An interview with Chairman of TSX listed AUG gives some insights into current projects, the evolving perception of Junior miners, and Goldcorp's investment.

Gerardo Del Real: This is Gerardo Del Real with The Outsider Club.

Joining me today is executive chairman of Auryn Resources (TSX: AUG)(OTC: GGTCF), Mr. Ivan Bebek. Mr. Bebek has nearly two decades of experience in financing, foreign negotiations, and acquisitions in the mineral exploration industry. His understanding of the capital markets and ability to position, structure, and finance companies that he has been associated with has been instrumental in their successes. Mr. Bebek formally was the president, CEO, and co-founder of Cayden Resources, which of course was sold to Agnico Eagle for $205 million in November of 2014. He's also the co-founder and director of Stratton Resources and a co-founder of Keegan Resources, which is now Asanko Gold.

Ivan, thank you so much for joining me today.

Ivan Bebek: Thank you for having me, it's a pleasure to be here.

Gerardo Del Real: Well, it's been a few months since we've spoke. The last time we spoke, we talked about the concept of one of the most aggressive exploration drill programs that you were looking to launch in 2017, and now, we're weeks away from that. In three weeks’ time, the company will start what I think is the single largest exploration discovery drill program in the world. It's 25 targets, 6 projects, it's 55,000 meters. Can you share some of the details for us?

Ivan Bebek: Thanks again. It's an exceptionally exciting time. Finding these gold mines or gold deposits as we've done with our previous companies has led to some great successes. We added a new, really big layer to our formula, and that's been by expanding our technical team dramatically. In the downturn, not only did we acquire some incredible assets, we got one of the deepest technical teams, which was predominantly formally Newmont's global exploration team, which is an outstanding group of experts that have found several million ounces of gold. To take on this big program, there's been a lot of prep work done to get these things to a drill-ready state.

As I was saying to you in a previous conversation, as we take off the layers on each target, the surface layers of data that we're collecting before we drill it, we're getting to the point on a few of them where we lose a lot of sleep because of the scale of how big they could be or how rich they could be. Not only are we going to take 25 really good shots at finding 25 substantial goldmines, but we're actually going to do that and a few of them could be something that the world talks about for many years to come. The company is really well-positioned for major gold discovery this year.

Gerardo Del Real: Agreed. Now, you mentioned the technical team and I think that's key. We spoke last time about everything coming together and the fact that the technical team really loves working within this model because of the fact that you don't have the red tape that comes with working for a company like Newmont, which is obviously much bigger and everything takes a lot longer. With that being said, what kind of analysis and planning goes into a program of this size?

Ivan Bebek: That's a great point to bring up. We did talk a lot about how we remove the red tape and let these guys chase their brightest ideas. Within a major, you generally have about 25 or 30 geologists that have different projects around the world and they're generally competing for budgets. Once they get a budget on a project, they have to earn future dollars to come in behind it and chase their ideas. With us, this technical team gets to go on a full-on blast and do everything from exploring things all together unifidely, a lot more people on one team, but they get to spend money and do the smart science that each target deserves.

In a major, you would have to divide it amongst several different projects. Here, they get to do everything on each project. It's kind of like the candy shop of a budget towards some really smart gold finders, to be real simple about it. What they've seen since last September... these guys have worked countless hours on each target that's coming up getting ready to drill to increase our possibility of having a discovery — our efficiency to discovery. We're going to spend about $40 million from January through December of this year, which is a lot, but the money that gets spent is getting spent in areas that have 14 layers of data prior to a drill seeing that target.

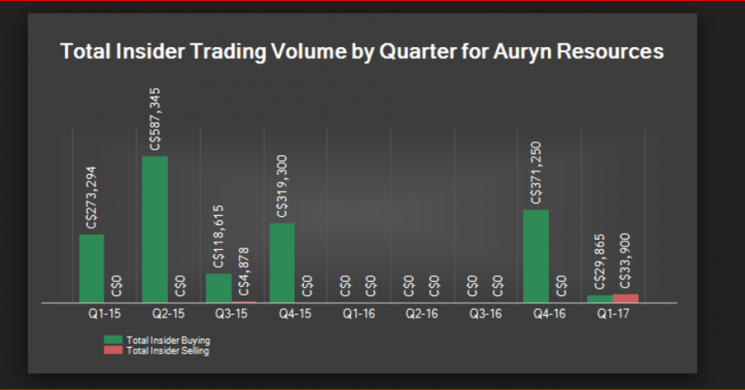

Normally, you'd see in most juniors, a few layers of data, but when you get these guys working on a target, it's really unreal. It's a surreal thing to experience and see. It leads me, as the executive chairman, to be one of the largest inside buyers of our company. It's the result of spending so much time seeing the potential really close upfront across all these targets. Really, an exciting time and these guys are really separate to anyone else out there.

Gerardo Del Real: You mentioned efficiency and I know that, obviously, having the technical expertise of someone with the experience that the ex-Newmont exploration team has, is hugely, hugely beneficial. But, back to the efficiency point. You also have the backing of Goldcorp's (NYSE: GG)(TSX: G) $35 million investment into Auryn, which, of course, came at prices actually higher than where you're trading today. How do you spend that in the ground and on exploration? How efficient are you with that?

