Earnings season started this past week and, as anticipated, they were mostly down year-over-year. The table below shows a number of examples. It seems that the market was just happy to see earnings at all, and ignored the fact that they were down year over year.

Company

Symbol

Actual EPS

Year-Ago

Alcoa

AA

$0.07

$0.28

Fastenal

FAST

$0.44

$0.43

CSX

CSX

$0.37

$0.45

JPMorgan Chase

JPM

$1.35

$1.45

Bank of America

BAC

$0.21

$0.27

BlackRock

BLK

$4.25

$4.89

PNC

PNC

$1.68

$1.75

Progressive

PGR

$0.44

$0.50

Wells Fargo

WFC

$0.99

$1.04

Charles Schwab

SCHW

$0.29

$0.22

Citigroup

C

$1.10

$1.52

The economic data wasn’t exactly warm and fuzzy either (table below), but that too was ignored and equities climbed higher, likely accelerated by short covering (which won’t last).

Release

Actual

Prior

PPI

-0.1%

-0.2%

Core PPI

-0.1%

0.0%

Retail Sales

-0.3%

0.0%

Retail Sales, Ex Auto

0.2%

0.0%

Business Inventories

-0.1%

-0.1%

CPI

0.1%

-0.2%

Core CPI

0.1%

0.3%

Initial Claims

253K

266K

Continuing Claims

2171K

2189K

Empire Manufacturing

9.6

0.6

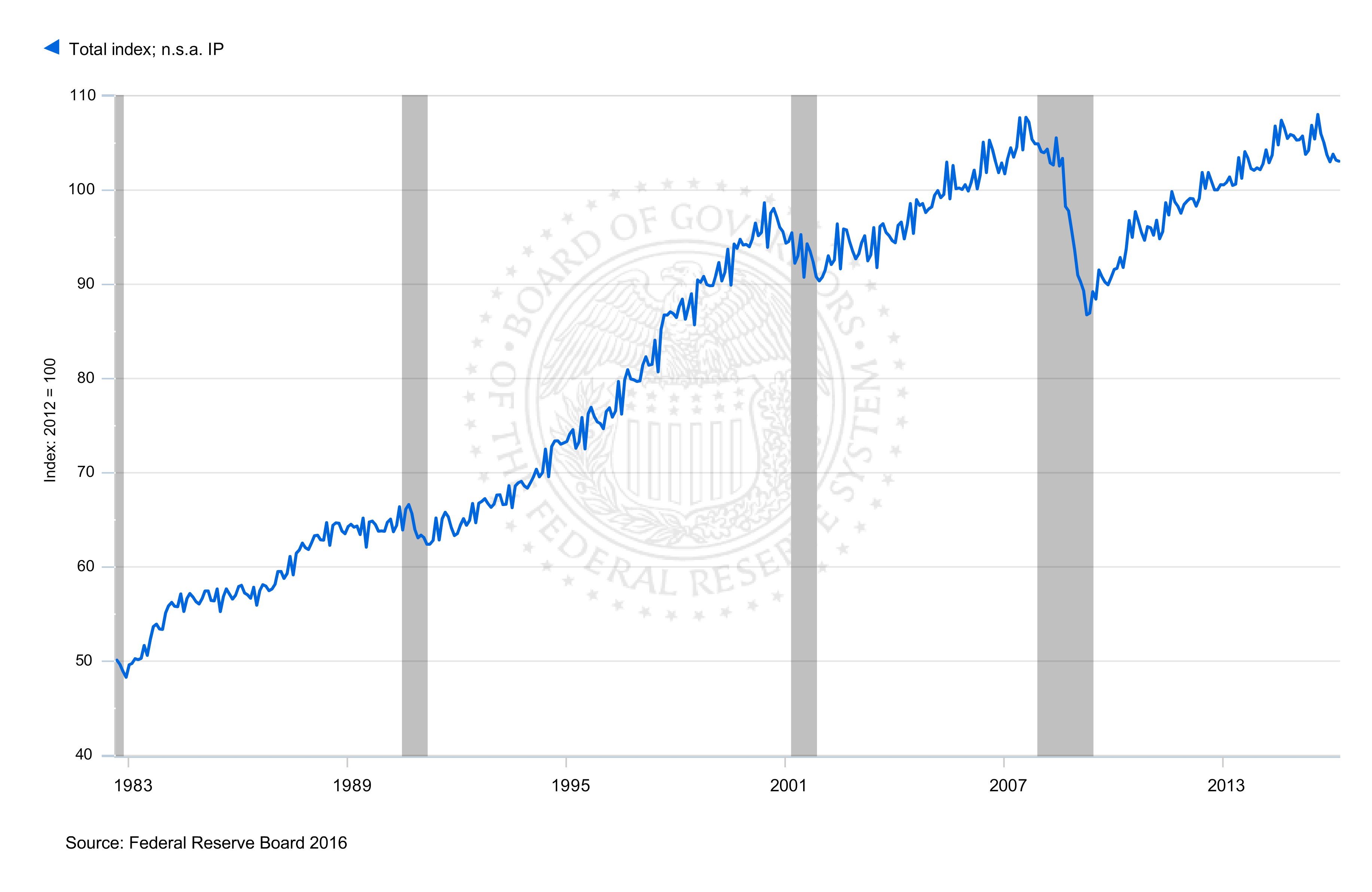

Industrial Production

-0.6%

-0.6%

Capacity Utilization

74.8%

75.3%

Consumer Sentiment

89.7

91.0

The media has pointed out the important drop in industrial production, but the market wasn’t listening to that either.

