Gold: Short-Term Storm Clouds Appearing

Source: Michael J. Ballanger for Streetwise Reports 02/20/2019

Sector expert Michael Ballanger discusses some of his recent trades in gold and silver.

The year 2019 has started out with rallies in virtually everything—stocks, bonds, metals and even cryptocurrencies—as the spectre of a Friendly Fed has given rise to animal spirits of the most extreme nature. The GGMA portfolio opened this morning ahead 27.18% YTD versus a 10.89% advance for the S&P, but as much as I would enjoy basking in the sunlight of temporary success, recent price movements in gold and silver are forcing me to adopt a cautiously pessimistic stance on gold and what could be best described as a hopefully optimistic stance on silver, both being influenced by their respective RSI readings.

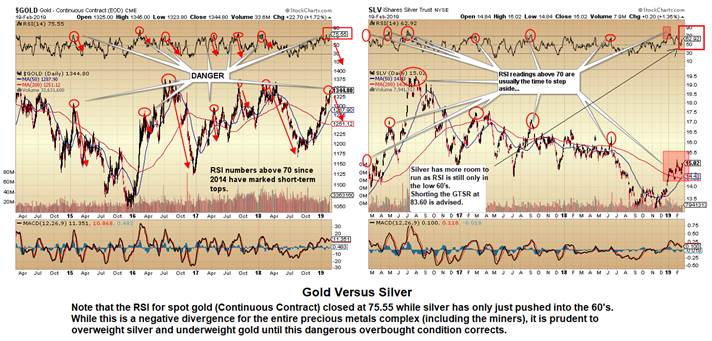

As you can observe from this chart, gold is substantially outperforming silver thus far in 2019 and that is being reflected in the current RSI readings, where gold's RSI is 75.55 and silver's RSI is 62.92. While it is not necessarily an outright "SELL" signal, history would suggest that even if it doesn't repeat, it stands a decent chance of rhyming, so prudence is the word for the week and caution the order the day for the leveraged positions reacquired on the 14th of February.

The action in the miners has been precisely what the doctor ordered for our ailing precious metals portfolios, and while the healing process has been quite remarkable since I re-established all long positions in late August of 2018 (link to August 27th article), it is only recently that bullish sentiment has spiked to levels usually associated with the topping process. To be clear, the term "topping process" is NOT an intermediate or long-term call on the trends for gold and silver prices, but rather a short-term indicator to be used in timing the purchase of additional precious metals products.

Additionally, several of us trade futures and/or options and/or leveraged gold miners or ETFs which, in my world of excruciating margin calls and equity drawdowns, have no place in the intermediate or long-term portion of portfolios. They are for TRADING—period—so when RSI for gold vaults into the mid-70s, where it resides today, I liquidate all long positions in leveraged products and sit back and wait for the ultimate correction from overbought to oversold status. Initiating leveraged longs into oversold conditions has yielded far better results over the years so I do not EVER try to outsmart the RSI, MACD or sentiment numbers.

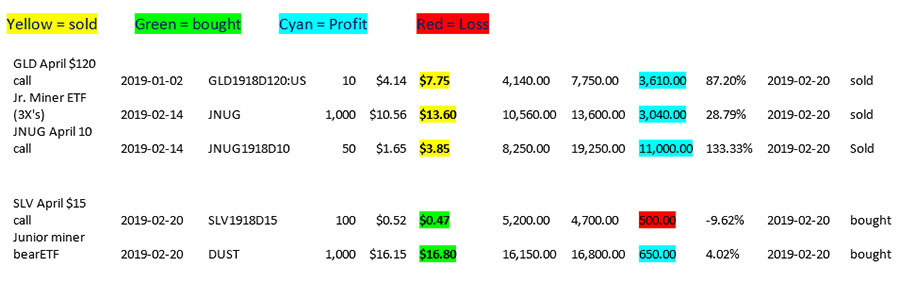

Accordingly, I am making some changes to the portfolio this morning wherein all options and futures positions are now sold and profits (a few substantial) booked. Of the US$17,650 profits booked, I am adding to silver with 1/3 of the profits buying the SLV April $15 calls for $0.52. This way we have leverage to silver (RSI 66) over gold (RSI 76) in case the precious metals continue to ramp higher while taking some risk off the table by way of profit-taking. I am also taking a high-risk flyer on the DUST at $16.15

Thus far today I have the following fills completed:

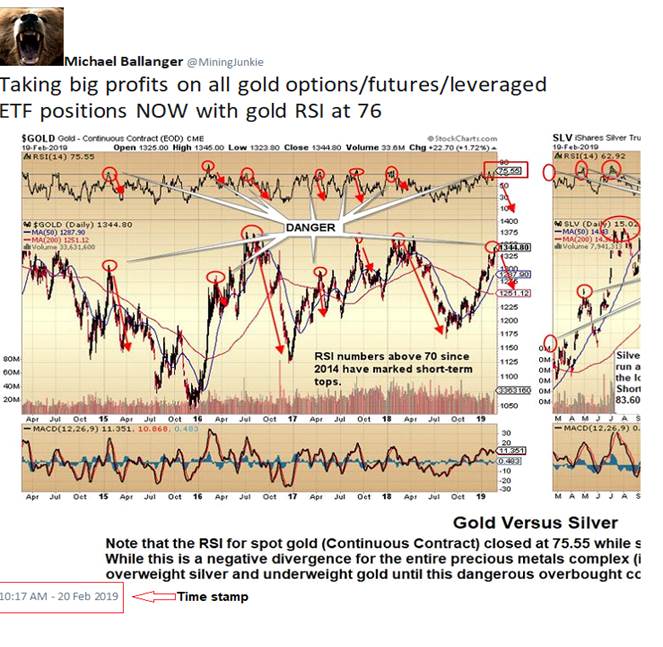

I will have an after-market commentary but as I executed these orders at around 10:30 a.m., I might have to post some time-stamps on the fills because I went to clean the fireplace glass for 45 minutes and when I came back, the miners were all down and the DUST was up! Timing was, shall we say, "fortunate"? My Twitter feed was at 10:17 a.m. and it can be found here, so there you go.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Read more by MarketSlant Editor