Earning season starts this coming week and it should prod the market into making a move. At the start of this quarter, earnings were projected to increase 1.2%. Now they are expected to decline 7.9%. At the same time, the S&P 500 has risen 0.8%.

If earnings come in-line with the projections, then quarterly earnings will have declined three quarters in a row. Yet the S&P is down just 0.7% since the start of the third quarter of 2015, which does not reflect the earnings expectations. Market participants either don’t believe the projections, or they are betting that guidance will be painting a rosy picture of future earnings.

The CME Fedwatch tool is predicting a 97.7% probability that the FED will hold rates steady on Apr. 27, and this confidence may be another reason for the buoyant equity prices.

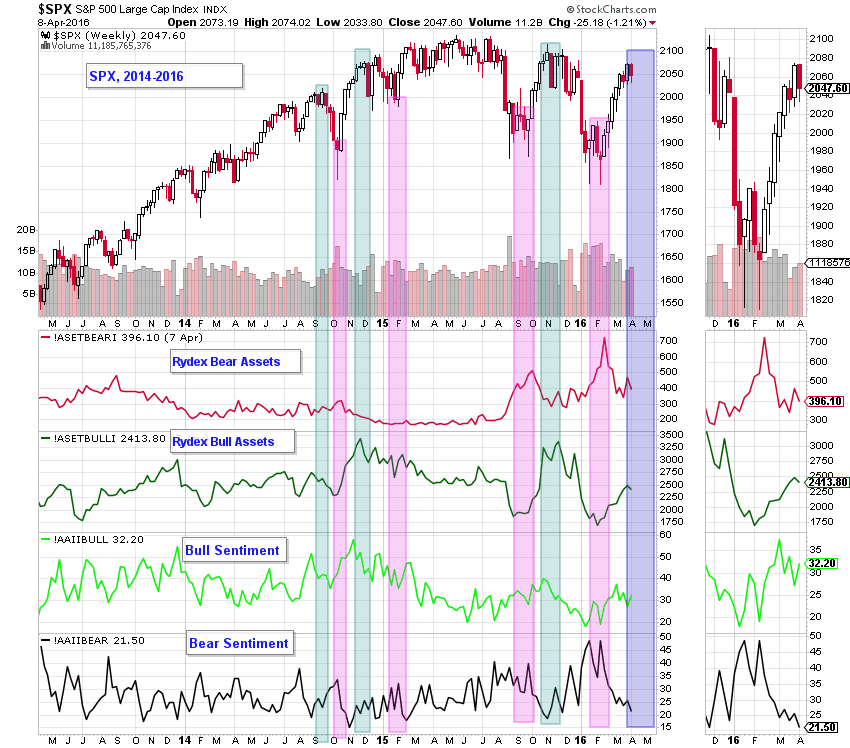

The chart below is an updated version of last week’s S&P sentiment chart.

Compared to last week:

- bear sentiment has decreased from 25.8% to 21.5% which is bearish

- bull sentiment has increased from 27.2% to 32.2% which is also bearish

- money flows into bear assets have decreased which is in a bearish direction

- bull assets have decreased slightly which is weakly bullish

Most of these sentiment indicators, while weak, are not at extreme levels as yet, except for the bear sentiment which at 21.5% could be considered extreme. The situation is not definitive enough to call this a top, but we are certainly starting to see a tendency in that direction.

This analysis coincides with our Price Modelling System remaining at neutral, but weakening somewhat compared to last week. It still signals almost even odds on a move in either direction.

If the market rallies, we will be looking to short it since we don’t expect to see new highs at this point. If the market starts to drop, we will likewise short it. If it trades sideways, we will wait and watch.

{This section is for paid subscribers only.}

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.

Read more by ANGTraders