Source: Rudi Fronk and Jim Anthony for Streetwise Reports 07/31/2018

With non-commercial gold shorts now at a 25-year high, Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, discuss the factors behind that, as well the potential for a reversal.

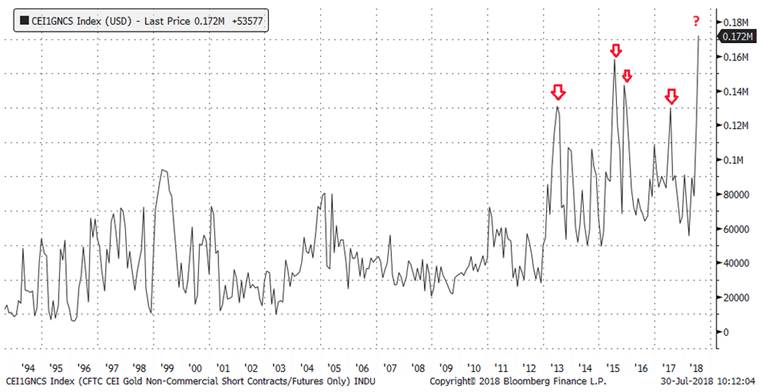

The CME COT report of July 27 shows non-commercial gold shorts have suddenly spiked to a 25 year high. Over the past five years, every similar spike in short interest (red arrows on the chart below) has led directly to a short squeeze rally in the gold price, with an average gain of 12.5%. Why should this time be any different?

The Daily Sentiment Index reading on gold for Friday, July 27, 2018 was unchanged at a low 13% while the Hulbert HGNSI was also unchanged at -2.17%, indicating that gold timers were more short than long. In a sign of the times, effective last Friday, the $2.3 billion Vanguard Precious Metals and Mining Fund (VGPMX) was renamed the Vanguard Global Capital Cycles Fund "as part of a restructuring intended to broaden the fund's mandate and diversify its portfolio." In short, the fund dumped its gold holdings.

The Vanguard fund's percentage of gold mining stocks dropped suddenly from roughly 80% to 25% as a result of the change in its mandate, which might explain the high volume, capitulation-style drop in major gold stocks such as Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and Goldcorp Inc. (G:TSX; GG:NYSE) on Thursday. As pointed out by The Daily Market Summary, Agnico Eagle was the fund's largest position as of June 30, Newmont Mining Corp. (NEM:NYSE) was the second largest, and Barrick was its fifth largest.

Also of note, gold stocks have generally performed better than gold itself since the most recent gold price swoon that began last April. And junior gold stocks have fared better than the large caps…both positive indicators.

GDX (VanEck Vectors Gold Miners ETF) made a marginal new low for the move on Friday, but GDXJ (VanEck Vectors Junior Gold Miners ETF) did not. The last time this divergence happened, it marked the December 2017 low in gold.

Back to last Friday's COTs. The commercial net short position fell 11% to 65,688 contracts as of Tuesday, which is the lowest short position since January of 2016, also a low in gold. The gross speculative short position rose 7% to a new all-time high of 172,023 contracts. This COT data obviously hasn't mattered yet, but it will at some point.

