Is the latest bitcoin bubble about to burst?

via Alistair Charlton and ibtimes.co.uk

In what may sound like news lifted from 2013, the bitcoin cryptocurrency is on a charge, breaking its own record every day as the value of each coin approaches $3,000 (£2,300), far higher than the price of gold.

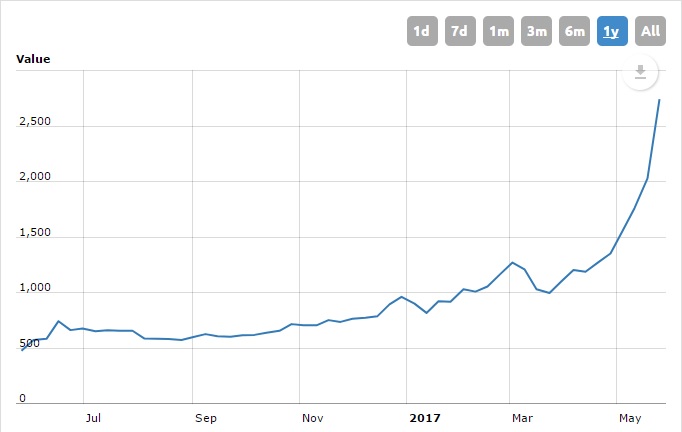

For a sense of perspective, bitcoin was worth less than 10 cents in 2010, before rising to fame, fortune and notoriety, breaking the $1,000 barrier in late 2013, before crashing to $300 by the end of the following year. The end of 2016 saw bitcoin recover to $600, but 2017 has been on an entirely different scale; the year began at $1,000, before surging to over $2,700 in just six weeks between late March and late May.

In simpler terms, a (very brave) $1,000 investment in 2010 would be worth $40m today.

As always with bitcoin, the cause of the rapid gain is open for debate. Coin Telegraph cites economic and political uncertainty in the US as a driving factor; the country is the largest bitcoin market globally, with a 34% share of daily trading volume. But an increase in global adoption is also to thank for the currency's 177% year-to-date growth.

Coin Telegraph adds: "The demand toward bitcoin is rising exponentially in major markets outside of the US, including China, South Korea and Japan. China, in particular, has made a strong comeback over the past few weeks, replacing South Korean, Japanese and European exchange markets to become the second largest bitcoin exchange market in the world."

But as with any bitcoin rally, the gains are immediately followed by talk of a bubble and a looming crash, just as there was in 2013 and 2014, and the bubble is expected to pop.

Current Bitcoin Pricing HERE

Bitcoin has grown from $500 to over $2,700 per coin in the last 12 monthsWorld Coin Index

Charles Hayter, chief executive of Crypto Compare, told IBTimes UK: "Yes, it does feel as if there is an element of a bubble taking over. The bubble will pop at some point". That being said, Hayter believes bitcoin is due a re-rating after Japan recognised it as a currency at the start of April this year.

As in the early days of bitcoin rallies, media attention can play its part in maintaining the rise-and-fall cycle. Hayter says: "Price rises generate media attention which generates further price rises and the cycle continues. Prices will reach higher highs [and] higher lows going forward for bitcoin, although when the market corrects there will be a lot of traders found wanting."

It's still the Wild West out there

In the early days it was easy to describe bitcoin and the cryptocurrency market as the Wild West. Bitcoin being used by illegal drug sites like the Silk Road helped secure the image, along with bitcoin exchange heists and the dramatic implosion of Mt Gox, the largest dollar-to-bitcoin exchange at the time.

But despite bitcoin's image being far cleaner now than back then, it is still incredibly young compared to traditional currencies. Hayter said: "We are only at the start of this industry and that's why it's a Wild West - misinformation is rife and there is the usual dose of skulduggery."

Writing for MarketWatch, financial columnist Matthew Lynn says: "In truth, it is starting to look like a bubble, and that should be making investors everywhere feel nervous. Why? Because it tells us that financial crazes are back. Because it will lead to overinvestment and wild speculation. And because bubbles inevitably crash - and once that happens, the losses can ripple out in unexpected ways."

Lunn adds: "Right now, bitcoin is on a roll. We have no way of knowing what its real value might be. The peak of a run might will be some way off. But when a crash comes, it won't just be its holders who feel the pain."

Big boys want bitcoin toys

But it isn't all doom and gloom. Speaking to IBTimes UK on Twitter, Stellabelle, who claims to earn a living from trading cryptocurrencies, said: "I doubt [there will be a bitcoin crash]. Real flow is coming from Japan who just legalized bitcoin. Australia is following Japan's lead. Hong Kong may follow then rest of Asia...[the value of bitcoin] might go down temporarily but then it will go up further. This is a huge influx of mainstream entering the scene. No one has a true global understanding of what's happening but I know the venture capitalist world is getting disrupted. Big boys want bitcoin toys."

Read more by Soren K.Group