• Gold Generally Outperforms When Stock Prices are Dropping

• Gold and Silver Can Help You Generate a Diversified Portfolio

• The Bull market in Bonds is Coming to an End

Gold is considered a safe-haven asset by many investors. During the last decade, the standard for asset allocate has changed slightly, with financial advisers telling clients that they should add alternative assets to their portfolios moving away from a portfolio that is strictly stocks and bonds. By adding alternative assets such as gold bars or silver coins, you are reducing your risk by adding a product that is generally uncorrelated to the changes in both stocks and bonds.

Why Should I Add Assets Other Than Stocks and Bonds?

One of the issues that investor face when only hold stocks and bonds is that many times these two assets move in tandem with one another. While bonds are geared to provide income and stocks can generate capital gains, when interest rates rise, they generate headwinds for both stocks and bonds. Bonds are interest rate products and so when interest rates climb the price of bonds will move lower. Stocks are derived from the future value of the cash flow a company. As interest rates climb, the discounted value declines, reducing the present value of a company's shares. If you truly want a diversified portfolio you need to add an asset that is generally not affected when stocks and bonds are declining.

The Performance of Gold During Stock Market Bear Markets

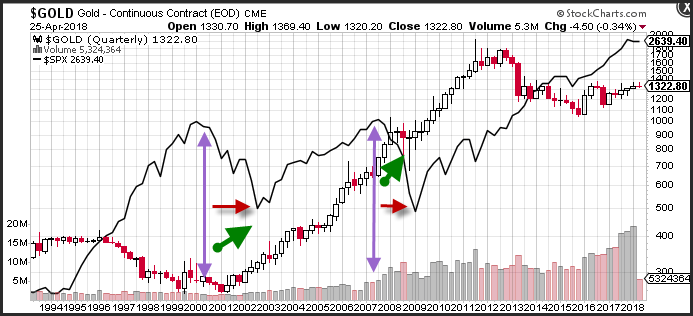

The chart of Gold bullion and the S&P 500 index shows you that gold can be a very effective asset when trying to diversify your portfolio. During the last two bear markets on the S&P 500 index, which occurred in 2000-2003 and 2008-2010, Gold prices performed well allowing a portfolio which included precious metal to outperform one that only held the large-cap index. During the bursting of the Nasdaq bubble in 2000 and the subsequent recession that started after 9-11, gold prices from the mid-2000 to early 2003 increased by approximately 41%. During the 2008 financial crisis that continued into late 2009, gold prices also increased by nearly 40%.

Why Should I Own Gold as Part of My Portfolio?

While the returns you receive from owning gold will depend on when you buy it, its real value to an investor is its ability to be uncorrelated to stock and bond prices. Gold is considered a hard asset, and by many a replacement for a currency. During periods when market turmoil is wreaking havoc, investors tend to purchase gold bars and silver coins to avoid owning riskier assets such as stocks. Gold is also viewed by many as a currency and commodity. It is quoted in US dollars, and when U.S. riskier assets are volatile, investors tend to veer away from the dollar which helps gold prices gain traction. Gold is also viewed as a commodity and performs well when inflation is increasing.

Summary

Precious metals including gold bullion and silver bars, are part of an alternative asset class that can help you minimize your risk of adverse market conditions. Gold bullion has historically been viewed as a safe-haven and has outperformed stocks during bear market conditions. By diversifying your portfolio, you can purchase gold bullion which is generally uncorrelated to the movements of stocks and bonds. Stocks have been on a tear, and the bull market in bonds appears to be coming to an end.

If you want to make sure that your portfolio is truly diversified, If you are looking to take advantage of a time to add precious metals to your portfolio, click on this link to get access to your Investment Kit or better yet, give us a call today at 800–982–6105.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer