Introduction

What follows is a walkthrough by a deep insider in the Banking industry. It lays out one future the Supranationals may have in store for us. His specialty is in the Global Real Estate financing sector and his opinions are rooted in what he sees in terms of real estate and debt service. He is no Gold bug, and actually prefers Silver for 6-12 month trades. He correctly called the domestic REIT market since 2008 as a buy and currently favors owning income producing properties that house doctors offices near hospitals. His opinion is that these "Doctor" buildings will pay their rent when other businesses default due to Obamacare, from which there is no going back. And that rents can rise without losing tenants in the event of inflation because proximity to the hospital is paramount for these businesses.

Anonymity

When reading something by an anonymous writer you must see it for what it is worth. But to voice this unpopular opinion publicly would certainly have a negative impact on him and his family.

A Bank Insider's Walkthrough on Trump, Fed Alchemy, Gold, and Debt

emphasis ours

On Fake Gold

Gold is money. The Alchemists have better "paint" now (computers, ETFs, derivatives), (then they did in the middle ages- SK) ,tulip buyers are just as easily excited (at the New Alchemy's shiny fake Gold -SK), but major investors are not fooled. Gross, Druckenmiller, Paulson, Faber, etc etc. They see through Janet and Mario like they are made of glass.

But they have a long while to wait unless a completely unpredictable personality (think Andrew Jackson), suddenly upsets the central banking apple cart. Kitco is correct: Gold should be highly correlated to Trump's chances.

On Trump

He is still prone to independent thought, Uber wealthy, somewhat unknown, with a heretofore unprecedented ability to capture the attention of all Americans. No US leader, and I mean nobody in fucking US history could ever fill a football stadium for a political rally. If elected were he to decide the Fed will be no more, or even that it's "toolkit" would be limited, few could stand in his way. That's highly unlikely, but it's the blackest swan of them all, and the hedge is gold.

On Competitive Devaluations

All central banks are debasing their currencies, so it goes then...That nobody debases if we all debase (somewhat) equally.

Note what Kyle Bass says on Debasing- SK

"I had a fascinating out of body experience meeting with one of the world's top central bankers .. And he said, "You know Kyle, quantitative easing only works when you're the only country doing it." So we're all trying...we're attempting through our treasury and our Fed to get the rest of the world to not devalue against us, while we quietly attempt to devalue ourselves against them, and it's all this...it is the race to the bottom, it is the beggar thy neighbor policies that we all talk about. And I believe that there is no way out. "

On Debt Service

...Except: Math. That final mathematical event where the tax revenues cannot service the debt. For the moment, even that appears to be solved by Fed, BOJ, and ECB QE programs. The US federal debt balance under Obama went from $8T to $20T or did it? The Fed bought $4T of it. Is it debt if you own the loan? Of course not. This is playing out the world over. Institutions (due partly to regulatory laws) rush to buy negative yielding debt ($11 trillion right now). Consider how completely insane that is...

The problem is this game encourages overproduction of basic commodities (and malinvestment of capital- SK) Those conglomerates cannot print money, they fail, economic activity throughout the chain is reduced. Govts react, with more stimulus, more bread, more circus, and the cycle continues... Continued but stable economic deterioration at a glacial pace.It is not different this time.

And you are 1000% correct, Donald or no Donald the game very likely has a long way to run :)

But NB: I've sold every gold I owned in May. Positioned 100% in U$. Sitting this phase of the game out.

