Rate Hike Expected... Then What?

Yellen is Bad at Being "Good Cop"

The Fed announces its rate decision today with expectation almost 100% of a rate hike according to surveys of economists. Of more interest will be how the market digests Yellen's briefing post announcement. Will it see this as the first of many, or "all we need"? Past experience is Yellen's rhetoric gets interpreted lopsidedly and markets move. Then another Fed governor will come out to counterbalance the effects of her words. Call it good cop-bad cop.

- Fed hike of 25 basis points expected today

- Market also gives a 7% chance of a 50 point hike

- Watchers will focus more on Yellen's press conference for clues to future path

Put another way: What Greenspan used to do all by himself (confuse markets into submission), now takes a double team. Sometimes 2 or 3 Fed members are trotted out to beat the market back into submission. It is taking more and more salesmen to convince the markets of the Fed's genuineness it seems.

Reviewing the Fed for 2016- Good, Bad and Ugly

The Good: everyone is working

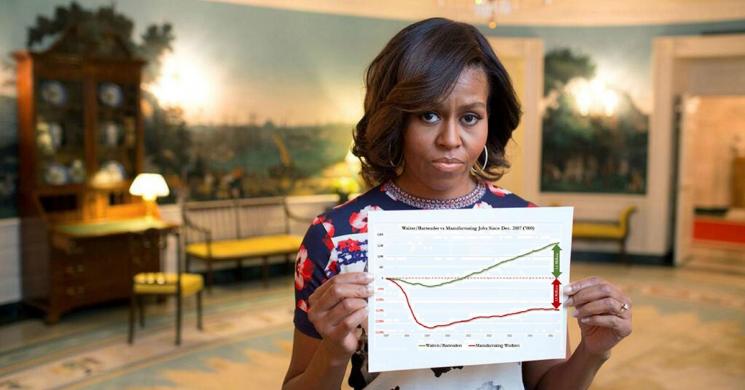

The Fed may have done a very poor job of managing market expectations in the daily and monthly behavior of things, but their Inflation and Jobs goals were pretty close. They may have gotten unemployment right. If you ignore that everyone is a waiter now.

The Bad- cherry picked statistics lie

If the employment numbers above aren't enough for you, consider the rate-hike past and future predictions.

Last year, they predicted 4 rate hikes for this year. That fabulously wrong guess came in sharp contrast to the Fed's seemingly spot-on unemployment and inflation projections. Looks like we will need 13 hikes of 25 basis points over the next 3 years.

Let's be crystal clear on Fed rhetoric. You are being lied to and managed.The alternative is far worse. If they actually believe their ability to predict future hikes then there is no hope of change at the top level at all.

Nice Call Skew on the Rate Hike Plot- Can't show NIRP? Just shrink the plot STDs until it fits

The Ugly- leaders are ignorant or malignant

Economics is a soft science, and we are being lied to. Here is the reality of what we are told:

The Path towards Fed Goals is unknowable- but the Goal will be gotten to over your dead paycheck

- The path towards a goal like CPI or NFP is unknowable due to surprise events- and interest rate predictions are like recent pollster predictions, snapshots lacking sufficient data.

- The Fed can, and will get to its goals, but has no idea how the rate path to it will look- all else fails, move the goal post

- We are told things like # of hikes to give people a sound-bite- to placate us because we are not able to handle the truth

- They think we are dumb, and they feed the press info to keep us dumb by playing to the lowest common denominator- and we accept it

- In an age of forced transparency the Academic Yet Idiotic (Intelligent Yet Idiotic-NN Taleb) elites must obfuscate what they are forced to tell us- mock rhetoric as "salesman wordsmithing" even while using rhetoric and calling it dialectic to lie . See: Pirsig's ZMM

Lions, Leeches and Sheep

Meanwhile government leaders spoon feed "journalists" sound bites. Modern Journalism prioritizes being first over being right. And we slurp it down. If the story is wrong, the correction is buried in the classifieds of the internet, wherever that is. Retractions are extinct. Outsourcing blame and spinning inaccuracy have killed them.

Fed Review of the Sheeple- 2016

You'll open up your eyes-And realize, How you fit-In the wild, A lion is a lion-No apologies, And a leech-Is a leech, In a corral- You're safe and warm , Pass it on to-Every sheep: Grohl, Homme, Reznor

Rate-Hike Math

We are mushrooms to the Fed. Or if you prefer, batteries in the matrix, frogs in a pot, or just sheep.

