Since the price of gold fell from its highs in 2011, producers have needed more capital to cover increasing costs. This is where precious metal royalty and streaming companies have come into play. These companies help finance explorers and producers’ operations by buying royalties or rights to a stream.Because gold miners have had to slash exploration budgets since the decline in metal prices, the kind of financing royalty companies provide has only grown in demand.

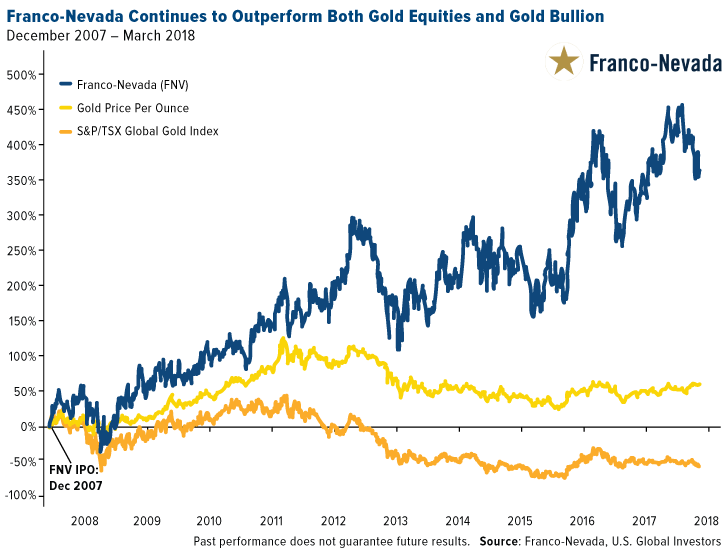

Chief among these companies is Franco-Nevada, which recently celebrated the 10-year anniversary of its initial public offering (IPO). Since the company went public in 2008, it’s raised its dividend each year and its share price has outperformed gold bullion and gold miners, as measured by the S&P/TSX Global Gold Index, due to its unique structure and debt-free model.

10 Years of Growing Dividends

In its 2017 results release, Franco-Nevada CEO David Harquail announced that the company’s 10th full year since its IPO was its best year ever, remains debt free and is “well positioned for another 10 years of success.” The company reported $675 million in revenue, a 10.6 percent increase year-over-year and basic earnings per share (EPS) of $1.06, a massive increase from 2016 of $0.70 per share. For its 2018 projections, Franco-Nevada expects attributable royalty and stream production to total 460,000 to 490,000 GEOs (gold equivalent ounces) from its mineral assets and revenue of over $50 million from its growing oil and gas assets.

This history of profitability and fiscal discipline is one of the main reasons we find royalty companies such as Franco-Nevada so attractive for investing.

Frank Holmes Says Gold Miners Should Outperform Bullion

Frank Holmes, CEO and Chief Investment Officer of U.S. Global Investors, recently commented on the upside potential he believes gold mining and royalty companies have during an interview with Kitco News. Frank said that “royalty companies have done well and those stocks that show better value per revenue per share, reserves per share and production per share should outperform.” Although Frank’s opinion is in contrast with views from other prominent investors such as Kevin O’Leary, who said bullion will outperform royalty companies, Frank holds true to his outlook. You can watch the interview on Kitco.com.

How to Invest in Franco-Nevada

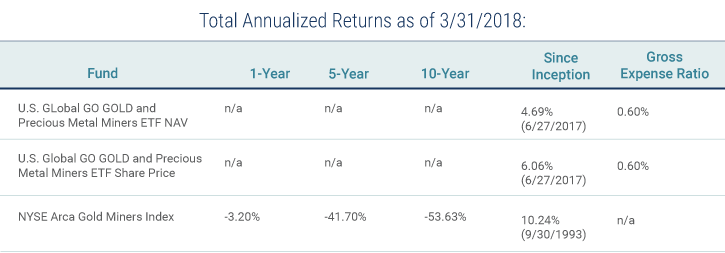

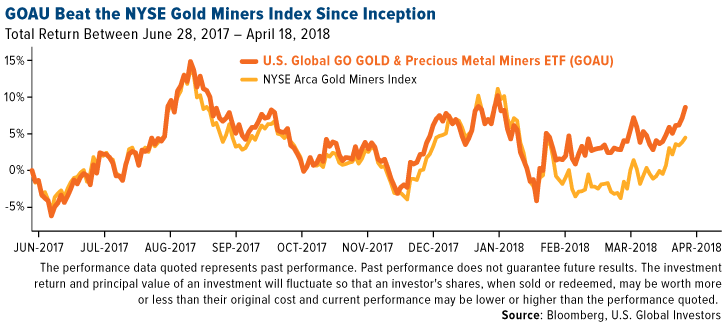

The U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) is a dynamic, rules-based ETF that seeks to invest in both junior and senior metal miners with strong balance sheets and skilled management teams. GOAU is unique for potentially having as much as a 30 percent weighting in gold royalty companies, such as Franco-Nevada.

As of April 18, GOAU has outperformed a popular gold benchmark, the NYSE Arca Gold Miners Index, which tracks companies involved in the mining of gold and silver globally. GOAU brings together both senior and junior producers into one gold ETF, providing investors exposure to some of the most profitable firms across the industry.

Interested in learning more? Explore the U.S. Global GO GOLD and Precious Metals Miners ETF (GOAU) today!

The fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectus contains this and other important information about the investment company. To obtain a statutory and summary prospectus for GOAU visit www.usglobaletfs.com. Read it carefully before investing.

References to other ETFs should not be interpreted as an offer of these securities.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P/TSX Global Gold Index is designed to provide an investable index of global gold securities. Eligible securities include producers of gold and related products, including companies that mine or process gold and the South African finance houses which primarily invest in, but do not operate, gold mines.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver.

Earnings per Share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serve as an indicator of a company’s profitability.