Today, we are going to revisit some of our earlier analysis regarding the VIX and our beloved VIX Spikes. Over the past 3+ months, we’ve been predicting a number of VIX Spikes based on our research and cycle analysis. Our original analysis of the VIX Spike patterns has been accurate 3 out of 4 instances (75%). Our analysis has predicted these spikes within 2~4 days of the exact spike date. The most recent VIX Spike shot up 57% from the VIX lows. What should we expect in the future?

Well, this is where we should warn you that our analysis is subjective and may not be 100% accurate as we can’t accurately predict what will happen in the future. Our research team at ActiveTradingPartners.com attempt to find highly correlative trading signals that allow our members to develop trading strategies and allow us to deliver detailed and important analysis of the US and global markets.

The research team at ATP is concerned that massive volatility is creeping back into the global markets. The most recent VIX spike was nearly DOUBLE the size of the previous spike. Even though the US markets are clearly range bound and rotating, we expect them to stay within ranges that would allow for the VIX to gradually increase through a succession of VIX spike patterns in the future.

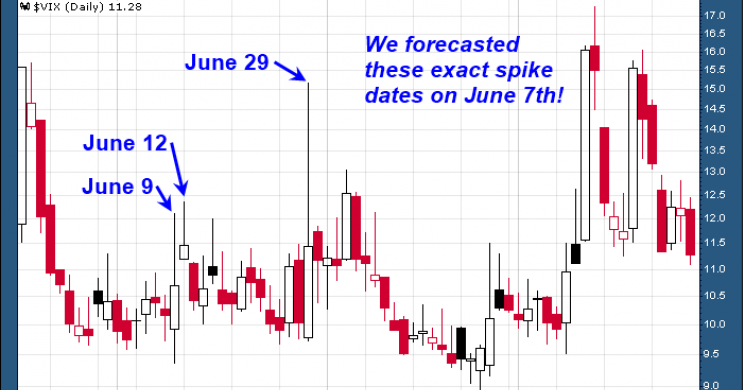

Let’s review some of our earlier analysis before we attempt to make a case for the future. Our original VIX Spike article indicated we believed a massive VIX spike would happen near June 29th. We warned of this pattern nearly 3 weeks ahead of the spike date. Below, you will see the chart of the VIX and spikes we shared with our members. This forecast was originally created on June 7thand predicted potential spikes on June 9th or 12th and June 29th.

What would you do if you knew these spikes were happening?

Currently, we need to keep in mind the next VIX Spike Dates : Sept 11th or 12th and finally Sept 28th or 29th.

Our continued research has shown that the US markets are setting up for a potential massive Head-n-Shoulders pattern (clearly indicated in this NQ Chart). The basis of this analysis is that the US markets are reacting to Political and Geo-Economic headwinds by stalling/retracing. The rally after the US Presidential election was “elation” regarding possibilities for increased global economic activities. And, as such, we have seen an increase in manufacturing and GDP output over the past 6+ months. Yet, the US and global markets may have jumped the gun a bit and rallied into “hype” setting up a potential corrective move.

Currently, the NQ would have to fall an additional 4.5% to reach the Neck Line of the Head-n-Shoulders formation. One interesting facet of the current NQ chart is that is setting up in a FLAG FORMATION that would indicate a massive breakout/breakdown is imminent. The cycle dates that correspond to this move are the September 11th or 12th move.

Please understand that we are attempting to keep you informed as to the potential for a massive volatility spike in the US and Global markets related to what we believe are eminent Political and Geo-Economic factors. Central Banks have just met in Jackson Hole, WY and have been discussing their next moves as well as the US Fed reducing their balance sheets. Overall, the US economy appears to show some strength, yet as we have shown, delinquencies have started to rise and this is not a positive sign for a mature economic cycle. Expectations are that the US Fed will attempt another one or two rate raises before the end of 2017. Our analysis shows that Janet Yellen should be moving at a snail’s pace at this critical juncture.

So, now we get to the VIX Spike data!

The last, most recent, VIX Spike was nearly DOUBLE the size of the previous Spike. This is an anomaly in the sense that the VIX has, with only a few exceptions, continued to contract as the global central banks continued to support the world’s economies. In other words, smooth sailing ahead as long as the global banks were supplying capital for the recovery.

Now that we are at a point where the central banks are attempting to remove capital from their balance sheets while raising rates and dealing with debt issues, the markets are looking at this with a fresh perspective and the VIX is showing us early warning signs that massive volatility may be reentering the global markets. Any future VIX Spike cycles that continue to increase in range would be a clear indication that FEAR is entering the markets again and that debt, contraction and decreased consumer participation are at play.

I don’t expect you to fully understand the chart and analysis below, but the take away is this. Pay attention to these dates: September 11, September 28 and October 16. These are the dates that will likely see increased price volatility associated with them and could prompt some very big moves.

This analysis brings us to an attempt at creating a conclusion for our readers. First, our current analysis of the Head-n-Shoulders pattern in the NQ is still valid. We do not have any indication of a change in trend or analysis at this moment. Thus, we are still operating under the presumption that this pattern will continue to form. Secondly, the current VIX spike aligns perfectly with our analysis that the markets are becoming more volatile as the VIX WEDGE tightens and as the potential for the Head-n-Shoulders pattern extends. Lastly, FEAR and CONCERN has begun to enter the market as we are seeing moves in the Metals and Equities that portend a general weakness by investors.

We will add the following that you won’t likely see from other researchers – the time to act is NOT NOW. Want to know why this is the case and why we believe our analysis will tell us exactly when to act to develop maximum profits from these moves?

Join www.ActiveTradingPartners.com to learn why and to stay on top of these patterns as they unfold. We’ve been accurate with our VIX Spike predictions and we will soon see how our Head-n-Shoulders predictions play out. We’ve already alerted you to the new VIX Spike dates (these alone are extremely valuable). We are actively advising our ATP members regarding opportunities and trading signals that we believe will deliver superior profits. Isn’t it time you invested in your future and prepared for these moves?