Full Article Here: http://www.guillermobarba.com/the-bank-of-mexico-reveals-its-gold-bar-list/

By Guillermo Barba

The Bank of Mexico (Banxico) has become one of the first central banks in the world to reveal its gold bar list.

In this space we have recommended that Banxico and any other investor with positions in gold as a store of value and financial insurance should maintain physical possession of its bars, or at least, store them in a secure vault on an allocated basis.

Last December, thanks to an official Request for Information by means of the Transparency Law, Banxico informed us that:

‘Of the 3.881 million ounces of gold that the Bank of Mexico has at the end of October 2016, 98.95% are held in the United Kingdom, 0.0004% at the Federal Reserve Bank in the United States and the remaining 1.05 % in Mexico.’

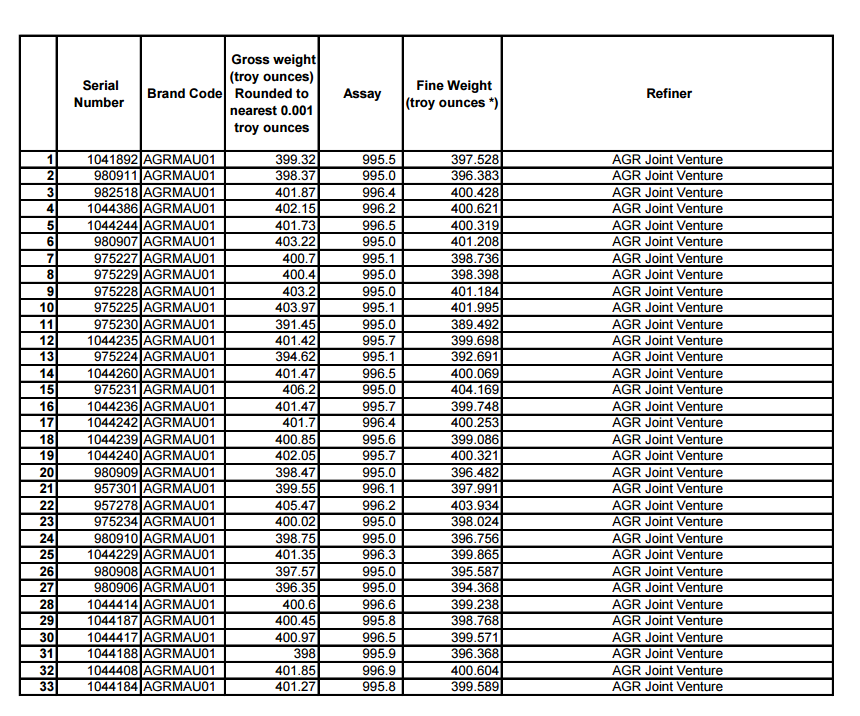

Banxico also told us that it had a total of 7,265 gold bars in allocated accounts at The Bank of England (BoE), which means that only about 2.9 million ounces are well identified with serial number, brand code, gross weight, assay and fine weight at that location.

The rest –more than 930,000 gold ounces at the BoE- are still ‘held’ on an unallocated basis. These unallocated accounts are those in which the ‘owner’ has not been assigned specific gold bars but simple ‘rights’ to a certain amount of gold. That is why Banxico could not tell us how many ingots it owned in this last case.

The Mexican central bank didn’t give us details on the number of bars or coins it has at the Fed nor at its main vault in Mexico City.

In any case, the problem with unallocated accounts is that, there are in fact more ‘owners’ of the same gold than (unassigned) bars. This means that the same gold is sold multiple times, and in the case of a crisis in which those ‘owners’ demanded the delivery of the metal, there would not be enough gold for everyone.

For this reason, a monetary authority, such as Banxico, should never have unallocated accounts since gold reserves are purchased to offset risk in fiat currencies, to not have another ‘paper’ risk.

We hope that Banxico will correct soon this situation and not only have all of its gold reserves on an allocated basis but (at least) half of them in Mexican territory. Repatriation is the name of the game, a game that every central bank should play.

Meanwhile, we are happy to share with you Banxico’s 7,265 gold bar list that it gave us through the document number LT-BM-18703. It’s a small step in the right direction, that of transparency. Congratulations, Mr. Carstens!

We hope that from now on, other central banks will publish their own lists. Gold market participants have the right to confirm publicly that their bars are theirs and only theirs.

Dowload the complete list here.

E-mail: inteligenciafinancieraglobal@gmail.com

Facebook.com/InteligenciaFinancieraGlobal

Full Article Here: http://www.guillermobarba.com/the-bank-of-mexico-reveals-its-gold-bar-list/

Read more by MarketSlant Editor