Industrial Production and Utilization

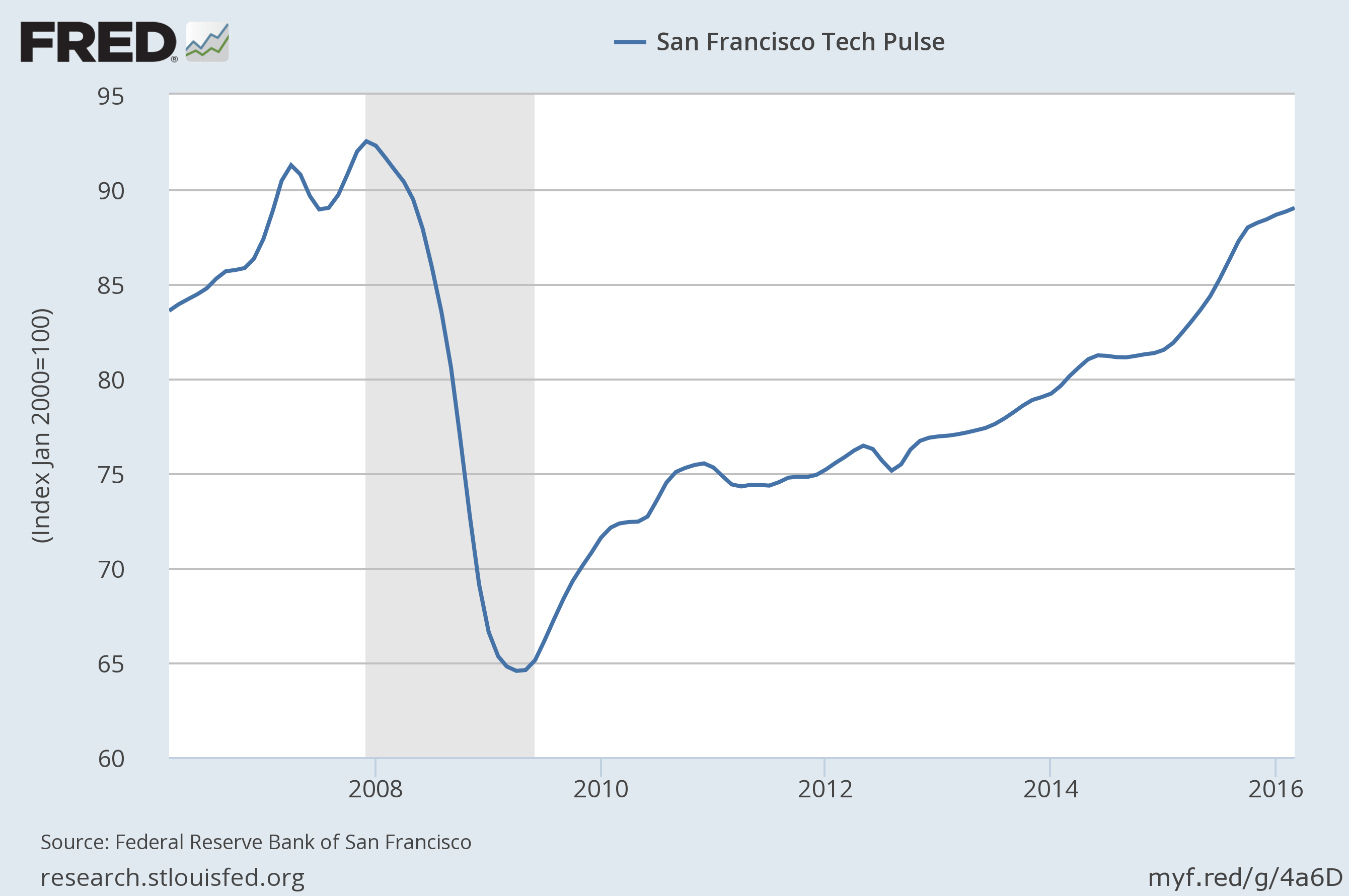

Maybe that was because they were looking at the health of the newer tech industry numbers which