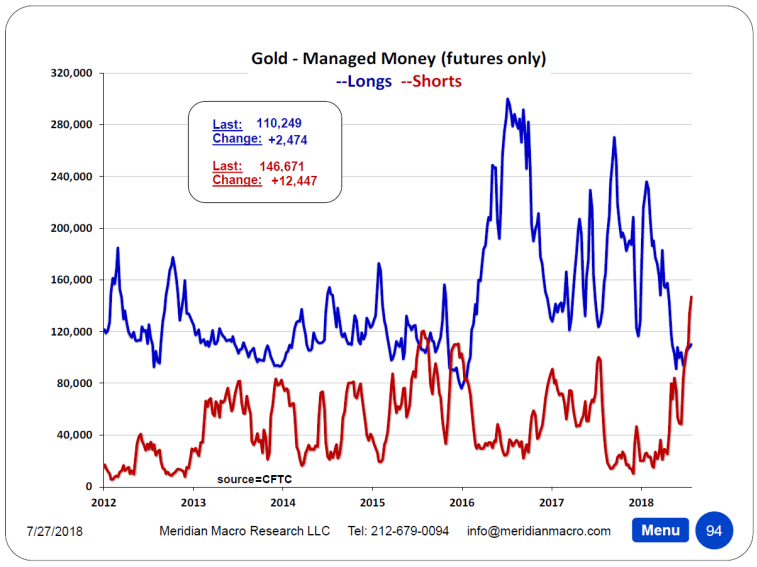

The aggressive players on the short side over the past few weeks have been the hedge funds, found in the disaggregated COT data as Managed Money. The gold Managed Money category reported a record net short position last Friday (see chart below). When this reading hits extremes, it typically signals that a turn higher is just around the corner.

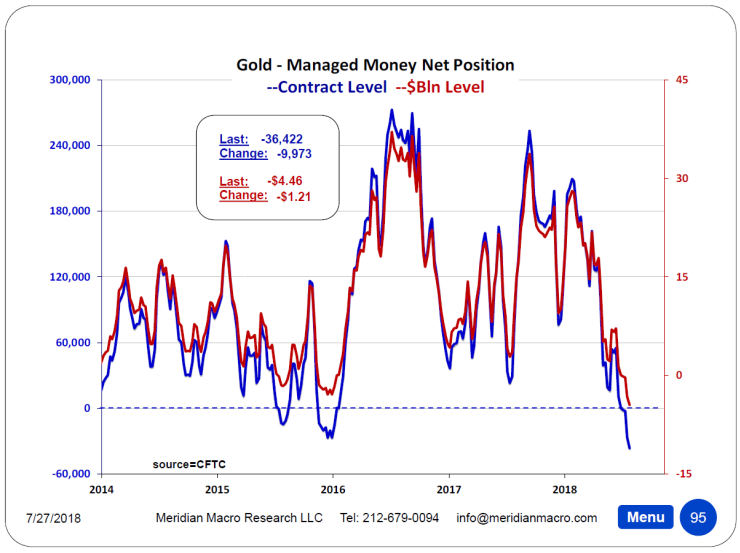

Meridian Macro estimates that the hedge fund net short position totals nearly $4.5 billion (see chart below).

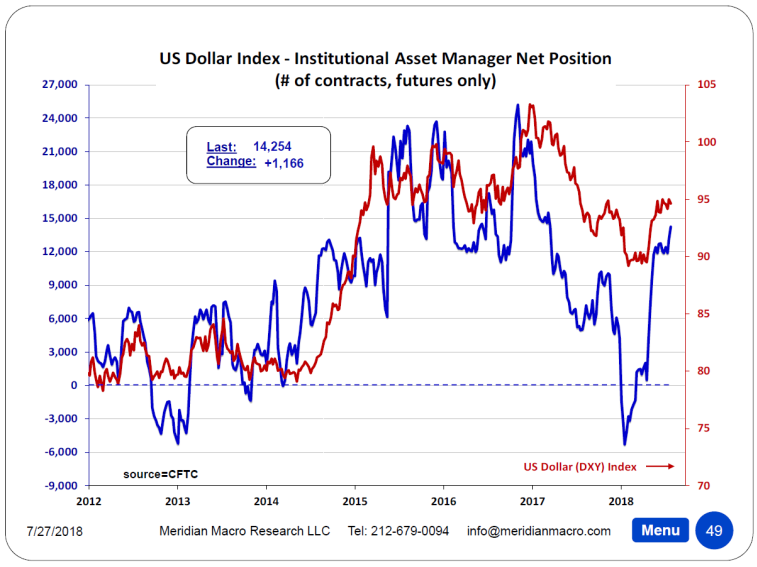

Meanwhile, Managed Money players have put on a record short position in Treasuries (a bet on higher rates) and are now crowding back into dollar long positions where their very strong buying has curiously not popped the dollar index above resistance at 95 (see below).

In aggregate, we see the potential for a reversal of recent trends where gold rises due to a short squeeze aided and abetted by lower interest rates as Treasury shorts are squeezed and accompanied by a reversal in the dollar. Perhaps gold is now a beach ball under water?

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders. Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

[NLINSERT]

Disclosures: 1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold. 3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by the authors.

Read more by MarketSlant Editor