$1247 gets you $1220, but above $1214 and the $1550 target is still in play

via Soren K. Group for Marketslant

It should be noted that we are concerned that Gold under $1247 gets us to $1220. But the wave count we have been following says that a sell-off above $1214 still keep it intact. It is just hard for us to buy dips on short term trades. We'd rather buy a bounce off the lows. But as long as Gold remains above $1214 both the wave count and our own feel corroborate each other. It is just a matter of a person's time frame.

Chart HERE

The only other thing we can add to the excellent analysis below is that there is now a double bottom on the 30 minute chart. That is something we like to buy with a stop out right below that level for a bounce swing trade in a bearish mindset. it would be nice if what we see as a swing trade is in fact really a bottom as Enda says it could be.- Fay Dress writing for SKG

GOLD bullish at 3 degrees of trend

via Enda Glynn and Bullwaves.org

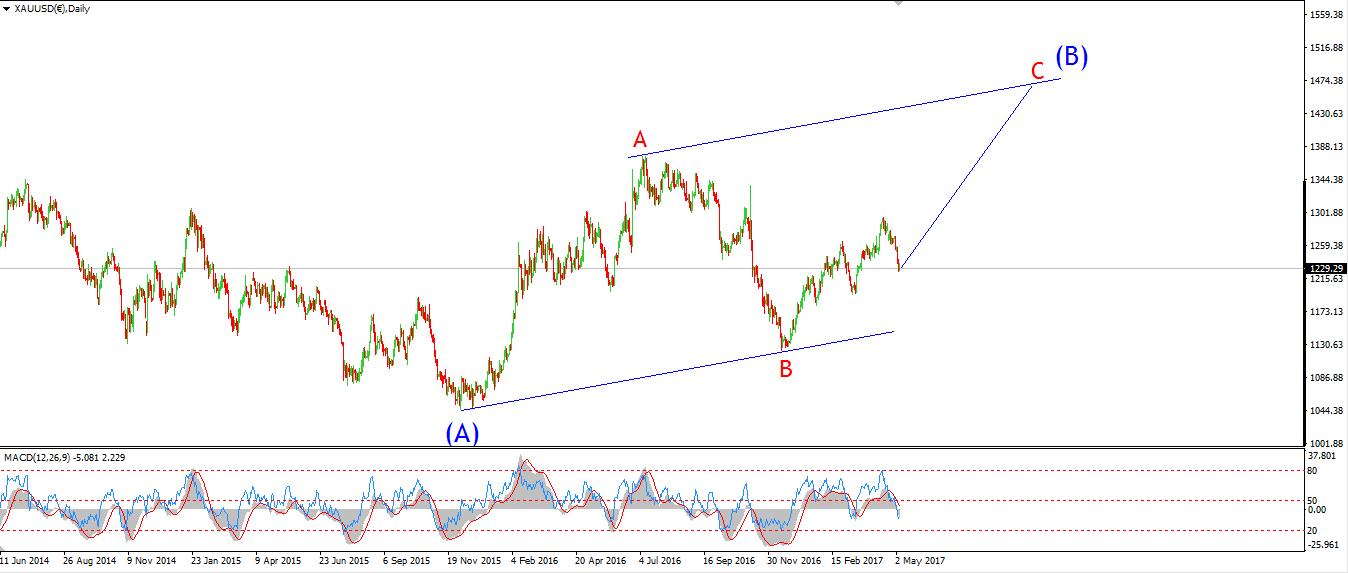

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: Existing Home Sales, Crude Oil Inventories.