show that it continues to grow non-stop (table below).

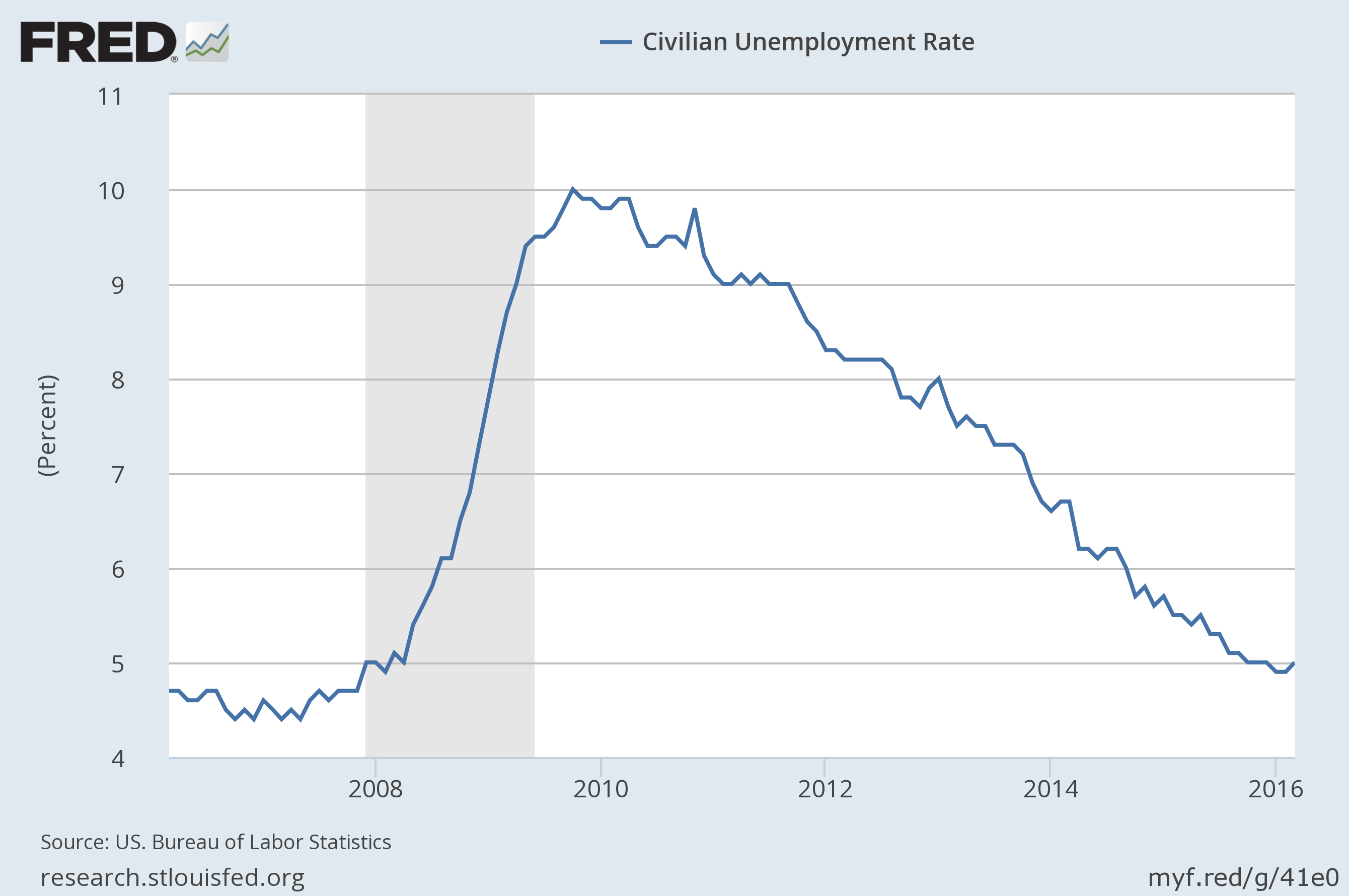

Or maybe the market was focused on the continuing low unemployment rate.