Ivan Bebek: About 89% of that is going to see the ground in terms of a big portion of that will be drilling and drilling prep work. 89% of the ground means that $36 million of that $40 million will actually go towards finding major gold discoveries. That ratio is extremely impressive in our business. A lot of juniors have relatively high burn rates to conduct their business and they're usually about a 60% in the ground, 40% split. We've got ours up to 89% going in the ground and a decent portion to market our company so that everyone can hear about it and the share prices can trade well.

The other point there with Goldcorp's investment... We're starting to see some mergers and acquisitions (M&A) in the business, as we saw El Dorado purchasing Integra the other day. I think there's a significant demand amongst the majors, and especially has been in the past, with rising gold prices for growth. In the last six years, there's been very little exploration done in our business because there hasn't been the capital to do it. Now that the majors have got their balance sheets in order, there’s been enough write-downs, they've started to see some really good profit margins on their existing mines. They're starting to look towards growth.

Goldcorp's investment, which would be about a 15-20% premium to our current price today, this came by virtue of interest in our portfolio and that's what we're exploring. It's now seven projects across Canada and down into Peru. Their interest, what I think would be obvious, that if we get into an amazing discovery, there would be M&A potential down the road. They weren't the only ones interested, but they were the most aggressive.

I think that if you look around the business, you've seen Newmont (NYSE: NEM), you've seen Barrick (NYSE: ABX)(TSX: ABX), you've seen Agnico Eagle (NYSE: AEM)(TSX: AEM) ... You've seen some great companies investing into these juniors, and I think the reason why you're seeing the magnitude of money coming to companies like ours is basically a foreshadowing to when discoveries are made, these are going to be the growth models for companies such as Goldcorp and the other ones that I had mentioned. The investment was two-part. It's 12.5% of our company, we own 18.5% as management.

It's very, very accretive to us in terms of having a substantial partner like that if we find something, obviously, really big. At the same time, is it going to create a repeat success like Cayden, our last company, where we did extremely well for shareholders by selling to Agnico Eagle in 2014? It does increase that possibility, but it's more of a tell for the market of what's to come. There's going to be a big growth demand for the majors. There's very few really high-quality projects around the business and companies and I'm proud to say that we're one of them that attracted their money at a very good price.

Gerardo Del Real: You mentioned Agnico Eagle and obviously, you have a history there with the monetization of Cayden. You recently acquired a second greenstone belt in an area where Agnico has decided to invest $1.2 billion over the next couple of years. Can you talk a bit about that acquisition and how that positions you for future exploration?

Ivan Bebek: You're touching base on our Gibson MacQuoid acquisition, which sits between Meliadine, an 11-million-ounce mine Agnico Eagle is building in Meadowbank and Amaruq, which are other mines that are being discovered or being built by Agnico Eagle. Their commitment of $1.2 billion is significant. It's in the Arctic. You have to understand that the Arctic can sound expensive, but the grade of gold that's being discovered up there is extremely high, which takes an area that's fairly remote, like the Arctic, or Nunavut, as the more commonly understood name for it, and it makes it a very affordable place to be.

The number-one thing that you can mine in the world that can solve any challenge for a gold mine is how rich the gold is — how high-grade it is. Agnico, in the last three years, have done a tremendous job with the discovery of their Amaruq deposit, which is next to us up in the Arctic. I believe, from zero, they're pushing through six or seven million ounces of about six or seven grams per tonne (g/t). That's an incredibly large and rich goldmine. We think it will get a lot bigger. I believe that's their impression, as well.

Our existing property, our main flagship asset, Committee Bay, we're testing 12 targets that could be that magnitude. We'd, obviously, be finding the early stages of it this year, not the entire mine, but it'd be a good place to start a major discovery in our Committee Bay Greenstone Belt. Gibson MacQuoid, the belt down to the south that I've mentioned to you, it actually sits a bit closer to infrastructure. It's not too far from Meliadine and it's got some tremendous scientific reasons that our technical team is elated that there could be some major discoveries there, as well.

When you go into an area to go find a gold mine, the first question we ask ourselves is, "How big could a mine be here if we found it? How rich could it be here? Is it going to be a one-gram mine or is it going to be a seven-gram mine?" The mines we're seeing up in the area, not only are they large in the six to eleven-million-ounce range and still growing, but they're also very rich in grade, which means these would be very profitable mines. We've done a pretty good job. I believe that between our Committee Bay asset, as well as our Gibson MacQuoid asset, we have two Greenstone belts.

One of them is much more mature which we're drilling this year, that being Committee Bay, but the other one, combined, they're about 400-500 kilometers in length of areas that we're going to explore and drill. With the magnitude of technical team we have, they've spent the last two years unlocking the best way to find gold in the Arctic where we're going to go explore, and I think that this year is going to be exciting. It will be the first year where we can get into some real discoveries because they've brought it down to a pretty efficient science of where we could start making these discoveries.

We are extremely excited about those projects up there. They're multi-generation exploration assets, meaning if you find deposits here, you'll probably be finding them based on the amount of targets, the amount of land that we've acquired, and the amount of gold signatures and surface, over the next 50 years. This is a real phenomenal place on the Earth where high-grade gold occurs. It's very early days, and we get to tip off the initial discovery of it this summer.

Read more by Soren K.Group