Source: Clive Maund for Streetwise Reports 05/20/2019

Technical analyst Clive Maund charts silver and finds that it looks "considerably weaker than gold."

Silver looks considerably weaker than gold, although that is normal at this stage in the cycle. It is still considered likely that it is forming a Double Bottom with its lows of late 2015, and if so then the support at those lows should hold.

On silver's 1-year chart it still looks like it is moving to complete a Cup & Handle base, because the pattern roughly parallels the pattern completing in gold, although the downwardly skewed Handle is driving the price back down towards the vicinity of the lows of the Cup. A breakout from the Handle downtrend will be bullish although this doesn't look likely short-term because of adverse seasonal factors.

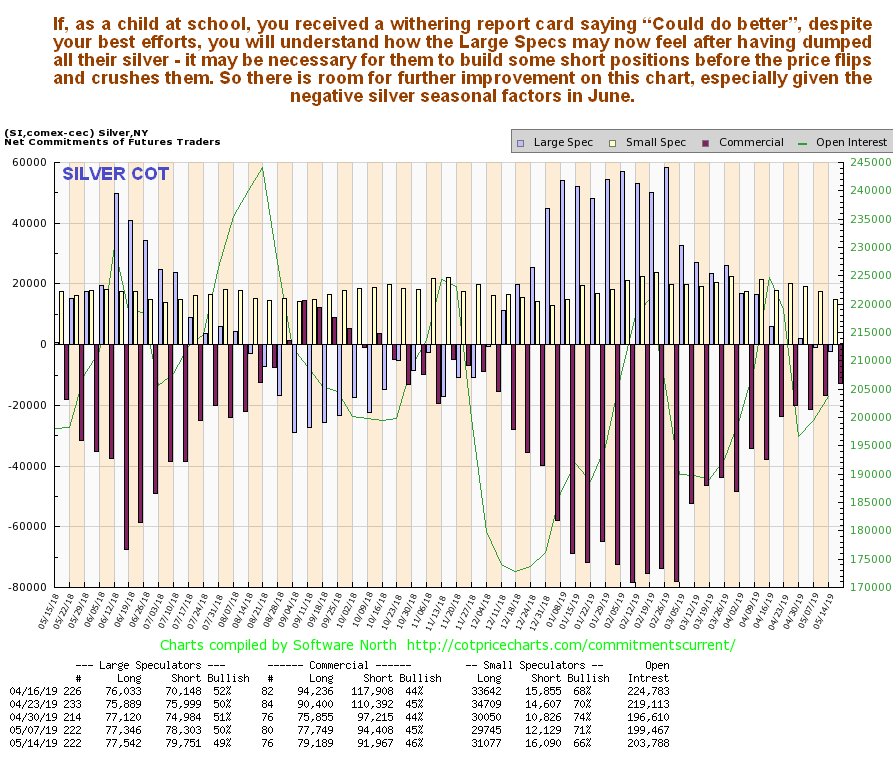

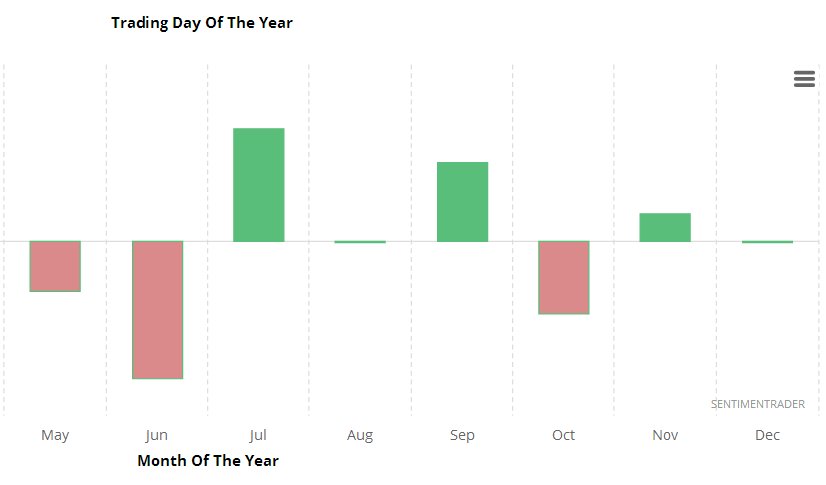

In contrast to gold, silver's latest COT chart is already starting to look positive, although there is room for further improvement which may occur, meaning still lower prices for silver in coming weeks, due to June being the most negative month seasonally for silver, although this will clearly not be the case if Iran is attacked.

Silver's seasonal chart does not bode well for coming weeks, although it should be emphasized that this is a background factor and silver has already dropped quite a lot and is approaching support, so we are not expected to see much more downside. The key bullish development to look out for is a breakout from the Handle downtrend shown on the 1-year chart, although that may still be some weeks out.

The conclusion is that the big picture for gold and silver continues to look strongly positive, although we may first have to contend with weakness between now and July due to the current downtrend coupled with negative seasonal factors until the end of June, which should present a window of opportunity to build positions across the sector ahead of the expected late summer advance that promises to be very substantial if gold succeeds in breaking above the key $1400 level.

Originally published on CliveMaund.com on May 19, 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure: The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Read more by MarketSlant Editor