Global Silver Mining Industry Productivity Falls To The Lowest In History

- Primary Silver Miners' represent approximately 30% of global mined Silver.

- Yield decline is poor and likely to get worse after Tahoe's new Escobal mine ages

- a drop in base metal demand would further damage supply of by-product Silver

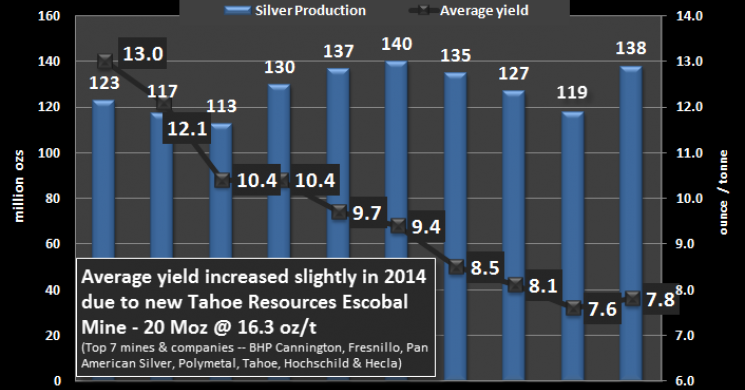

After the Primary Silver Mining Industry enjoyed a brief increase in productivity over the past two years, it fell to the lowest ever in 2016. The reason the primary silver mining industry’s average yield increased in 2014 was due to the addition of Tahoe Resources high-grade Escobal Silver Mine.

Tahoe’s Escobal Silver Mine’s average yield in 2014 was an astonishing 16.3 ounce per ton (oz/t). Not only did Escobal Mine enjoy one the highest silver yields in the world, it produced over 20 million oz (Moz) in 2014. Thus, the addition of Tahoe to the Top Silver Miners pushed their average yield to 7.8 oz/t in 2014 versus 7.6 oz/t in 2013:

Yes, it is true that the decline of yield is on the Primary Silver Mining Industry. However, Primary Silver Mining still provides a good portion of overall silver production 30%. Without this primary silver supply, the Global Silver Market would be in serious trouble.

Now, what is very interesting about adding Tahoe’s Escobal super high-grade mine to the group, it didn’t move the average yield up that much…. only 0.2 0z/t to 7.8 oz/t.

I didn’t update this chart for 2015. However, I have now added the data for 2015 and 2016. As we can see in the updated chart below, the group’s silver production has increased over the past two years from 138 Moz in 2014 to 158 Moz last year. The majority of this increase was due to the ramp up of Fresnillo LLC’s Saucito Mine:

Even though the top 7 Primary Silver Mining Companies increased their production to 158 Moz in 2016, the amount of ore they processed also reached a record high. For example, these silver mining companies processed a record 21.3 million tons of ore in 2016 compared to 19.9 million tons in 2015. Furthermore, the top silver miners only processed 9.4 million tons of ore in 2005 to produce 123 Moz of silver… yielding 13 oz/t.

The falling average yield in the silver mining industry seems to be overlooked by the majority of analysts. As we can see in the chart above, the primary silver miner’s average yield has fallen from 13 oz/t in 2005 to 7.4 oz/t in 2016. This is a 43% decline in just 12 years.

Lastly, Tahoe Escobal Mine’s average silver yield will continue to fall over the next ten years. Thus, the global silver mining industry will continue to process more ore to produce the same or less silver in the future. While the cost of energy has declined over the past few years, falling ore grades will continue to put pressure on the silver mining industry going forward.

Check back for new articles and updates at the SRSrocco Report.

UPDATE:

h/t to Blue 8 Ball / Purple Bottle / (Yellow Snow )?

Each year, the Silver Institute works with Thomson Reuters GFMS, a leading research company that is based in London, to prepare and publish a comprehensive report on that year’s silver supply and demand trends, with special emphasis on key markets and regions. This annual survey also includes current information on prices and leasing rates, mine production, investment and fabrication.

Read more by Soren K.Group