China is Buying More Gold than We Know

A few months ago the Soren K Group took a closer look at Chinese Gold demand by analyzing their market structure. The article concluded that china does truly "Own it's Gold through its people". By that we saw that China's government had authority to confiscate citizen holdings much like the US did. We saw China's market structure as conducive to 'controlling much of its gold' without actually owning it. From that article:

The quote by Arthur Levitt above is apt. China is explicitly a centralist economy. The US may be headed in that direction as well slowly. But China does not need the propoganda skills that the US employs to remove our freedom. That's not to say they don't have those skills. They just have a market structure that obviates the need to candy coat what they want if the time comes.

Market structure is key to an institution successfully controlling that which it needs to control. China's Gold market is an example in extremis of how market structure can and will determine the end game for the powers that created or influenced the structure's creation.

China is not a Democracy. It is capitalist statist entity projecting itself that it is moving towards democracy. Not true. We will show using market structure as our guide the likely path of Gold ownership in the future should a crisis occur. Full post here

We recommend reading both posts for a comprehensive view of Chinese demand and control. Our research is an attempt to handicap what China will do with its Gold. RBC's is more quantitative and tries to get a handle on how much Gold they are really buying.

Here RBC takes a closer look at the market structure in an attempt to truly asses the actual demand coming from the east. And to no one's surprise, it is being publicly understated:

Gold Strategy: West to East

via George Gero and RBC Metals Research

Gold has climbed by roughly $100/oz since the start of the year and we view its most recent bid as the market repricing a number of risks. This month, we also dive deeper into available data in an attempt to uncover unaccounted for Chinese gold demand in the context of the ongoing flow of gold from west to east.

- This Month in Focus: In this month’s focus we dive deeper into the structure of the domestic Chinese gold market, local supply and demand figures, and take a particular focus on trade statistics and implied Chinese domestic gold demand.

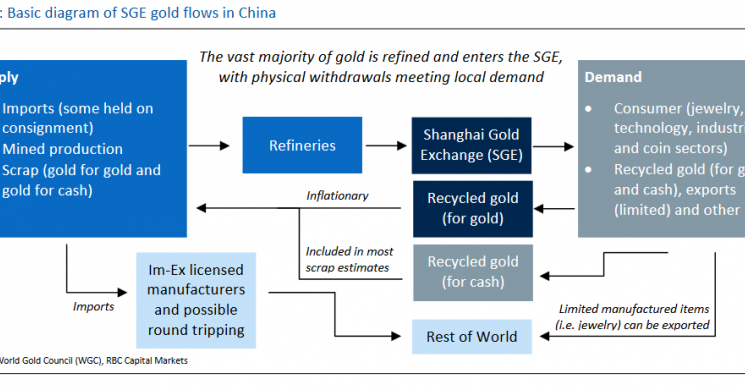

- The structure of the Chinese gold market and the central role of the Shanghai Gold Exchange together provide a useful framework in which to analyze trade flows and ultimately point towards otherwise unaccounted for Chinese gold demand. Trade data (while not perfect) shows continued high levels of shipments to Hong Kong and an increasing flow of gold directly to mainland China; China has remained a significant net importer. In our view, while there is not enough data to definitively point towards any particular source of unaccounted for demand, we do think that there is at least some additional demand that may at least partially account for some of the net long that has developed in supply and demand balances (page 2).

- Monthly Market Analysis: Gold prices are up an impressive $100/oz since the start of the year. That move however masks a bit of a rocky path, the materialization of unknowns and the pricing in of additional risk – something we have cautioned. Most recently, we think gold got a bid due to the US healthcare reform saga as the market repriced its expectations for prospective economic reforms. In our view, the healthcare saga was interpreted by the gold market as an indicator for more gold-relevant economic issues (i.e. tax reform, trade, and other macro-relevant policy issues). Preliminary Q1 average prices are roughly 3% higher than our Q1 forecast and as we approach Q2, gold appears to be trending towards our existing Q2 forecast of $1259/oz. We think gold will be mostly range-bound for the balance of 2017 as unknown/economic policy risk premiums get repriced throughout this year, against a backdrop otherwise full of macro headwinds – a view still in line with our “Trumped Up, Tickle Down” trading thesis for 2017 (page 6).

Table of Contents

Monthly Market Analysis 6

Macro Factors 7

Physical and Financial Demand 8

Asia Regional Factors 9

Supply Factors 10

Pricing, Ratios and Exchange Holdings 11

CFTC Positioning in Precious Metals (managed money and swap dealers) 12

Correlation Matrix 13

Global Economic Calendar 14

About George Gero

From the MarketSlant report again

We start here:

In the Gold Survey 2016 report by GFMS assessed Chinese demand at 867 tonnes. Try again.

As gold in the Chinese domestic market is not allowed to be exported, the amount of gold withdrawn from SGE designated vaults therefore serves as a decent indicator for wholesale demand.

Estimates of true Chinese gold demand in 2015 must have been north of 2,250 tonnes (import 1,575 tonnes, mine output 450 tonnes, scrap supply 225 tonnes)-Koos Jansen

And that Gold is all the PBOCs if they ask for it.

Full Report HERE

Read more by Soren K.Group