Donald Trump is the King of All Media

Greek Banks are closing, EU stocks are under pressure, PEOTUS Trump calls China out on Yuan manipulation, The UK seeks to strengthen its Anglo alliances pre Brexit, The Yuan's volatility continues, and likely replacements for Yellen are more hawkish than the current chair. In a continuation of all things opposite "No-Drama Obama", Trump keeps all eyes on him with UK and China statements.

- Pound Falls to 10-Week Low as May Hints at Single-Market Exit- BBG

- Offshore Yuan Falls for Second Day as Bears Reload After Squeeze- BBG

- Nine Trump Nominees Who’ll Face Extreme Vetting by Democrats- BBG

- Why the China Manipulator Label Looks Increasingly Appealing to Trump-BBG

- Florida airport shooting suspect to appear in federal court-RTRS

- Meryl Streep calls out Trump for mocking a disabled reporter back in 2015- NYT

Yellen's Replacement

With just over a year remaining on Janet Yellen's current term as chair of the Federal Reserve, the candidates at the forefront for replacing her are all more hawkish on rates than she ahs been. Glenn Hubbard of Columbia University, along with Stanford University’s John Taylor and Kevin Warsh, are all seen by Fed watchers as potential future chairs should President-elect Donald Trump decide not to re-nominate Yellen.

Gold is Good Today

Trump watching is the new Fed Watching

Funds cut bullish COMEX gold positions to 11-month low, Palladium hits highest in more than a month.

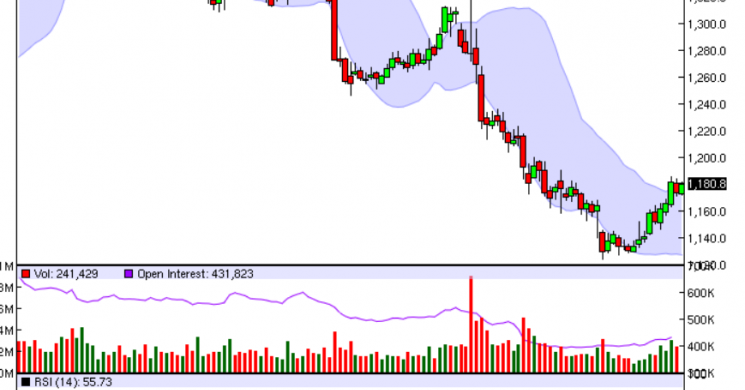

The metal, which posted its biggest weekly increase in two months last week, lost some ground on Friday after a U.S. payrolls report supported the view that the Federal Reserve will raise interest rates this year, boosting the dollar. However, it found good support around $1,170 an ounce, the 23.6 percent retracement of its November to December decline.Feb gold was up 0..6 percent at $1,180.80 an ounce at 7:35. Silver for March delivery is up 5 cents at $1656 as of 7:35 as well. We caution the $1200 number as a point of inflection. Stop-in orders are building in that area from asset allocators who will buy the "headline". What is unknown is how much trapped money is sitting there ready to take advantage of that buy side liquidity. The first reaction of an intraday spike and pullback would not surprise us. Blowing through the $1200 area would be a most welcome sign however and suggests much more money is looking to get in than has show up yet.

Silver is the Goldilocks of Metals

We've been saying it for months now and the analyst community is catching on. If you are bullish Gold, buy Silver. And not just for the upside volatility, that is a 2 edged sword. Buy it because in a 1970's inflationary scenario it will benefit like copper from early stage industrial demand. Then after inflation is finally acknowledged, it will move with Gold.

In the 1990's Silver was the worst of both worlds: Not precious enough, and not industrially used (post film's demise). Now Silver is the Goldilocks of metals.

The CME Ratio contracts also will increase Silver investment and liquidity. Not unlike how taking a company public increases its multiple. Increased visibility puts Silver on the "gum-rack" at the supermarket cashier now. More will be bought. And to those of you worried about Gold taxes or confiscation, fair enough. Buy Silver. its not a Central Banks metal, and that we feel is JPM's long game in the end.

And now the potential reason for today's sector firmness

"Trump is speaking this week," said Julius Baer analyst Carsten Menke. "On Wednesday he has a press conference, which will be very interesting, given how gold has reacted since his election."Gold slid more than 12 percent in the past quarter as Trump's election victory boosted expectations that his tax and spending policies would boost the dollar and inflation,prompting more U.S. rate increases. "From our perspective, in terms of the overall economic backdrop, we see no reason to change our views," Menke said. "Weare still bullish on the dollar, we still see more upside for bond yields, which of course translates into some headwinds for gold." RTRS

Note: until he changes his mind and shouts BUY AMERICAN as an excuse to weaken the USD.-Soren K.

Gero's Notes

- Gold continuing first quarter asset allocation possibilities as still being under owned by funds according to Commitment of Traders reports from CFTC

- Futures open interest at 432375 up from 423967 on January 3 shows bargain hunters and hedgers have been active on good volumes

- Silver OI at 165852 follows gold, up slightly, copper up also at 229213.

- Approaching 1200 within hailing distance affords more psychological support, price making news and possibly attracting the funds.

- Most FED tightening news is priced in as we are back to basics and an improved inflation outlook.

RBC 2017-2018 Outlook

ICYMI, people keep talking about the RBC Gold report as a solid reasonable touchstone for making investment decisions. Read it in its entirety HERE

Trump Today- (11)

11 is the number of days until Inauguration. (h/t Brian Brady), and likely the next chapter in the Trump reality drama. Bet on some policy statement like "Buy American, a strong dollar is bad for the US" neong said at some point post swear in date.

Since his words mean more to markets than fundamentals for now, he deserves his own section it seems.

British Foreign Secretary Boris Johnson is in Washington this week as the U.K. seeks to strengthen ties with the incoming administration. The president-elect tweeted yesterday that he is looking forward to meeting Theresa May following his inauguration. Meanwhile, speculation is mounting that the PEOTUS will follow through on threats to label China a currency manipulator at the new review in April, despite the country only meeting one of the three criteria specified by the Obama administration.

UK Reaches out in Preparation for Brexit

The Pound is weaker today as UK PM May re-affirms her wanting a hard exit from the EU. The pound fell to a 10-week low after May said in a Sky News television interview on Sunday that leaving the EU will be about “getting the right relationship, not about keeping bits of membership,” suggesting Britain may opt for a so-called hard Brexit. She signaled control of immigration and lawmaking are her priorities in the deal.

This would necessitate stronger Anglo alliances and steps are now being taken in that direction. It also is in no small part why China hads been accelerating its depreciation of the Yuan. China had been banking on its closer ties to the UK on trade via Hong Kong to facilitate its EU business. The Yuan's depreciating began accelerating post the Brexit vote last year. And while that in no way implies causality in what is going on now in the Yuan, it certainly is not a good sign for Chinese trade. The concept of a global Anglo alliance combined with Trumps jawboning on Chinese FX manipulation is enough to give the Yuan more than a queasy stomach. In any event the global trade situation is increasingly becoming polarized.

Good Luck

Read more by Soren K.Group