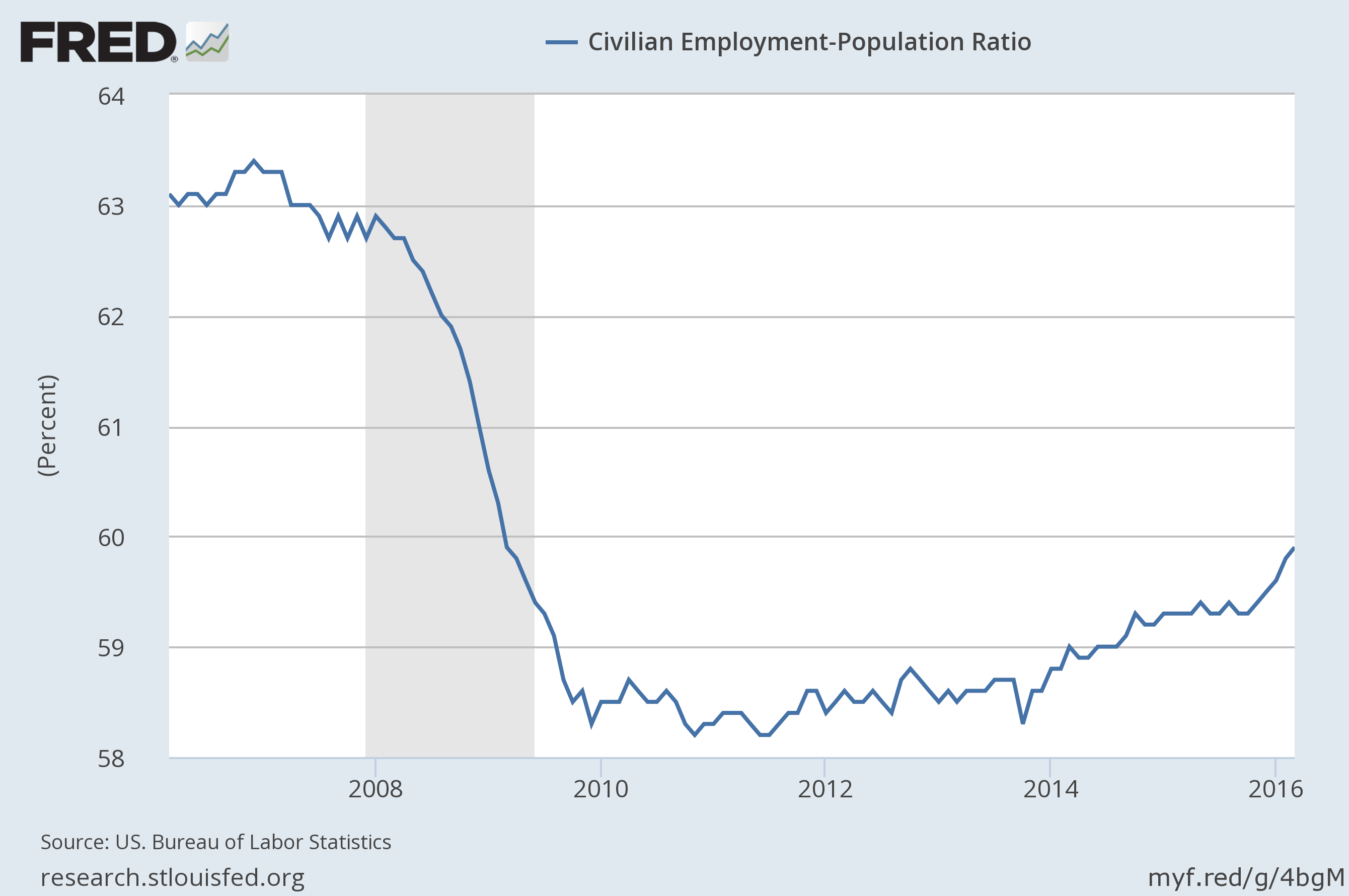

We doubt that the market was looking at the population-employment ratio which has yet to move above 60%. It was above 63% before the great recession.

