Stocks Hit New Record Highs, Dollar Jumps On Senate Vote; Japan Has Longest Winning Streak In History

Tax-cut optimism, a potential Fed Dove appointment and the Yen takes a powder as equities rally. All of these strengthened the USD with Gold suffering the most.

5 minute chart

Global stocks hit new all time highs overnight, with US stock-index futures, Asian and European stocks all rising overnight after the Senate adopted a fiscal 2018 budget resolution, paving the way for Trump's $1.5 trillion in tax cuts, while news that "dove" Jay Powell may be the next Fed chair added to the risk-on sentiment.

Among key macro trades, the USD rallied on optimism Trump tax cuts are a step closer, with USD/JPY close to 113.50 and USD/CHF back above 200DMA. USTs push through overnight lows dragging bunds and gilts lower; short Sterling strip initially bid higher after dovish Cunliffe comments before unwinding due to steepening in Eurodollars. European equity markets opened higher but ground back towards flat, as mining stocks and banks outperform. The euro slipped as investors awaited the next move in Spain’s Catalan crisis, and the yen fell ahead of Japan’s election. Gold dropped along with European bonds as safe havens lost favor. WTI crude fell as Iraq sought to restore flows from fields in a disputed region. Spanish banks Sabadell and Caixabank weigh on IBEX after Catalan separatists target them for deposit withdrawals; not reflected in Spanish bonds, however, which actually outperform. ZAR weakest in EMFX due to speculation Deputy PM could be fired; crude futures pressured by the strong USD.

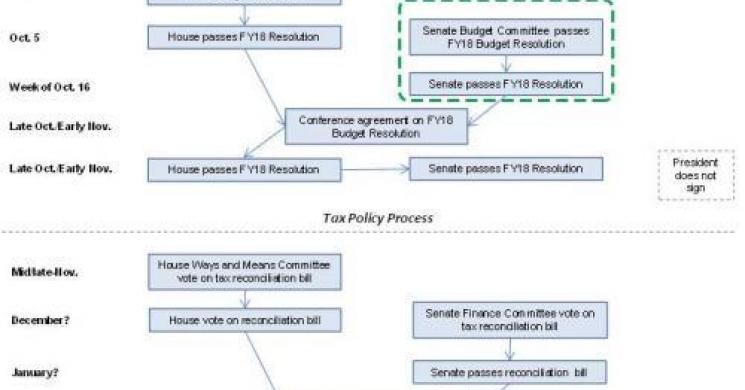

In the top overnight event, the Senate voted to adopt budget resolution through 51-49 vote, which paves the way for a tax overhaul and shields a future tax reform bill from a Democrat filibuster. To be sure, this is only the first step in a process that only now becomes fraught with disagreement among republicans. Sure enough, “the budget still has to pass the House, but near-term, it should be supportive for the dollar,” said Shinichiro Kadota, a senior foreign-exchange strategist at Barclays Securities Japan Ltd. in Tokyo. “Senate passage of the budget was a step required for budget reconciliation to advance tax reform.”

There were also reports that US President Trump is leaning towards Powell for Fed Chair. However, it was later reported that US President Trump advisers are said to be leaning towards Taylor or Powell as the next Fed Chair and added that the Fed chair role was down to the aforementioned 2 candidates, although according to online betting site Predicit the contest is now over.

Investors continue to eye political developments in Spain, the decision on a Federal Reserve chair that may sway the path of U.S. interest rates, and Brexit negotiations, suggesting caution as markets head into the weekend. But Thursday’s bout of volatility dissipated quickly as tax-cut optimism took hold. The CBOE Volatility Index, which surged as much as 17 percent on Thursday, actually ended the day in the red and fell further on Friday. Spain’s IBEX was unchanged after falling -0.2% even as the Stoxx 600 gained as officials in Madrid are finalizing plans for taking control of Catalonia. CaixaBank down 0.4%, Banco Sabadell were down 1.6%; separatist campaign group Catalan National Assembly called on supporters to pull cash from the two banks to protest at their decision to shift their legal domiciles out of the region.

Material and tech stocks are supporting European equities this morning after a resolutely weaker day yesterday, and earnings are the main focus with Volvo shares hitting a record high after its earnings beat estimates. Swedish firms are among the best performers with Ericsson also gaining 4.8% after its earnings. Meanwhile the IBEX is lagging peers as investors exercise caution ahead of a potential triggering of Article 155 this weekend.

Japan’s Nikkei 225 Stock Average rose for a 14th day, matching the longest winning streak on record ahead of Sunday’s general election when the Abe administration’s popularity will be put to test. The last time the index saw a similar rally was back in 1961. The Nikkei 225 has gained on every trading day in October, rising 5.4 percent, while the Topix index extended its rally to a tenth session. Shares reversed an early decline as the yen weakened after the U.S. Senate adopted a fiscal 2018 budget resolution that boosted the odds for U.S. President Donald Trump’s tax cut plans. Stocks in Tokyo have been boosted on the outlook for strong corporate earnings, foreign buying and bets that Prime Minister Shinzo Abe’s coalition would retain power with a two-thirds majority in parliament. There’s “more stealth” in this Japan market rally, said Andrew Clarke, director of trading at Mirabaud Asia Ltd. in Hong Kong. Abe’s ruling coalition is projected to lose its two-thirds majority in the election, the latest Nikkei poll showed. The most likely scenario is the Liberal Democratic Party-Komeito bloc picking up 297 seats, shy of the 310 needed for a so-called super-majority. “If the Abe victory is not priced in or is even better than expected there are going to be a lot of people chasing their tails,” Mirabaud’s Clarke said.

Elsewhere in Asia, the MSCI Asia Pacific Index was little changed at 166.91. New Zealand retirement-village operator Ryman Healthcare Ltd. fell 4.1 percent, amid concerns incoming Prime Minister Jacinda Ardern’s policies will lead to lower property prices. Kiwi stocks fluctuated and the local dollar fell. “While political dust is settling in New Zealand with the formation of a coalition government to be headed by Jacinda Ardern, the climate is heating up in Japan ahead of general elections on Sunday, said Rob Carnell, head of research and chief economist at ING Bank in Singapore. In Hong Kong, the Hang Seng Index gained 1.2 percent, rebounding from its biggest lost in two months Thursday. India is closed for a holiday after a ceremonial shortened trading session to mark Diwali on Thursday. Shares in New Zealand .NZ50 notched their 14th straight rising session and fifth winning week to close at a record after the nationalist New Zealand First Party agreed to form a new government with the centre-left Labour Party following weeks of political negotiations, ending the centre-right National Party's decade in power. But the New Zealand dollar wallowed at five month lows after a 1.7 percent fall on Thursday, its largest daily fall since June 2016, on concerns the new Labour coalition will take a tougher stance on immigration and foreign investment.

In commodities, West Texas Intermediate crude dipped 1 percent to $50.76 a barrel. Gold fell 0.7 percent to $1,281.22 an ounce. Copper climbed 0.7 percent to $3.19 a pound.

In rates, The yield on 10-year Treasuries increased four basis points to 2.36 percent, the highest in more than a week. Germany’s 10-year yield increased four basis points to 0.43 percent. Britain’s 10-year yield advanced three basis points to 1.276 percent.

Economic data include existing home sales. P&G, General Motors, Honeywell and Baker Hughes are among companies reporting earnings.

source Zerohedge

Read more by Soren K.Group