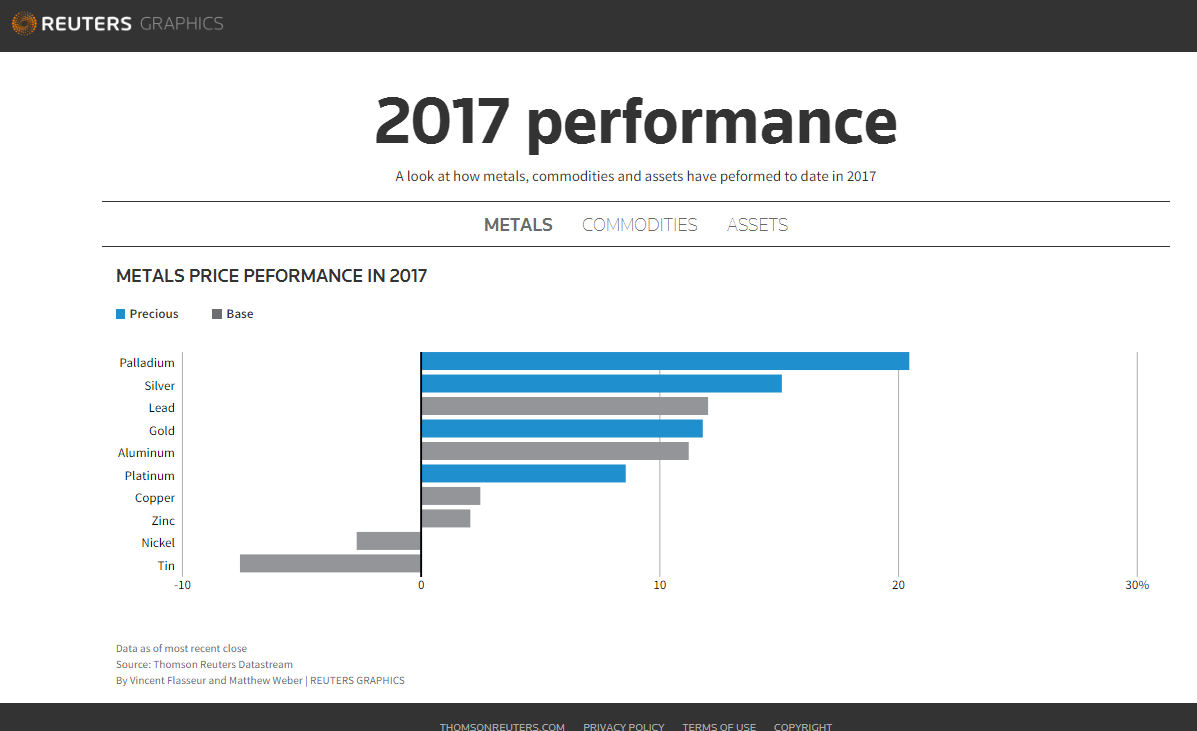

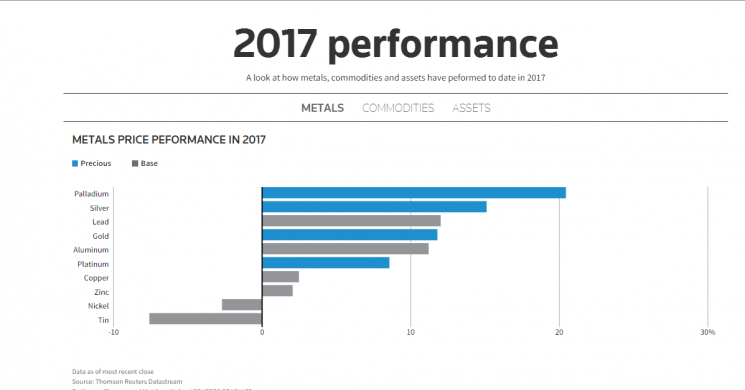

2017 Charts - Silver Leads at 15.1%, Energy Lags, Sugar Sags

To be fair, Palladium is King so far this year. But we discount that because its pretty much all under Putin's bed. Silver on the other hand is outperforming even Gold, which is retaking its rightful place as money in the eyes of the world. So even though we are worried about Silver lagging in this most recent rally, it is still out performing its more senior brethren. Lead's performance makes sense as well given the rise in strategic metals like uranium. But that is another sardonic story.