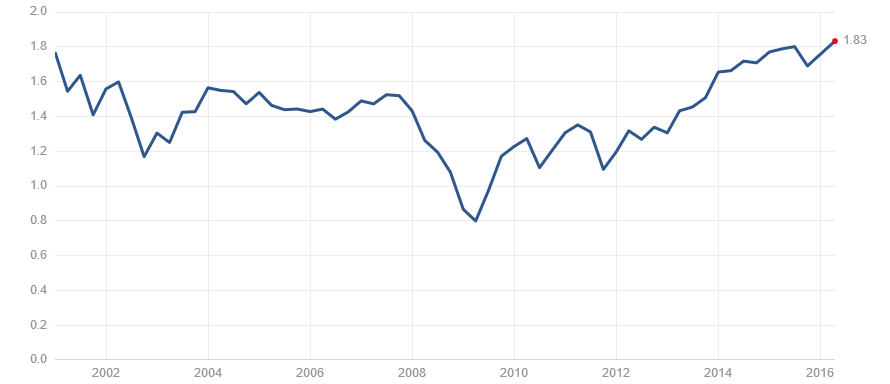

It certainly wasn’t focused on the price-to-sales ratio for the S&S 500 which at 1.83 is the highest level in fourteen years.

S&P 500 Price to Sales Ratio

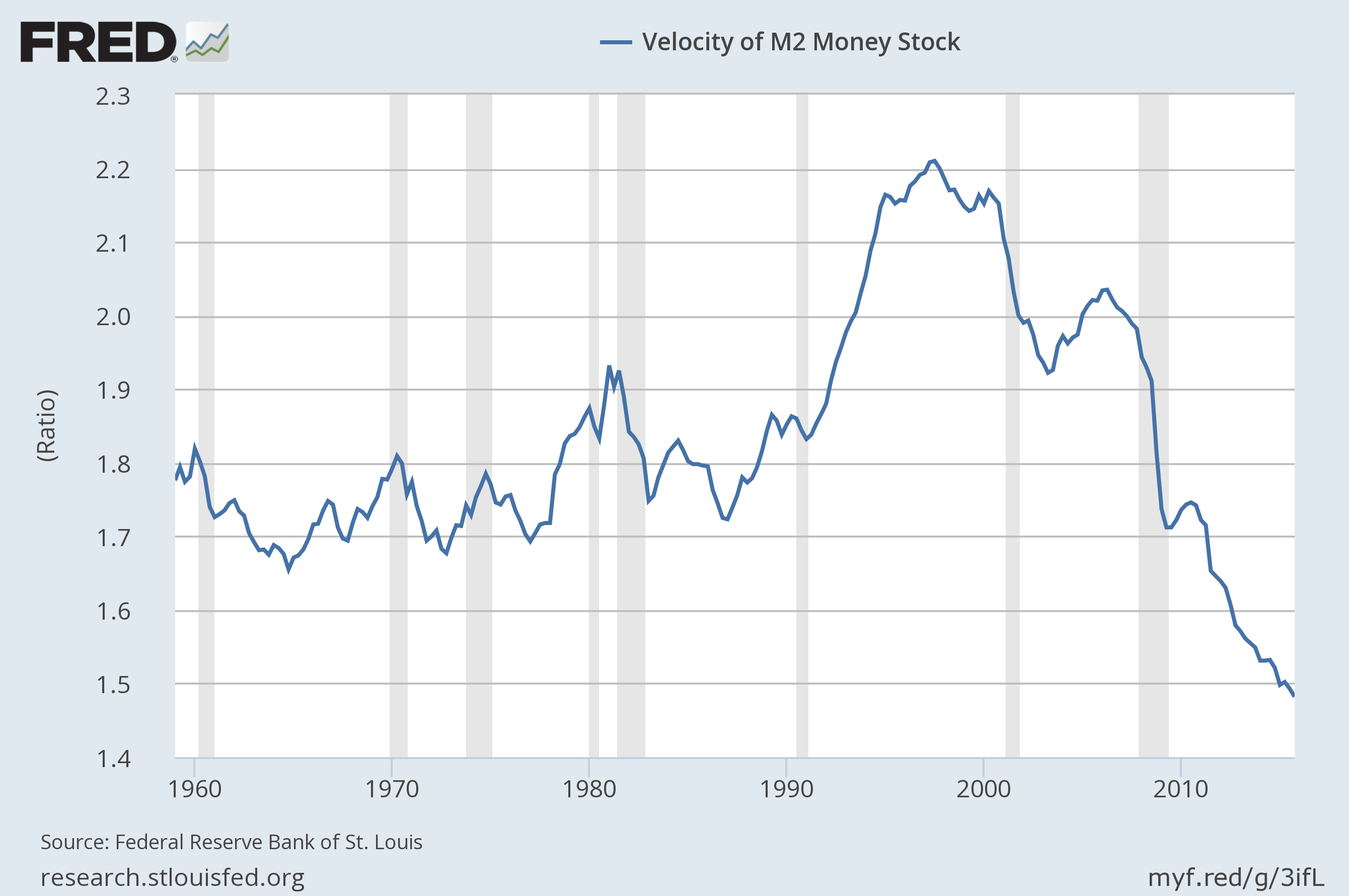

It is equally unlikely that the market noticed that the velocity of money is at its lowest level in the last six decades.

Whatever it was that the market was focused on, it caused equities to get chased higher.

Our own Price Modelling System is signalling a weak negative bias, which does not rule out a further short-term rise in prices at this point, however, there is more potential for a pull-back than there is for new all-time highs.

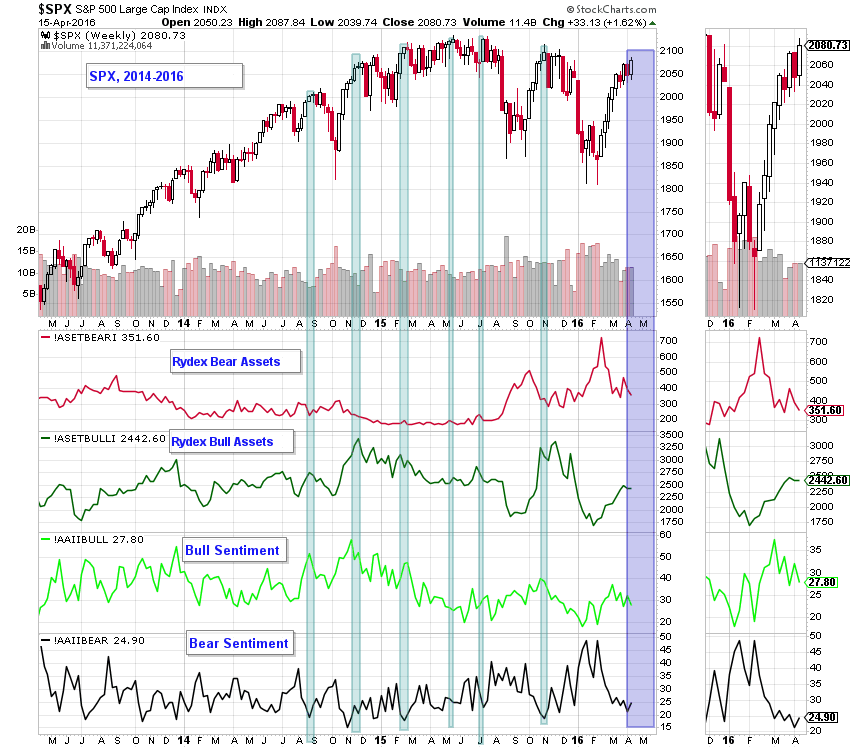

The chart below, high-lights the local tops on the S&P and shows how they correlate with:

- Low bear assets

- High bull assets

- High bull sentiment

- Low bear sentiment

Little has changed since last week (see purple area and thumbnail);

- bear assets dropped slightly (bearish)

- bull assets were essentially unchanged (neutral)

- bull sentiment was lower (still neutral)

- bear sentiment was up slightly, but still at very low levels (bearish).

In other words, a slight downward bias, rather than a screaming topping signal.

We won’t bet the farm on the short side, but we won’t be chasing prices higher either.

{This section is for paid subscribers only}

We wish our subscribers a profitable week ahead. Please check your email for Trade Alerts.

ANG Traders

Replicate our trades and profits by joining us at www.angtraders.com

Read more by ANGTraders