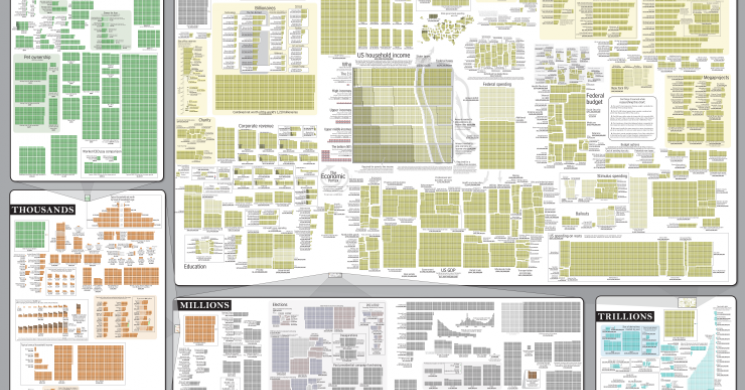

Above: some perspective via xkcd.com

Gold Does Not Sustain

After a single day's respite from the deluge of selling, triggered by North Korea nonsense, Gold skated higher to rest just above the first area of resistance at $1307 we spoke of yesterday morning.

There was another $10.00 before the next resistance, and the market ran up to it and rejected it hard.

This set is up for our fear of a re penetration of the $1307 area in spot overnight. Gold did not disappoint; Or rather it did disappoint.

Previous posts calling the potential "quick" movement:

It has worked it's way back up to $1294 over the rest of the evening and we may get a respite from further sell-offs today based on the double bottom left on the hourly. But the bias is still lower even if the market is short term oversold....The lack of solid pauses on the way down are actually encouraging should an event trigger a rally, as there should be little to stop gold from hitting a slippery slope higher up until $1307. A breach above that would give some more boost.

Geo-political issues were the catalyst it seems. If the market stabilizes here, there is room to move according to Michael Moor:

Gold is projected higher now, but I would be aware there is decent resistance on the way up at 13170-97 (basis Dec.)

Basically, the market respected every level going down to $1288 area, back up quickly to $1307, and to $1317 (dec) as Michael suggested.

We have no quantified feel from here as our signals are giving no risk reward scenario. At this point we'd be out of directional plays for this reason.

But the break down again through $1307 spot tells us the only thing stopping the market from being magnetized to the monthly descending

Lbreakout line (white bottom trendline) would be a missile that doesn't pas over japn, but one that lands there. That is how complacent the world is.

Market Wrap: If Apple Took a Holiday

By Michael Comeau of T3Live

Yesterday, the Nasdaq took a big hit yesterday on a sell-off in Apple (AAPL).

Today, we saw the opposite as Apple powered higher.

After a positive start to the day, Apple accelerated in the afternoon on expectations of a repatriation tax holiday in President Trump’s tax pln .

Apple has a mount of cash overseas and would be a direct beneficiary of such a measure.

Lately, there’s been plenty of chatter about weakness throughout Apple’s supply chain. But keep mind, the Apple supply chain is pretty tough to game because of its sheer size and complexity.

And chatter about a potential tax benefit gave traders an excuse to buy the dip.

The Nasdaq rose 0.4% vs. a 0.1% gain for the SPX.

Meanwhile, the Russell 2000 set a new record high, surpassing the 1460 mark for the first time ever.

US economic data is mixed today. The Richmond Manufacturing Index was well above consensus. The S&P Case Shiller Home Price Composite was slightly above expectations. Consumer confidence was in-line. And New Home Sales expectations missed by a pretty large margin.

Meanwhile, the Fed heads injected confusion by tossing out opposing views on inflation.

Chicago Fed President Charles Evans said he support gradual rate hikes, but he also said that “I’m a little nervous that some of the recent weakness might be a little more structural.”

Minneapolis Fed President Neel Kashkari outright said the “The Fed should be under no pressure to raise rates. We have time to let inflation climb back to target.”

Meanwhile, New York Fed President William Dudley said “I expect inflation will rise and stabilize around the (Fed’s) 2 percent objective over the medium term.”

FOMC Chair Janet Yellen also made some waves. She said the Fed may have overstated the strength of the labor market and inflationary trends.

Presumably, this hints at a more dovish Fed. However, she added that the Fed “should be wary of moving too gradually,” which points to hawkishness.

In other words, nobody knows anything.

Based on last week’s policy announcement, the Fed as a whole appears hawkish, but it’s getting harder and harder to figure out what’s what.

The VIX hit a low of 9.94 this morning, marking the 7th straight day with an intraday low below 10. That’s obviously a sign of the market’s overall inaction.

We’re still not seeing much intraday movement in the indices, though some individual stocks certainly bounce around quite a bit, particularly in high-beta tech.

The dollar bounced again today, which pushed gold back down towards the widely-watched $1300 level.

Biotechnology sold off today after a data disaster at Axovant Sciences (AXON).

AXON shares fell over 70% today on negative results for a Phase 3 trial of its Intepirdine Phase 3 MINDSET Alzheimer’s treatment.

Credit reporting agency Equifax (EFX), which was recently hit with a major data breach, announced that CEO and chairman Richard Smith has retired. Current board member Mark Feidler will serve as non-executive chairman. Paulino do Rego Barros Jr., president of Equifax’ Asia Pacific region, moves into the interim CEO slot.

Equifax fell -1.0% today

Crude oil saw some mild profit-taking, dipping back under $52.

Read more by Soren K.Group