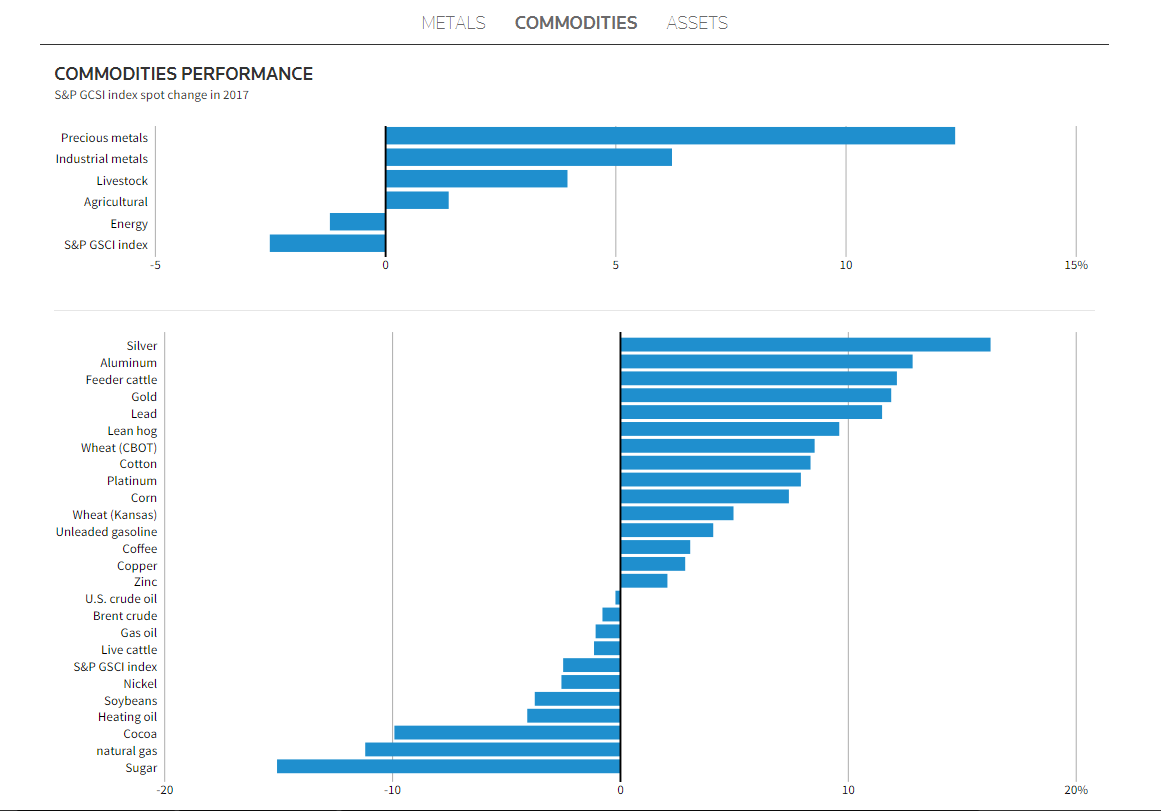

Commodities

Precious metals lead the commodity pack this year with industrial metals in second. Frankly, we have been thinking industrials would continue to outperform for some more time and are surprised at the Precious performance. This has to be in part a function of the "fear factor" that does not bolster things like steel. if this were just reflecting inflation, PM would not be in first. But then again, reality does trump expectations here.

