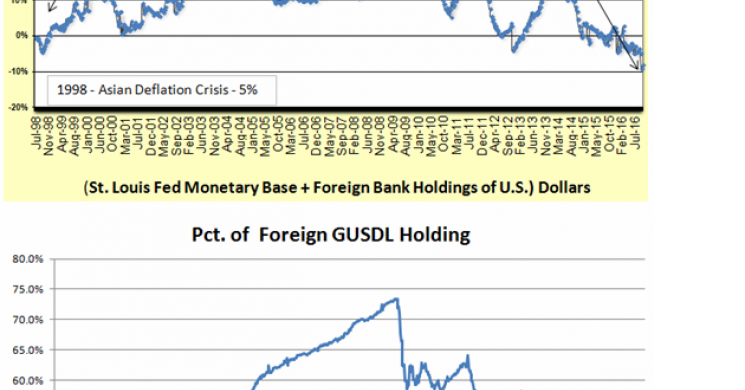

I began tracking the Global U.S. Dollar Liquidity metric (GUSDL) during the Asian crisis of 1997. This metric was devised by Charlie Clough of Merrill Lynch during the crisis to gauge whether the world was likely to face financial liquidity strains in the future. And so I have tracked this measure over the years. You can see that at a reading of NEGATIVE 7.99%, we are now at the deepest negative level since Clough talked about this on national TV during the Asian meltdown.

But that’s not all there is to the story. The GUSDL is comprised of foreign bank holdings plus the St. Louis Fed’s monetary base. The chart lower left shows the massive decline of foreign holdings as a portion of GUSDL immediately following the financial crisis. From around 73% of the total in 2008, the share of dollar holdings by foreign central banks experienced a waterfall decline immediately with the financial crisis to below 60%! That occurred immediately because of the trillions of dollars created out of thin air by the Fed and held in the monetary base.

The portion of foreign holdings of GUSDL bounced around in the high 50% to 64% range until around 2011 or 2012 when it became apparent to the world that there would be no Keynesian escape velocity to revive the U.S. economy. At that time, foreign holdings of GUSDL fell to around 45%, where it has remained over the past few years.

Clearly the world has had its fill of U.S. dollars, and I dare say a growing portion of the world is totally fed up with the wars and rumors of wars that the U.S. is imposing on any country that will not bend over and let the Anglo American Empire rule over them like Russia and China at this moment in history.

George Soros sent his NGOs headed by Victoria Nuland into the Ukraine to overthrow an elected government because that government was trying to serve the best interest of the Ukranian people which meant it needed to trade more with Russia. Soros and the other war mongering members of our ruling elite—the military industrial complex that Eisenhower warned us about and that also endorses Hillary Clinton—are pushing the likes of China and Russia to give up their sovereign rights. I believe that is happening in part due to the rapidly deteriorating loss of respect for the dollar and an American economic empire that is rotting from within. It isn’t Putin’s fault. It is the fault of the Fed that has abused the privilege of owning the reserve currency and bastardizing it. Now NATO is surrounding Russia and threatening it with war and denying China the right to patrol its own sea lanes.

Meanwhile, as F. William Engdahl has explained in his books and on my radio show, an enormous economic expansion is taking place in the most populous countries in the world—namely, China and India, in concert with the country with the most resources in the world—namely, Russia. Our media won’t talk about those constructive economic plans because our ruling elite want to wage war and take over those countries to feed the sick economic monster that was born with the destruction of our monetary system by Richard Nixon in 1971.

If Americans knew the truth about what is taking place, our people would be aghast with it all and would overthrow our government in a heartbeat. But the rest of the world is not ignorant about the abuse at the hands of the Anglo American Empire. And they are doing what they can to protect themselves against the ungodly Anglo-American monster. The rest of the world is angry at the U.S. and they are reacting. Note the following headlines, which are very destructive to the dollar and thus most likely very bullish for gold.

Saudis, China Dump Treasuries; Foreign Central Banks Liquidate A Record $346 Billion In US Paperhttp://www.zerohedge.com/news/2016-10-18/saudis-china-dump-treasuries-foreign-central-banks-liquidate-record-346-billion-us-p by Tyler Durden

Duterte Visit to China: The Pivot Has Failed

http://planetfreewill.com/2016/10/18/duterte-visit-to-china-the-pivot-has-failed/

The anger toward the U.S. and the turn of Duterte toward China are indeed very remarkable and must be seen as a very severe slap in the face against the U.S. and outright hatred toward the evils our country has carried out against the Philippine people over many years. These are just two examples of a turn against the U.S. and NATO from this week. The trend is undeniable. And longer term it is very bad news for the dollar and for the economic prosperity of the U.S. It should be very bullish for gold.

Jay Taylor

Read more by jaytaylor