forecast- Pimco

- Meanwhile, Goldman Sachs Group Inc. cut the chances of a December rate rise to 60 percent, from 75 percent.- go figure

Commodities Surge

- Trump's promise to rebuild American infrastructure means commodities used for those projects will benefit under his administration

- Copper added as much as 3.9 percent to $5,625 a metric ton on the London Metal Exchange

- Zinc futures in Shanghai climbed to the highest level since November 2010.

- Iron ore rallied to its highest level since January 2015.

Stocks Boom Higher as the Rotation Begins out of Bonds

- In Japan, the Topix index closed 5.8 percent higher

- the MSCI, S&P, Nikkei, and the Stoxx 600 all were higher this morning.

Media and Polling Failure

There will be plenty of takes on what is next for our economy in the coming days. We will give our own as well. One thing should be patently obvious to all. The people who got everything entirely wrong should not be asked “What happened?” They are by and large the shills and infotainment talking heads of the main stream media. Politically, the Elitist Democrats are coming off as the new “Bitter-Clingers”, married to their dogma and in deep denial as to what happened. Similarly, the economic “contributors” who get paid by the media to say something, anything to keep viewers on the screen to swallow more advertising tripe should be fired. Instead, they will become the “go to” people who are asked what went wrong. Almost as if the markets are wrong, and they were right. These people should be ashamed of themselves.

The Main Stream Media is a Tool

The Press abdicated its responsibility, eschewing its role as the 4th estate for ratings and becoming voice boxes for its owners. You know, the ones who donated to campaigns and instructed their employees to pass off opinion as fact. And the anchors are now worse than the bubble headed bleach blonde weather girls used in the 80s to report the weather. Half were vapid idiots spewing dogma put in their earpieces. The other half truly were bitter-clingers. Incumbency is the new conservativism. If you are in power, Dem or Repub, you don’t want it taken away. The main stream media is a tool. Do not get us started on banks that release research to get you to trade and give them an exit strategy. That, my friends is a fact.

Pollsters are Clowns

Passing off polling as a “probability” tool is repulsive. A poll is merely a person’s opinion at that particular moment. And with so many events happening, these people should be drawn and quartered, passing off a 2% lead as reliable. We made this extremely clear during Brexit, and continued to explain the shortcomings of polls in a situation where data was not plentiful. Polls should come with a warning label

WARNING: Clinton has a 2 percent margin in the popular vote today. There is a 10% margin for error. So she could be up 12% or down 8%. Our poll is meaningless. And by the way, we are a Democratic Republic, so popular vote is an erroneous tool. The gerrymandering of our republic has made our poll even less relevant. Feel free to flip a coin. We don't know our own science.

We’ll have a lot more to say on this later, with special attention to the popular vote being contrary to the Electoral College twice.

Echobay’s Calls: Good, Bad, and the Ugly

- Our group completely thought that Trump would lose after the Comey “get out of Jail” letter was released. We were wrong.

- We voted for Trump. Not as a “Lesser Evil”, but as a Greater Good. The rationale being

- Trump will not be able to do anything rash, balance of powers will see to that

- Trump talks bigger than he acts, and at heart will compromise. His popularity is more important than his philosophy.

- A Trump victory forces the Dems to radically rethink their way of doing things

- The GOP must also rethink itself as their entire infrastructure was built on Trump not winning

- There is a real chance that the parties will both begin to heed the message sent by the voters. That being We are Right here and you are not paying attention

We stick by that

- In several previous posts, we described Trumps likely policies and their effect on Gold.

- Trump Will Spend Like a Drunken Sailor- if they let him

- Fiscal, not Monetary Tools- tug of war between Fed and Trump means he spends, Fed raises rates.

- Inflation will happen in a more orderly manner- welcome to the 1970’s

- Isolationism and downgrades of war risk in the Middle East- lives will be spared, trade wars may be a negative factor. Trump was called the Peace President by the Russian people (not Putin). Think on that.

- Building things whether we need them or not- that’s what he does. Borrows to build.

- Stocks will outpace bonds for the foreseeable future- The UK is the template

- Gold: Give it a name. We were right. And not afraid to say when we are wrong. That is what traders do. Newsletter writers make excuses. People with skin in the game reassess. Those without can rationalize being wrong. That goes for Central Bankers, the Academic Yet Idiotic crowd. While others were opining on who would be better for Gold, or that Gold was dead, or some other navel gazing nonsense, we laid it out there. We gave investment and trading advice. Not simple predictions that can be ignored if we are wrong. So keep watching CNBC and listening to so-called experts who will continue to spoon feed you pablum like: Gold should do well, We are buyers of dips, Trump may cause inflation, if you want to be comfortable and not think for yourself. Everyone else, start paying attention to the "alternative media" like MarketSlant, Zerohedge, HedgEye, Taleb, and others who lay it out there and are not in denial.

- Buy it at $1250

- Sell it at $1300

- Be careful of a sell signal under 1308

- The GDX was not a better buy than Gold after its 10% drop

- Be long through the Fed

- Be flat, reassess through the election

- Stocks were poised for a massive move lower

- Nov 2 Update: Gold hits $1308, S&P trades 1297-What Next?

The Original Post: Oct 9th: Gold Trade: Long above $1250 with $1300 Target- here's why

For now we’d like to assess the last 48 hours and look for clues towards the next 4 years.

