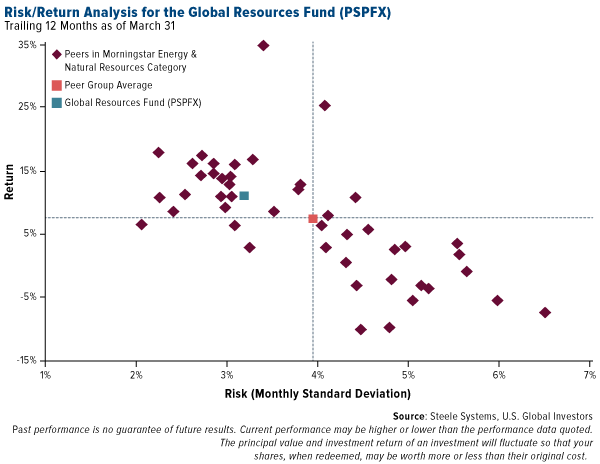

Two of our mutual funds, the China Region Fund (USCOX) and Global Resources Fund (PSPFX),offered investors very attractive risk/reward profiles compared to their respective peer groups for the 12-month period ended March 31. I believe this is the result of our unique, actively-managed quant models and nimbleness to act based on market volatility, money flows and other factors.

Look at the scatterplot graph below. The y-axis measures the 12-month return, while the x-axis measures monthly standard deviation, or, more generally, risk. Ideally, for any given time period, you want your investment to appear in the upper-left quadrant, as this indicates you’ve received higher returns for a relatively low amount of risk.

For the 12-month period ended March 31, the China Region Fund (USCOX) delivered a noteworthy return of 37.06 percent, compared to its benchmark, the Hang Seng Composite Index, which rose 24.40 percent. Its return was also higher than the average for the China peer group. At the same time, USCOX had relatively lower risk than many of its peers, with a monthly standard deviation of between 3 and 4 percent.

In USCOX we maintain overweight positions in consumer discretionary and technology. As we see it, these sectors are where the growth is, driven by innovative tech firms, from Sunny Optical to Tencent; automakers such as Geely Automotive; and casino names like Galaxy Entertainment and Wynn Macau.

Explore the China Region Fund (USCOX) by clicking here!

A Look at the Global Resources Fund (PSPFX)

Our Global Resources Fund (PSPFX) similarly had an attractive risk/reward profile for the one-year period ended in March. The fund returned 11 percent, well above many of its peers in energy and materials, and it was less risky than the group’s average.

For PSPFX, our rigorous quant research process begins with 1,600 possible names in the energy and materials space. We immediately whittle this number down to around 700 or 800 after screening for net debt-to-enterprise value—we don’t want overly-leveraged companies—as well as liquidity and free cash flow growth.

Next, we look at enterprise value-to-EBITDA—or earnings before interest, taxes, depreciation, and amortization—meaning we seek companies that offer greater value in their sector relative to their peers. In other words, we compare oil producers to oil producers, not oil producers to, say, logging and timber companies.

Finally, we screen for return on invested capital (ROIC), one of the most widely-used factors, and free cash flow yield. We like to invest in companies that we anticipate will reward us.

This gives us the 50 or so names that eventually make it into PSPFX. It’s a process that we’re committed to and that we believe delivers highly competitive results.

Commodities on Sale

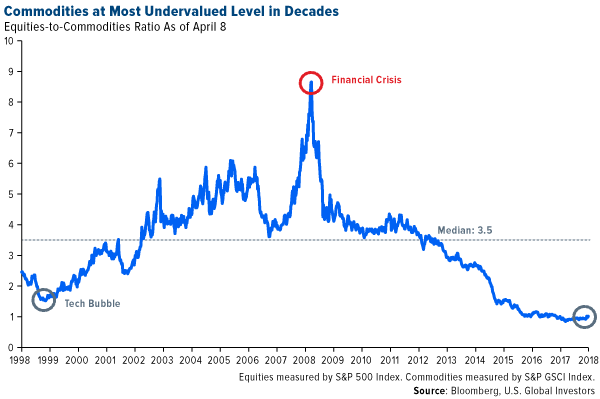

Another reason investors might want to consider commodities is that they’ve rarely been this cheap relative to stocks. The equities-to-commodities ratio, as measured by the S&P 500 Index and the S&P GSCI Index, is at its lowest level in nearly 50 years. This means that materials could be ripe for mean reversion, representing one of the most attractive entry points in recent memory.

Commodities are also responding to geopolitical jitters. With oil, aluminum and other materials making multiyear highs because of Russian sanctions and military action in Syria, Goldman Sachs recently issued a bullish statement, writing that “the strategic case for owning commodities has rarely been stronger.”

Of course, this is only one investment bank’s opinion, and there’s no guarantee that past events will end up being repeated. It’s possible a full recovery is still months or even years away. Proceed with caution, but I think it’s worth your time to at least consider adding to your commodities exposure.

Interested in gaining exposure to commodities and raw materials? Visit the Global Resources Fund (PSPFX) page!

Please consider carefully a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Past performance does not guarantee future results.

Total Annualized Returns as of 3/31/2018:

FundOne-YearFive-YearTen-YearGross Expense

China Region Fund37.06%8.99%1.80%2.76%

Hang Seng Composite Index24.40%6.00%2.48%n/a

Global Resources Fund11.00%-8.30%-5.91%1.85%

The Adviser of the China Region Fund has voluntarily limited total fund operating expenses (exclusive of acquired fund fees and expenses of 0.02%, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments) to not exceed 2.55%. With the voluntary expense waiver amount of 0.38%, total annual expenses after reimbursement were 2.36%. U.S. Global Investors, Inc. can modify or terminate the voluntary limit at any time, which may lower a fund’s yield or return. Expense ratio as stated in the most recent prospectus. Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies. It represents the stock market's performance by reporting the risks and returns of the biggest companies. The S&P GSCI (formerly the Goldman Sachs Commodity Index) serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. The Hang Seng Composite Index is a stock market index of the Stock Exchange of Hong Kong that has components of 200 companies.

Debt-to-enterprise value measures how much debt a company carries relative to its total value. Free cash flow (FCF) is a measure of a company's financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base. Enterprise value-to-EBITDA, or EV/EDITDA, equals a company's enterprise value divided by earnings before interest, tax, depreciation, and amortization. Return on invested capital(ROIC) is a profitability ratio that measures the return an investment generates for those who have provided capital. ROIC tells us how good a company is at turning capital into profits. Free cash flow yield is an overall return evaluation ratio of a stock, which standardizes the free cash flow per share a company is expected to earn against its market price per share. The ratio is calculated by taking the free cash flow per share divided by the share price.

You cannot invest directly in an index.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the China Region Fund and Global Resources Fund as a percentage of net assets as of 3/31/2018: Sunny Optical Technology Group Co. Ltd. 10.62% in China Region Fund, 0.00% in Global Resources Fund; Tencent Holdings Ltd. 10.41% in China Region Fund, 0.00% in Global Resources Fund; Geely Automotive Holdings Ltd. 9.84% in China Region Fund, 0.00% in Global Resources Fund; Galaxy Entertainment Group Ltd. 2.67% in China Region Fund, 0.00% in Global Resources Fund; Wynn Macau Ltd. 2.05% in China Region Fund, 0.00% in Global Resources Fund.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate for every investor.

Read more by Frank Holmes