UPDATE: Right now we are loooking closely at things as traders, not as writers. Gold is damaged as a long biased trading vehicle. But that was always on the table. The investment concept is a 5 year one, and more valid than ever. It is a hedge against the rest of your assets. Ignore End of the world predictors telling you to buy gold now or you never will be able to again. It's crap. But do not sell what you own. Buy more as it drops IF you are taking profits in stocks. That's the idea.

ICYMI

1- long thru the fed

2- flat the election

3- sell signal below 1308

4-we sold 1289 getting out of longs pre election... miserably happy now

Note the url- http://www.marketslant.com/articles/gold-alert-close-spec-longs-now5- right or wrong, all things must be considered.

**Original analysis begins after update ends

TRADERS TAKE

- Some notes after a risk meeting today. Note statements put in a "factual" phrase are just opinions we are testing out.

- If this type of thing is something you'd like to see more of, then we can accomodate.

- Future versions would be neater.

- Comment and/or upvote if you want more stuff like this.

- We need to know readers care if we are going to do it.

- Takes alot of resources to do properly. Excuse typos for today please

- Gold Dump- crispin odey probably puked. Druckenmiller was out. $1400 lots hit market ahrd, then another 1100 lots.. probably otc bank got hit and laid off on cme screen. after already shorting/ frontrunning while odey was on hold.. lol

- 1970s inflation thesis is intact, more so now.

- HELICOPTER MONEY- the permanent monetization of debt (bonds become like stocks in a sense) is the preference here. Just roll the debt forward, repeat...Steepens curve, trickles down better, used successfully to finance Vietnam.

- also gives people jobs.. illusion of safety, creates confidence and esteem in public... but inflation kills buying power

- BUY AMERICAN will become the cry, and noone will be able to buy anythign else becasue of the inflation.

- The endgame is inflation... but the game now is to spend as much money as we can before inflating. Look for the US to just buy stuff likethechinese do in advance of debasing

- Tesla is dead... govt subsidies will end.. but cheaper competition will stick a fork in it.

- Coal is the real deal as efficient energy, but any pretense of clean coal is a scam.. so be long but dont believe the hype

- Gold like the 70's will be last to rally in this inflationary cycle. Gold does not lead in real inflation. look it up.. slow rally.. spike is end in 1970-1984 mkt

- Fed will chase inflation. their inability to get rid of deflation for 10 yrs is proof they wont be able to just raise rates to stop the acceleration.

- Real rates will stay negative.forcing more money into stocks, even while bond yields start to rise.

- Fed will buy stocks now. This way it can hedge inflation,issue debt, and monetize it without flattening curve. China will also buy stocks

- Chinese stock market will do better than us maybe? as we go real assets, they go financial?

- buy industrials, but on massive pullbacks, ignore the herd. sell into spikes when we have the stomach

- December is dangerous- Italy, France, Brexit, Fed, all on table. and CB coordination is dead- nationalism on rise. blowback of Obama globalism peak

- trump, brexit, nationalism- be careful what you wish for- trade tarrifs, isolationism etc.

- can the EU survive? what a mess wihtout dfiscal unity, monetary policy is at its end

- do not underestimate supranationals ability to defend their globalist dogma.. their survival depends on it.

- Fed will raise rates to offset Trump attempts to spend by issuing debt over long term

- Fed will raise at least 1x by march.

- Banks will do well as financiers of infrastructure, deregulation as Trump is happy to become an insider

- Gold will have technical pressure every time it gets to $1250- $1280 now

- Yield curve will continue to steepen- Banks, Fed, want that.

- QE hinders curve steepening but sterilizing money printing with long end bond buying, but... it may be necessary to get the chinese to slow their sales of our debt.. at least a little

- Platinum/ Gold spread is worth looking at

- New Silver/ Gold contract will serve to increase Silver buying net/net and narrow the spread from retail interst.

- Silver/Gold./Copper Ratio trades are on our radar now

- Gold is sufferring rightfully because of the irrational front-running of industrial resources.

- The herd is still in control.

- The UK is still the template for the US going forward- strong stocks, weak Dollar.. but not weak fast enough.

- Trade wars will make it hard for USD to weaken.Fischer already rationalizing that

- Correlation trading is back, as things decouple now and slowly act on fundamentals.

