Recent news that Theresa May was unable to convince members of Parliament to even consider her current deal as well as the future political and societal consequences of any failure to move ahead with an orderly Brexit deal. The question before traders and investors is how will this reflect in the global markets and how will currencies react to this new?

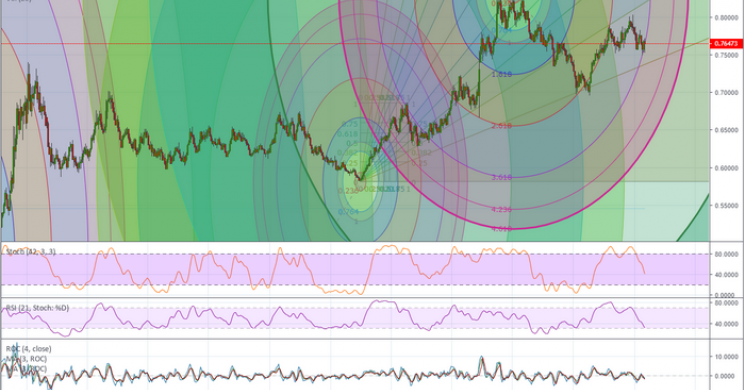

The GBP (British Pound) appears to be poised to a breakdown move aligning with our Fibonacci Arc structures. These arc structures help us to understand where “inflection points” are likely in the markets and where bigger moves may initiate. The current Arc level, near current price, is indicating that any failure of an upside move will likely prompt a downside move to near 0.739 – or lower.

The overwhelming vote to deny Theresa May's Brexit deal came down to 391 Against and 242 For the current Brexit deal. It is likely that the British Parliament will continue to break down into warring factions as a contentious future political outcome will play out. The people of Britain are still wanting to complete the Brexit while it appears Parliament has yet to come to terms with the process.

We believe this current event will be somewhat isolated to Britain and European nations, yet be believe there could be a larger contagion even if other nations attempt to push their desires to leave the EU as well. Overall, time will tell how this plays out with global investors. Our first impressions are that the global markets will move lower on this news and that currencies could find new weakness as this chaos continues.

Please take a minute to visit www.TheTechnicalTraders.com/FreeResearch/ to read all of our most recent research – including our very details 5-part global economic research post. This post is very important because it shows you predicted price levels going all the way into 2021 and highlights why this “new bull market” may just be getting started. Find out why www.TheTechnicalTraders.com is dedicated to helping you find and execute better trades and stay ahead of these market moves.

Chris Vermeulen