Technical Brief: Are Stocks Living in a Domed House?

- Stocks are weaker

- Gold is range bound

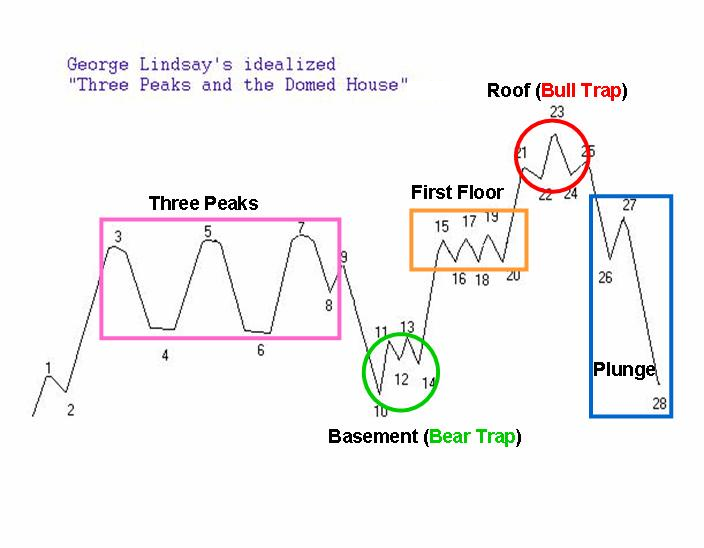

The technical formation called "Three Peaks and a Domed House" is potentially signaling a serious top in the stock market. It is a complicated pattern and as a result appears infrequently. It is also true that complex patterns work less often than fans expect.

Break it Down

As a result, of its outrageous complexity not too many people take the pattern seriously. but perhaps if they looked at it more as a combination of 2 separate patterns, that would change. In this case a triple-top breakout followed by a rounded top failure. Looking at it that way, applying it to the S&P you might be more inclined to pay attention

Ignore at Your Own Risk

The point of noting these formations is not to have a market opinion. The point is to know what to do if they are fulfilled or triggered. The "domed house" formation calls for a massive selloff once the "first floor" is breached. So feel free to put a sell stop in at that level. But make sure you have a stop loss in as well.

Noted and Alert is Set

For us, when formations get this complex, we like to break them down into smaller formations. Right now we see a potential rounded top forming with a lot of congestion to work through if we get down to 2120. But to dismiss formations because they are so rare is to not buy earthquake insurance in San Francisco. It is equally irresponsible for pundits to go around crying wolf when a formation hasn't even formed. Especially when the Fed is the market backstop.

Perma-Bear Cemetery Below

S&P Technicals

- Fibonacci Pivot- 2145

- under 2145 negates upside

- choppy sideways here

- under 2125-2120 may pause then accelerate down move

- get out of the way if new highs. it will likely be a pile -in event

Gold Weekly

interactive chart HERE

Gold Technicals

- Fibonacci Pivot= $1338

- neutral between $1325 and $1338

- slightly bullish above $1325 on today's close with a tight stop

Good Luck

SK

- The Deutsche Bank Crisis Primer

- Top Day: Deutsche Fallout, Yuan's Rise, Gold Bid

- Is Elon Musk's Success the Problem with Tesla?

Read more by Soren K.Group