- China sees the US as a competitor on industrial goods and will lift offers before debasing its Yuan even more. Thats what they do. Spend Yuan, then weaken the currency. Then public panics and buys the top. (see brexit)

- low price of gold will cause countries long on gold and short on cash to sell into weakness, like Russia

- Russia might get killed- oil low, gold low, cash reserves low. Economic warfare will cause them to withdraw aggressions?- russia has most defaults on bonds if memory serves right.

- Everyone buying infrastructure stocks, sellingtech stocks will be right years from now. But it is all hot money. And hot money pukes on the slightest bad news.

- Retail is buying physical gold now... saps or ground swell?

Trades to assess

- Selling puts on Gold companies might be an idea worth looking at on selloffs vs buying SPX puts

- Buy silver, sell copper.. use Gold as "precious" hedge- trade the range at extremes

- Sell bonds on rallies- TiPS are good but CPI numbers will be coooked. too many govt employees now

- Buy farmland companies- Agro on bovespa?- see if Soros still owns

- keep buying silver coins on dips- preference maple leafs now- "college fund"

- REITS? revisit and see if they will benefit from tax code changes.

END UPDATE

Technical Update- Gold and Stocks

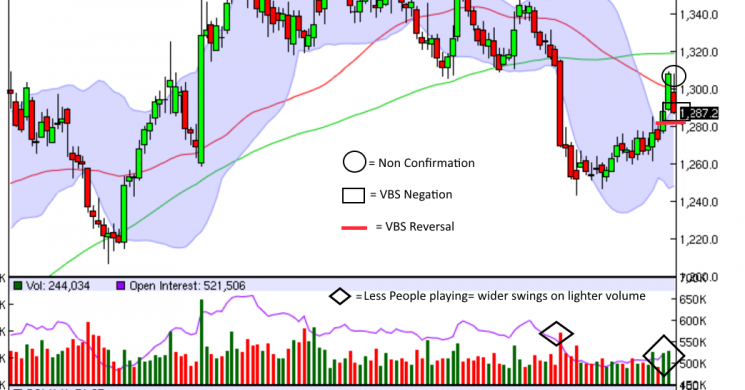

We use several different types of models for different types of trading opportunities. The best trades come when different models corroborate each other. Three days ago we had one such corroboration when our value signal which gave us a BUY at $1250 was backed up by our own Volatility Breakout Signal (VBS) trigger at $1278. Our signals are right about 50% of the time. But when they are right the payout is at least 2 to 1 on a risk reward basis.

Right now we are getting a sell signal on one system in Gold, and an "exit longs" on another. These are powerful and should not be ignored. They served us well at $1250 in Gold and 2147 in the S&P.

Gold Two Days Ago- Long Through the Fed- Article HERE

Gold

The Article 50 rejection gave some hope to the non-Brexiters and likely was an external driver. Why, we do not know anymore. Peter Hug explains it better. But the technical systems say Do Not Buy the Dip if you are already long. Exit liquidity is thin.

- Recovery Rally - The rally objectives were hit, but we are still in a down trend

- VBS Says Get Out- The Breakout system we use for momentum trades has given this morning an "Exit Longs NOW" signal.

- Trend Reversal Not Broken- Only a close over $1308 (Fibonacci Reversal) negates the downside

- Non-Confirmation-Yesterday's high was not confirmed by a new high in the RSI, just as the low at $1250 did not have a new low in the RSI

- Less Risk Capital-Volumes and Open interest confirm suspicions that less people are allocating to Gold after they got hurt in the sell-off

Bulls:

Hope that this is a bull flag inside the larger bear flag and buy dips or they can buy above the Fib Number

- buy dips above $1289 and as far down as $1278. We have no stop levels below we like

- buy strength on a settle above $1308 or a trade above $1312 with a $1307 stop

Bears:

We could be setting up for a nasty reversal. VBS said to exit longs below $1289- we did

- Sell Weakness- VBS says to short on a settle below $1289 or a trade below $1282- we will not do this trade, but it is valid

- Sell Strength- Non-Confirmation says to be short below $1308. Which implies selling strength, not weakness- we will scale sell rallies on light volumes between $1290 and $1300 with a $1308 stop

Stocks Might Be Even Worse Now

Original Technicals- 10/10

Trend line broken yesterday, weakness continues

Under 2147 (Fibonacci Pivot) > 2128

Under 2128> 2093

Domed House in play

The Original Signal

Happened.. and reversed hard.. trade is done. lucky to get out alive- SK

Followed by the Potential Domed House

Read more by Soren K.Group