Election Night Was Stupid, Markets Acted Properly Afterwards

Assumption- There will be Inflation. Invest Accordingly

Gold: Buy Dips Now, Not Rallies

A $50 move higher was insane, even if it was justified because the dollar took a pounding. We told you. Gold will be a buy if Trump wins. It will move in an orderly fashion higher. But not until the initial euphoric reaction goes away.

- Conclusion: Gold will rise in a more steady manner. Volatility of price will be less than under Clinton. This applies after the initial spike post Trump's win. Let's face it, Trump will be hog-tied by the senate and locked in a closet for 30 days. That will not stop inflation. It will just give a dip to buy.

- Trump won. Do not chase Gold, let it come back to your level. Trump will not get much done in his first 100 days. The legislative houses will block him at every turn giving opportunities to buy.

- The last 10 Years have shown us what happens When Gold moves higher too Fast for the Fed's taste. It also shows us that the Fed's effectiveness is waning. Lastly, low volatility Gold gets the job done without headlines.

Stocks: Here is the Answer Key

Stocks will perform better than bonds, but not well enough to offset all inflation. The “tell” is the UK. Since the GBP devaluation and the Brexit vote, their stock market has been one of the best performing of the year. But in GBP terms it has been the worst. The Gilt is under water as well. And that is the way markets behave under inflation.

FTA: Inflation Begins and the UK is Ground Zero

This is Inflation. Right here, Right now- U.K. Edition

Nothing has made sense. Fundamentals are useless. Active management is devalued. Stocks go up on bad news, and up on good news. Correlation Lock is on the horizon again. Here is something that finally makes sense.

- Fact 1:The UK has the best-performing major equity market this year 12.08%

- Fact 2: In constant-currency terms, it's the worst-performing. GBP/USD=-16.67%

What We are Doing

Gold and Silver

What: Buying with a 5 year time horizon

How: On dips. The trading aspect of Gold will be to sell some on spikes because the Fed will raise rates and chase hot money away. Then pick spots to add again

Why: Central Banks will become chasers of Gold now as their fears of a “disorderly” dollar debasement will grow. Central Bankers are no longer coordinated in their efforts.

Stocks

What: Buying them. However we feel the value of active mgt will rise in importance. Passive funds are sheep herders. ETFs are crap. Election night should have made that clear. Stock selection will be back.

How: Not sure yet. Depends on our opinion on the USD, which is mixed. For starters, short MSM on principle! Long energy refiners, infrastructure firms. The big question is, do exporters (caterpillar etc) do better or worse?

Why: equities will keep a pace with inflation somewhat. Call it a dollar hedge. We also feel there will be a massive rotation out of bonds into stocks now.

Bonds

What: we’ve had no strong feel on this until recently. Short Bonds, Long TiPS.. still needs more info

How: Sell rallies, lock in your variable rate mortgage

Why: The Chinese will accelerate their Yuan devaluation to remain competitive. This is part of their need to sell their massive US treasury portfolio at a faster pace. Trump will likely not do QE, which supports bonds even while it prints money. He will just issue debt and spend. Helicopter money is also on the table. By any other name, H-Money is just printing money and getting it to mainstreet either via jobs or be permanently monetizing our debt. This is what we did in Vietnam.

USD

We are not sure. Gold's rally will be a function of its re-monetization. Gold doesn't have to depend on the USD as much to rally. But a weak dollar sure helps. That said there will be a tug of war:

- Weaker Bonds= weaker USD sometimes

- Isolationism= weaker USD, but not as badly as the countries that need $.

- Fiscal Policy- functions like "spending at home", but weakens bonds and the USD.

- The Fed= raising rates will curtail weaker $, but always in reaction to facts already in evidence. They always "chase" the problem.

Conclusion: We don't know. But given that we will be short Bonds, long stocks, and long Gold, why even bother with a USD opinion? The other positions will benefit from a weak dollar. We do feel the dollar will be debased. However, not until everyone else has finished racing us to the bottom. Our goal is to first export our deflation. Then to "virtually default" on our debt by printing.

Final Thoughts: The UK vs.Japan.. and Trump as Curve Steepener.

England is Inflating

The UK is showing us the way in terms of normative market behavior. They are exhibiting the "whiff of inflation" first. And noone cares, which we like.

Japan is Not

But diametrically opposed is Japan. The BOJ has tried for 10 years to stem deflation and has failed.

Which is the True Trend?

So why the difference? Our only leg to stand on that differentiates between the 2 economies is the sheer homogeneity of Japan. They are old, and dying. And the consumerist approach is not working. So what gets rid of deflation in Japan? Immigration. We bet they change their policy on immigrants and become a more diverse economy. Our bet is Australia benefits. but Japan may not be able to get itself together fast enough to stem the coming Chinese encroachment on their lands.

Trump did in 2 days What the Fed has Failed to Do for 2 Years

That being steepen the yield curve. hiselection and the bond market steepeningmarks teh end ofQE. adn the beginning of straight deficit spending.

Are we angry? You bet. That is the irony of the ttrading business. What makes us profitable isalso what makes us so annoyed that people do not get it. So we will be more profitable for it and able to spend money on therapy afterwards..Heaven knows we will need it.

Good Luck

Read more by Soren K.Group