Recap:

Global Central Banks flexed their muscles today in a coordinated effort to put to death any fears of a crisis in the markets.

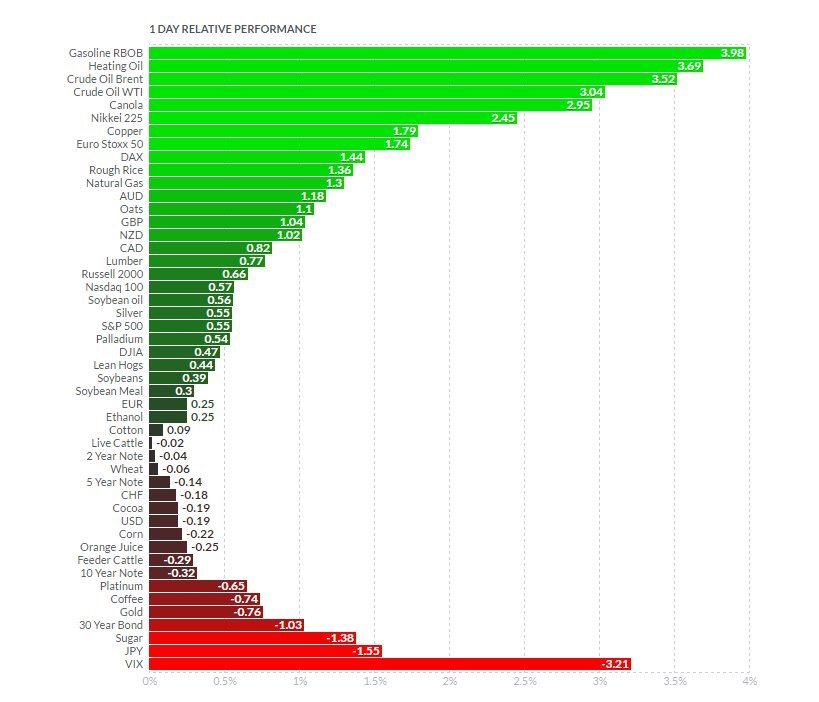

Japan announced a coming $200BB stimulus package, no less than 4 FOMC members spoke on television, and it was decided that a "Brexit" would have close to no impact on U.S. markets. The result was stocks rallied globally, US bonds had a very bad day, Oil was up and Gold was lower. Here is a snapshot intraday. - Soren K.

"Buy everything but Breakfast today" (h/t @chigrl)

That answers what happened and points out drivers behind today's market moves. What needs to be answered is why did certain asset classes move as they did? Here is our take.

What was needed

- Global leaders had to soothe Brexit fears- they did

- Japan needed to weaken the Yen- Yup

- US FOMC had quell again fears that they would tighten in the midst of oversees concerns- "Welp" that was interesting to watch

Play by Play

- Starting Monday morning, Japan's QE announcement drove money out of the Yen globally. It then drove money into equities locally starting Monday

- Monday in the U.S we saw markets begin to digest the assumption that if Japan is doing a stimulus package, then the U.S. is likely to as well.

- In the very least, tightening isnt happening any time soon

- Europe will print for Italy, Greece etc.

- Tuesday morning saw follow through in Japan, hugs and kisses in Europe and the FOMC come out in force to calm nerves

Asset Class Reactions

All markets saw the same news. Some digested it as you would expect. Others like precious metals may not have. But in our opinion everything did what it was supposed to

- Equities- QE means more money will be printed. With interest rates at zero globally, there is no where else to put money. Today you saw stock markets discounting the next round of easy money, or in the least discounting there will be no tightening any time in the next 6 months- RISK ON

- Bonds- Saw the same information and sold off. People rotated money out of low yielding Bonds and into Equities- RISK ON

- Metals- As safe haven assets were deemed less needed, investors pulled money out of them- RISK ON

- Industrial Commodities- Easy money means speculation is encouraged. A genuine recovery means Commodities are used. Take your pick.-RISK ON

Everything makes sense to us. But instead of looking at the world as Risk On and Risk Off because it is so neat, we want to look at it as traditional investors do. In the time before the tail wagged the dog. Back when stocks rallied because of positive economic expectations. Not stocks being pumped up with the hope that inflating asset prices will fix the economy. From that point of view

- Equities rallied because the market is discounting no recession for the next 6 months

- Bonds Sold off on a rotation out of "safety" into growth assets. This also signals inflationary awareness

