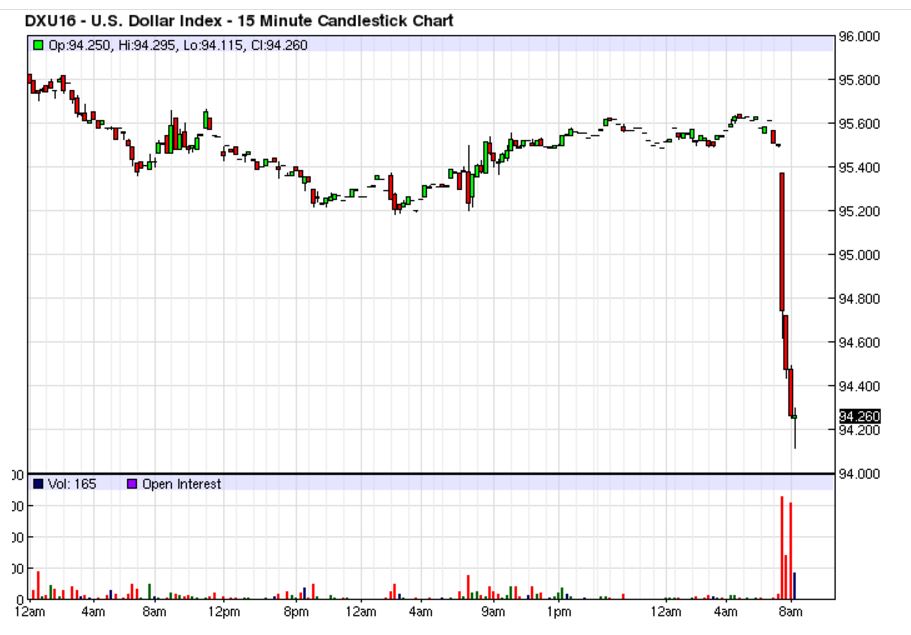

I will let you chose your expletives to describe May’s employment report but the adjective that I am using is appalling. In fact I had to do a double take after seeing job growth of 38,000 pop up on my computer screen. Although one data point does not make a trend, it hard to find anything to rally behind to soften the blow of this report. Pretty much every major sector saw declines: construction, manufacturing, information technology, and mining to name a few. These are solid wage jobs and these losses will be felt for the next few months and highlights growing downside risk during the summer, which is traditionally the prime growth season. This one data point has completely shifted expectations for Federal Reserve interest rate expectations. CME 30-day Fed Fund futures are now pricing in a less than a 4% chance of a rate hike later this month, down from almost 21% the day earlier. July expectations have also significantly dropped to 32.4%, down from almost 50% on Thursday. What a difference a day makes! Because of interest rate hikes, I have been slightly bullish on the U.S. dollar but am ready to shift my expectations. As you can see the September U.S. Dollar Index Futures have fallen off a cliff following the data on extremely high volume. Could this be the trend shift?