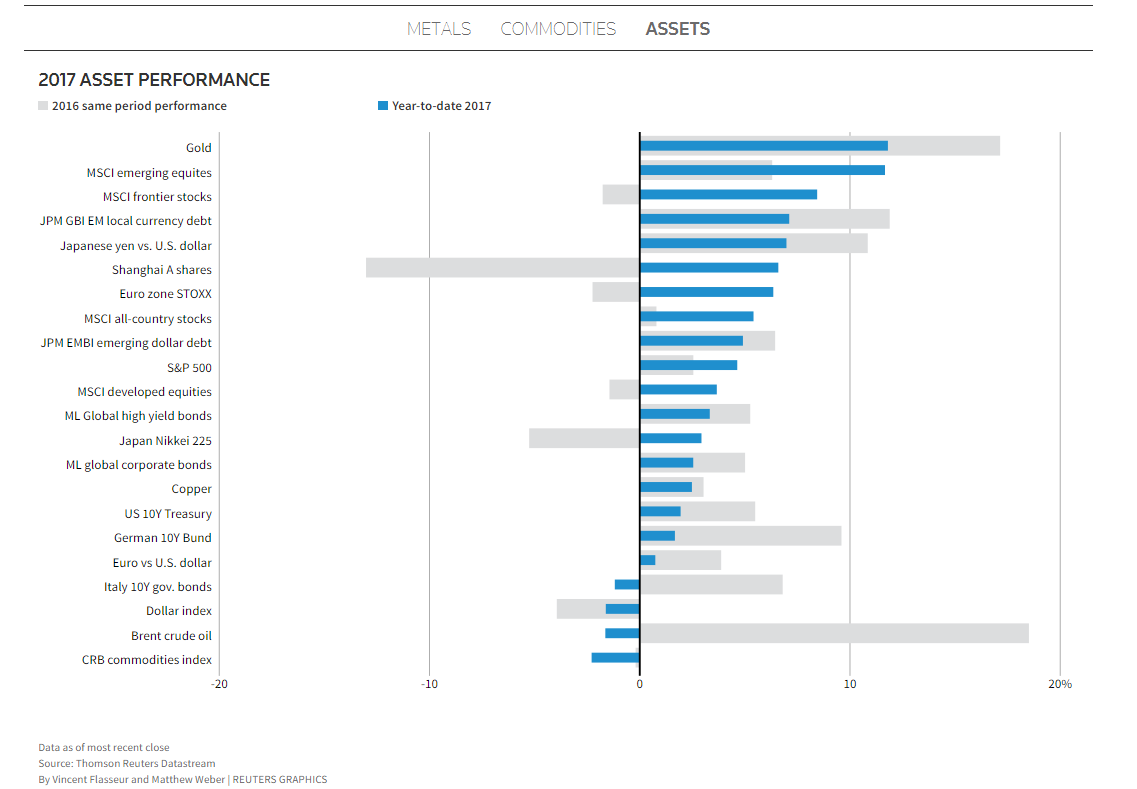

Assets

Emerging Markets

Note Emerging markets are doing quite well. This is in part mission creep as stock slingers are pushing more and more stock investors into overseas ETFs. The story goes like this: Emerging market currencies are hammered, and this makes it easier for them to export their raw materials. Buy those companies. All this is sound logic.

Just remember that a country's currency reflects its ability to generate revenue just like a stock price. Therefore a weak currency has debt, default risk or political uncertainty tied to it. We feel as in the past with the BRIC narrative, so in the future. As the currency race to the bottom continues, these countries will be left holding a bag full of dollars.

Energy: The Secular Trend Wins

Note the reversal from last year in Energy. This is in spite of OPEC production cuts. The lesson here is Shale is driving market prices lower no matter what is done. The descent can be slowed, but the production of oil is getting cheaper and cheaper. Like robots replacing people in Detroit, Shale will keep a cap on Oil for some time, exogenous events notwithstanding.

interactive charts HERE

Gold Retreats From Five-Month High As Dollar Rebounds

- Investors on edge over simmering geopolitical tensions

- Trump says dollar too strong,

- Fed should keep rates low

By Devika Krishna Kumar and Jan Harvey

NEW YORK/LONDON, April 13 Gold prices eased from five-month highs on Thursday as the dollar rebounded from a slide triggered by comments from U.S. President Donald Trump that the greenback was too strong and that he would prefer the Federal Reserve keep interest rates low.

The metal was up about 2.6 percent on the week, on track for its biggest weekly gain since June, as concerns over tensions in North Korea and the Middle East kept stock markets under pressure.

Spot gold was up 0.06 percent at $1,286.84 an ounce by 2:26 p.m. EDT (1826 GMT), having earlier hit its strongest since early November at $1,288.64 an ounce. U.S. gold futures for June delivery ended 0.8 percent higher at $1,288.50.

"We think that gold prices could fall back in the near term if tensions cool, as seems likely, and that they will continue to fall as the Fed tightens policy later this year," Capital Economics said in a note.

Trading volumes in wider markets have been light ahead of the long Easter holiday weekend.

The dollar index, which tracks the greenback against a basket of six trade-weighted peers, was up 0.4 percent, after a 0.6 percent decline on Wednesday marked its biggest one-day fall in three weeks.

Fears of a new weapons test by North Korea as a U.S. carrier group sailed towards the region, as well as worries about the upcoming French presidential election, still kept investors on edge.

Russian President Vladimir Putin said on Wednesday trust had eroded between the United States and Russia under Trump, as Moscow delivered an unusually hostile reception to U.S. Secretary of State Rex Tillerson in a face-off over Syria.

"We remain constructive on gold (given) elevated political tensions in both Korea and Syria, coupled with a lower drift evident in U.S. equity markets," INTL FCStone said in a note.

From a technical perspective, gold faces strong near-term resistance at $1,291 an ounce, the location of a trendline declining from its 2011 record high of $1,920.30 an ounce, analysts said.

One of the major physical gold markets, India's imports of the precious metal soared to $418 billion in March, data showed.

"The recent rise in imports is the result of the rise in demand expected during the wedding season, which has just begun, and for the Hindu festival of Akshaya Tritiya at the end of the month," Commerzbank said in a note. "In addition, there was probably something of a demand backlog following a period in which Indian traders held back with buying gold when the government suddenly launched its cash reform, having used first of all their stocks."

Among other precious metals, silver was up 0.3 percent at $18.52, off a five-month high of $18.599 earlier in the session. Platinum was 0.05 percent lower at $968, while palladium was down 0.3 percent to $794.50.

(Additional reporting by Nallur Sethuraman in Bengaluru; Editing by David Holmes and Meredith Mazzilli)

Read more by Soren K.Group