"The Seed of Failure is Sown in the Greatest Successes, Whether you be Bricklayer or Billionaire"

- The Bricklayer- actual quote

Please, I laid brick for 30 years. Don't you dare tell me I don't know how to tune a piano!

- The Billionaire

"I made a Billion dollars with my last idea. I am good at this. Luck and Providence had nothing to do with it. If I'm good at this, then I should be good at anything I try"

Elon Musk actually said this about his Mars program

Are you prepared to die, then you are a candidate for going to mars

Read the Signs

Electric carmaker Tesla Motors Inc (TSLA.O) Chief Executive Elon Musk told employees in an email to follow company policy of not offering discounts on new cars, answering some investors' recent concerns about the practice.

In a Twitter message, Musk said "corrective action" had been taken on discounting of new vehicles, which "seems to be limited to a small number of cases." Tesla has posted an operating loss in 14 consecutive quarters and negative cash flow since early 2014. It is facing a cash crunch at a time when it seeks to purchase its money-losing sister company, SolarCity Corp (SCTY.O).

Do The Math

Cowen's Investment Thesis

In the 12-month investable time frame our rating contemplates, we see Tesla as a great company lead by a true visionary, but must acknowledge the asymmetric risk/reward profile for the stock at the market’s current valuation. Simply, we see a lot more that can go wrong than can go right as the company transitions into Mr. Musk’sgreater vision as laid out in his Master Plan, Part Deux. We see the potential for delays in the introduction of the Model 3, ramp of the Gigafactory and integration of SolarCity leading to increased cash burn levels.

Note The Fraudulent Pretense

FTR: The acquisition of SolarCity may be more of a benefit to the acquired company than to Tesla. We struggle to see quantifiable synergies attributable to Tesla.

Beyond operating expense reductions it remains to be seen what cross-selling opportunities truly exist over the next two to three years. We question how much knowledge transfer can occur from a Freemont, CA based auto assembly plant to a Buffalo, NY solar module facility. Longer term, we are positive on solar+storage systems, but the current regulatory construct in major markets does not make them economical.

- From the MarketSlant Article

FTA: Tesla then makes a bid outright to buy all of SolarCity at above market valuations using Tesla stock. This essentially ensures a payout to himself and his partners at SolarCity while eliminating the SpaceX debt. Now it all depends on the price of Tesla stock. And Tesla has been punished by the market since the announcement.

Finally there is the loaned stock by Elon Musk to SolarCity. If Tesla drops enough for a margin call, it is all over in our opinion. what we have not covered includes the valuation offerred to buy SolarCity. Public shareholders of Tesla should be incensed atthe price being paid for SolarCity. Meanwhile, much of SolarCity's stock is still in the hands of Musk and family members.If Tesla stock drops enough, it could take out potentially all 3 companies. Essentialy Musk is at the center of an American Keiretsu.

Full Article here: Elon Musk Played us

- Tesla Board Said NO to Solarcity Deal in Feb.

Mr. Osborne goes on to point out ,incredibly, that just month's prior to the SolarCity bid, the Board decided it was not in Tesla's best interest to get involved with SolarCity

FTR: Tesla’s Board held a special meeting on February 29th according to the proxy to evaluate the combination with SolarCity. Following the discussion, the Board of Tesla determined not to proceed with the evaluation of a potential strategic acquisition of a solar energy company, “due to the potential impact on Tesla management’s time and resources in light of Tesla’s execution of ongoing operational and strategic initiatives, including Tesla’s ongoing production ramp of its Model X vehicle.” We believe the Board of Tesla should have stuck with its initial gut reaction....

Yet it Happened Anyway. We think it is obvious why. What isn't obvious is how Tesla's board was convinced to change their mind?

Auto-Pilot has No Protective Moat

Built in the basement of the first person to hack an iphone- Coming to Costco soon?

Feel The (Cash) Burn

- SpaceX is the Financial Linchpin in Elon Musk's Government Subsidized Empire

Space X had positive cash flow because it collected revenue foodservice to be provided i in the future. So its current expenses of production were minimal compared to SolarCity and Tesla. it helps to understand how revenue is earned at each company

- Tesla- good product, capital goods, negative cash flow that needs production scale to survive

- SolarCity- fee based "rental" business that is a cash burner needing production scale to keep costs down and survive

- Space-X- takes in revenue NOW for promises in the future of services.