End

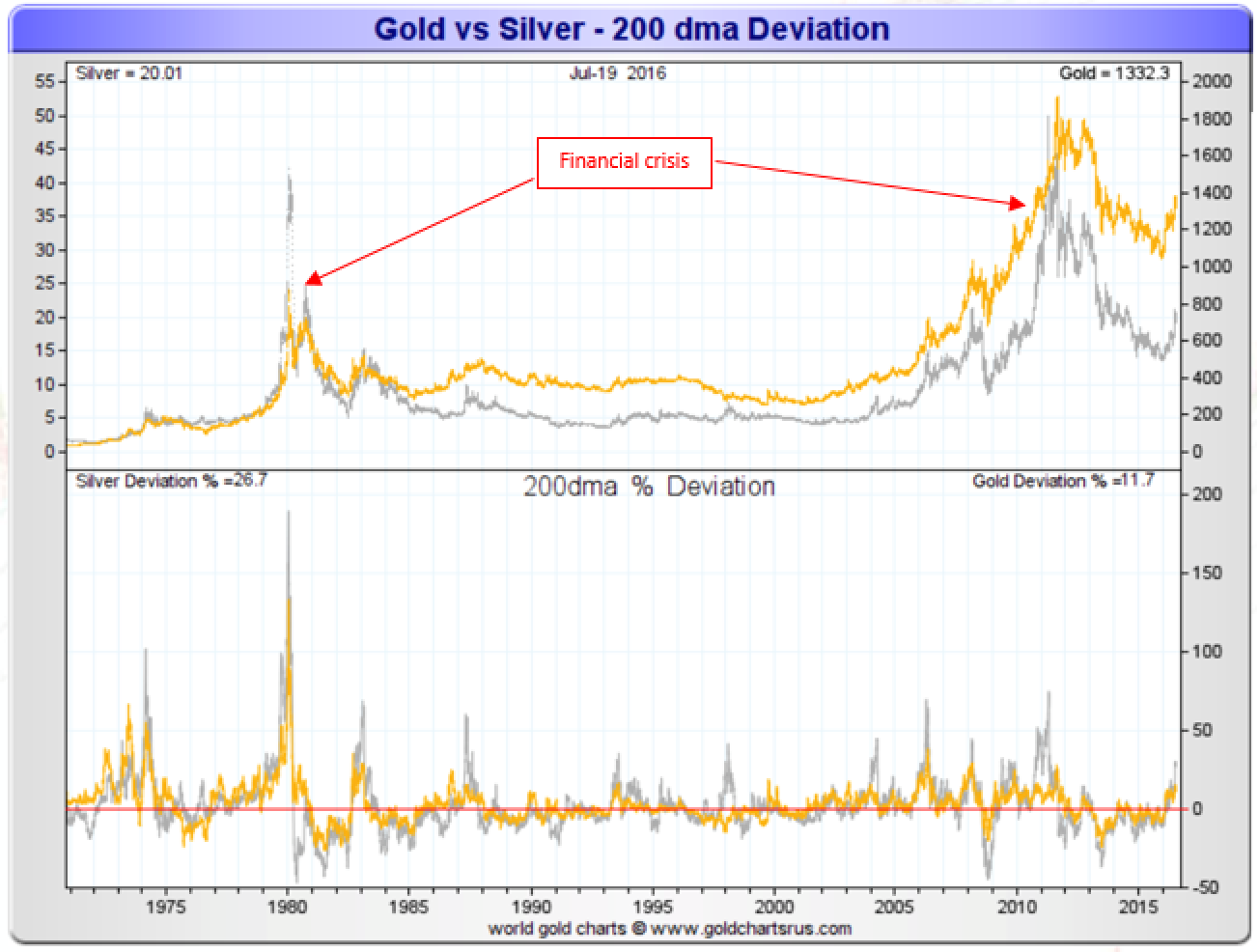

When the Next/ Last Crisis comes, Own Gold if you can. Silver will be the New Gold?

h/t Dan Popescu

Editor's Note: The author believes it will happen on a longer time frame than we do. That was reflected in his ReIt purchases in '08 when we were buying Gold. So for him to say he is not long PM group and is long the dollar, he is saying that the world will be permitted to debase before the USA does as long as the USD is the world currency, The Fed will be provider of liquidity to those countries that peg their currency to us, and to the EU, which gets access to the Fed window in times of crisis. The author is more of a Silverbug anyway. He and I are in agreement when we say, If gold is confiscated, taxed, or paper gold is disconnected, Silver will not be. Silver will be the new Gold and gold will be part of an SDR. That old and busted Silver/Gold ratio will be once again important. Don't believe us? Ask JPMorgan's Jamie Dimon. He has telegraphed a panic is coming. He has told us to take our GOLD out of safety deposit boxes …and he is buying SILVER. Silver will not be confiscated if Gold is. And the ratio will be the ratio of record if that happens. Do you think JPM will spoof Silver lower or higher if Gold is confiscated? Silver wil go from being the "Poorman's" Gold to being Gold by any other name.

Read more by Soren K.Group