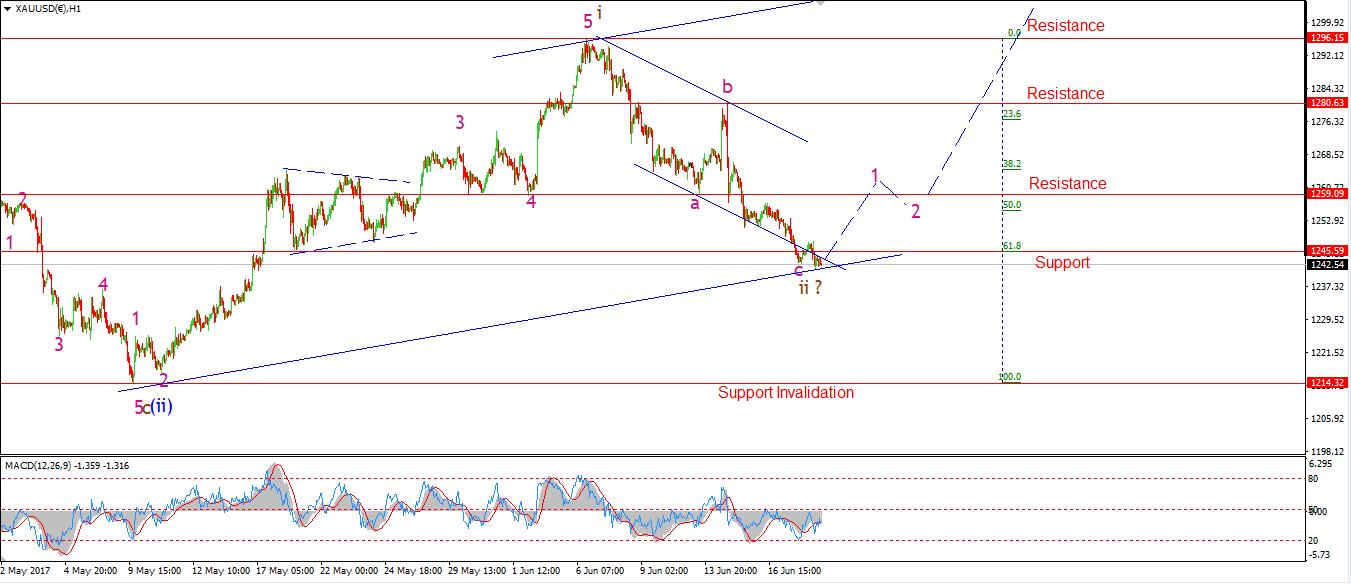

Downside momentum in GOLD has now flatlined after todays sideways action. Wave 'ii' brown is now likely complete at the lows of the day of 1241.23.

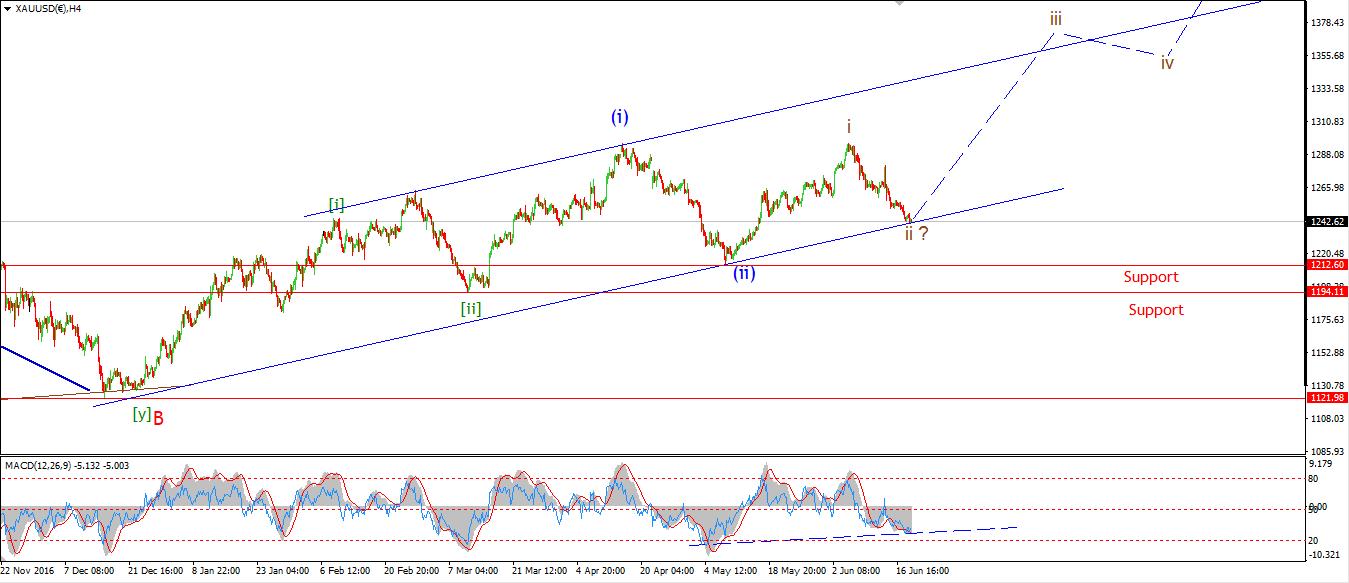

Remember this market has now completed a rally and decline to higher lows at three degrees of trend over the last six months. I believe we are now on the cusp of a serious acceleration higher in the GOLD price.

The momentum situation is very bullish again on all three charts. And this setup coupled with the bullish wave count should make even the most skeptical onlooker sit up and take notice.

Wave 'iii' brown will begin with a break of 1259.09 and a correction to a higher low. I have shown that possible rise as waves '1' and '2' pink.

For tomorrow; Look for signs of a turn higher, And an Elliott wave buy signal off the lows.

30 min

4 Hours

Daily

More analysis at Bullwaves.org

Previously:

- MYSTERY SOLVED? GOLD OVER $1214 GIVES $1550 AS TARGET

- Project $1550 Gold: Buy Dips Above $1248

- Why Gold is Up and Why $1550 is Still The Target.

Read more by Soren K.Group