Witness the Denial

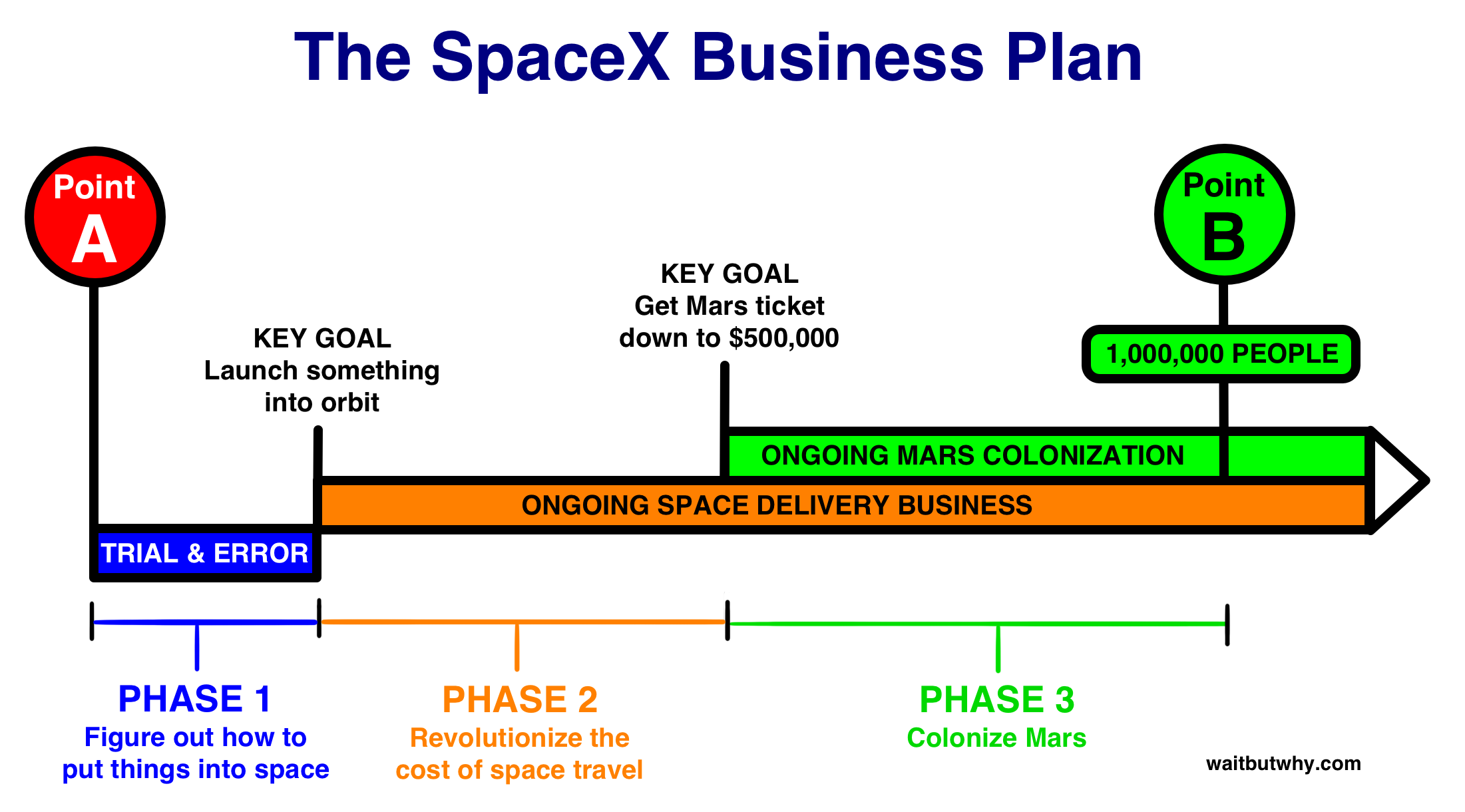

When a cult leader's predictions do not come true, they kick the can down the road. A test rocket doesn't work? No problem. Let's talk about going to mars. Visionaries are prone to betting on themselves. And when they fail, they see it last. In the video above Musk discusses Point B. Visionary Entrpreneur? YES. Businesman with a plan? Not so sure about that. It is a lbig leap from taking credit card numbers in PayPal to sending rockets into orbit. Even for a visionary motivator running 3 companies at the same time. He will succeed. Because the Government cannot have another disaster like Solyndra.

Good Luck with that. This is about militarization of space, and mining minerals. In the end, it will be robots, not people on those flights. Weekend getaways to Mars are just the selling pretense.

Read more by Soren K.Group