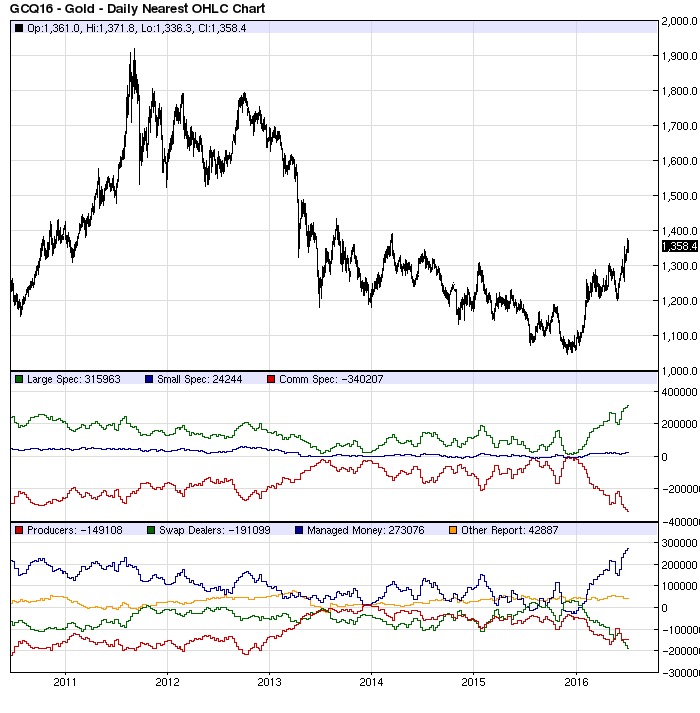

- Precious Metals sold off because people wrongly think that Gold is a safe haven or RISK OFF asset. Gold is money, and nothing more. Had it rallied we would say "Gold is behaving like money that cannot be printed. It is discounting inflation." But it sold off. So we say: "Gold is behaving like a safe haven or 'Risk-Off" asset. And we accept it as perception. But we do not think that is the end game for Gold

Gold Should Be Sold

The point about Gold is that we do not judge the market as right or wrong. We merely identify what happened and ask why? And to us it is easy. Money that was parked in Gold from Brexit fears and EU issues pulled out. This was obvious from the Open Interest discussed several times here. Gold should have sold off because of the reason it was bought in the first place. No crisis? Sell our Gold.

The long open Interest is dripping with momentum players and Risk-Off types

We are saying Gold is not a Risk Off asset. It is ridiculuous to say that a market that is tiny by comparison to the cash sloshing around out there can accommodate people looking to reduce risk. The force of that money in and out of the market is enough to CAUSE risk: Entrance risk, Exit risk, liquidity risk, etc.

Gold should sell off more to shake these types of hot money players out. A person buys gold for one reason: as a hedge against paper money being debased. It is a hedge against domestic inflation.

Right now there is no inflation, but there is currency debasement going on. And for every person who bouight gold today from inflationary fears, 3 were selling to pile money into equities because it was time for them to put Risk On. The financial world is a bunch of people front running central banks now. So what is the End game for Gold if you own it? What it always has been: Inflation.

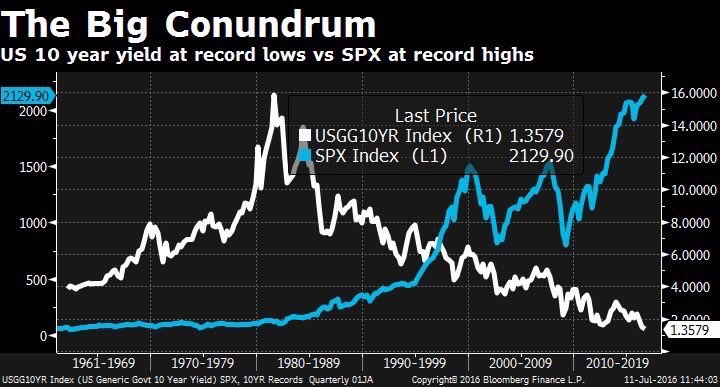

If you are over 25 years old and not getting hit by a car chasing pokemon in the street then you will see what we mean clearly just by looking at this chart

What is the End Game for Bond Yields? That is the end game for Gold

The Fed has No end Game

The market can stay irrational longer than you can stay solvent, is a phrase every trader knows to remind him to respect the market adnnot to impose time limits on irrational market behavior. But when there is a player in the market who dominates, that player BECOMES the market for a while. It rotates from player to player. Now that player is the Global Printing Press. So lets restate the axiom with a tweak.

The Fed can stay irrational longer than you can stay solvent. Your money market rate should tell you that is true.

Central bankers ARE the market now. They were supposed to be a backstop in crisis. Leaning on the backstop is now the Norm. So the end game is inflation. You do not want to make money from a financial catastrophe. Because then you will not be able to keep it.

Look at the chart above ask yourself what Gold, the price of bread, a new car, steel, all do when the white line goes back up? Then be thankful you have a 401k with some money in it, and be ready for the next 10 years of inflation. The Fed has no end game. But the markets do. And every biggest player gets taken down eventually.

For Inflation- when it comes, not if.

- Be Long certain types of Stocks

- Be Long Gold

- Be long Cadillacs, California wine, and anything else built domestically

- Short the shit out of Bonds (buy TiPs)

Final thought

The stock market is pricing the future behavior of the Fed. If the Fed does not follow through or they raise rates what will happen? It isnt'tl ike theUSA hasn't asked the Saudis to pump oil before we invade to keep price shock down. Just saying, 500 points off all time highs isn't as bad as 500 points off unch YTD. The ultimate pump and dump.

Be Careful

Soren K.

Read more by Soren K.Group