For example, the # of hikes is a joke. As outlined above, the Fed cannot account for unknown events and therefore pathways to their goal are not knowable. If they are right, they will crow about it. If they are wrong, they will site their goal is attained despite unforeseeable circumstances. They are right either way. And when the goal is not attained, the books will be "temporarily" cooked. By temporarily, that means as long as the current board is employed.

Fed Job Security Demands Avoiding Error

The headline is partially inspried by the philosopher William James who said (paraphrase): Errors will be made in seeking truth. But many people falsely think these two are a choice. They believe either one seeks truth OR one avoids error. But errors must be made on the path to truth seeking.

"Believe truth! Shun error!—these, we see, are two materially different laws; and by choosing between them we may end by coloring differently our whole intellectual life. We may regard the chase for truth as paramount, and the avoidance of error as secondary; or we may, on the other hand, treat the avoidance of error as more imperative, and let truth take its chance-...Our errors are surely not such awfully solemn things. In a world where we are so certain to incur them in spite of all our caution, a certain lightness of heart seems healthier than this excessive nervousness on their behalf. At any rate, it seems the fittest thing for the empiricist philosopher." W. James

Sadly we are now living in a world of error avoidance. How did this happen? In part because the US citizenry believes only in the religion of deductive logic. In banishing rumors and conjecture as truth (untested inductive reasoning), the world of facts has killed the seed of truth seeking. If no facts, then no truth!

But the facts are locked up inside a politician's head or a government vault. Meanwhile we are all still held to "provability" via facts. Facts are important obviously for conclusions of theories. They are indispensable in scientifically testing induced hypothesis. They separate the lunatic theories from the sound hypothesis. The problem is, without facts, all theories are demeaningly labeled "conspiracy". There is no murder without the body.

Mushroom Management

And who controls the facts? The same people who tell us Russia hacked us, money is bad, one world one currency is good. The people who would have you believe that the CIA, sponsors of failures like "Yellowcake" and "WMD in Iraq", are using objective information to tell us Trump used Russia to steal the election. Meanwhile, in the other corner we have WikiLeaks' thousands of emails showing patterns of abuse, but no facts. Who are you going to believe? Does the duck have to bite you on the butt for it to be a duck? The Mushroom farmers.

You Can't Prove it's a Duck Anymore

Through inductive reasoning, subjective (Bayesian) probability, the seeds to search for truth are created. Then, via facts and scientific method, those theories are tested.

Not a Duck

Our leaders rely on this "facts-based" deductive reality to demean conspiracy theorists. Then they hide the facts from us. Narratives are dismissed as coincidence. All that matters are compartmentalized facts now. The "conspiracy theorist" label lumps the loons with the real idea generators.

Inductive thinkers historically ask the hard questions that lead to the hard evidence.

The Press is supposed to play that part. They do not by and large anymore. We are all inductive thinkers who see correlations in events, but do not have access to facts to verify the idea.

That inductive or empirical thinker wants to know if observed correlations are causally linked. But he cannot. Because the facts are under lock and key. "It may walk and quack like a duck, but without DNA evidence, we cannot say it is a duck sir."

Many lawyers have said : If the facts are on your side, argue them. If the law is, ignore/obscure the facts. If neither are, punt until you are right.

That is why "fringe blogs" have to repeat themselves a million times using market observations as their data.The facts are not available. And the law can be changed or violated at government discretion.

Tin Foil Hats For Everyone

Will the sun come up tomorrow? Pure deductive reasoning says 50-50 chance. This is endemic in all areas of government and especially in the central planning circles. Probabilities are ignored, but action is expected. Decision analysis in climates of uncertainty demands probabilistic assessment lacking facts. And more and more people are waking up to this intuitive part of themselves again. The Tin-Foil hats are looking more like prophets. Meanwhile, The Fed is getting raves on its EOY MSM commentaries.

The MSM Gives the Fed EOY Kudos

Unemployment? NAILED IT!!

Inflation? Almost There!!

Core Inflation: Much Better !!

GDP- Lets throw in a disappointing headline to keep up appearances, but its still getting better!!

Looked at through a jaundiced eye: the Fed can "make" themselves right in terms of data machinations on the books. They can't lie about transparent actions like rate hikes.expected. It is our contention that it isn't just Corporate America that is cooking its books.The government has a license to. But we digress.

Do You Want Fries With that Shake?

So while the MSM congratulates the Fed for getting employment and inflation numbers right, remember who creates those numbers. Also remember it is the type of jobs people have that matter. Do you feel better off now than you were 8 years ago?

h/t @RudyHavenstein

FED, CIA, POTUS: it's all the same thought process

All we can do is laugh at the irony of it all

We told you before, welcome to the abattoir

Good luck

Read more by Soren K.Group