Top Day: OPEC, Yellen, Draghi, Wells Fargo Fireworks, and the BOE

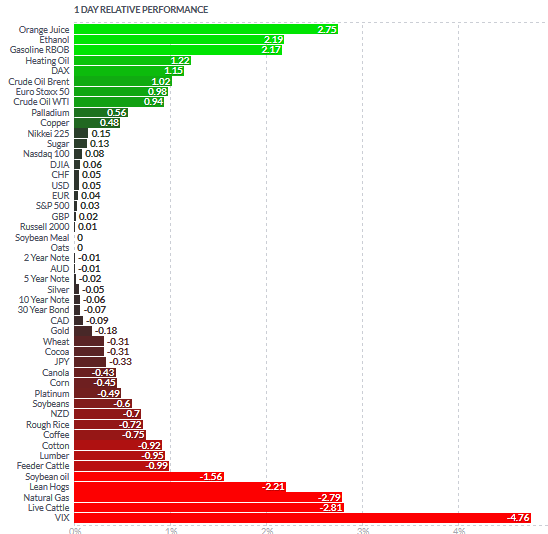

- OPEC discord could result in much lower oil prices

- Yellen and Draghi speak before legislators

- the BOE will ease

Janet Yellen will testify before the House Financial Services Committee at 10am ET

- FOMC's Bullard and Evans also will gives speeches

Our Take- Grandstanding by congressmen up for re-election and redirects by the Fed. Markets may gyrate regardless

Mario Draghi will field harsh questions at the German Parliament

- ECB's easing policies will be questioned

Our Take: Criticism is expected. What would be a surprise would be if Draghi came out and stated more easing is coming, especially in light if the BOE's expected move and pending BREXIT.

OPEC begins talks today in Algiers today

- Iran will not freeze production until it recoups marketshare

- Saudi Arabia continues to talk congenially, but has not agreed to give up marketshare

- Saudi Arabia is a huge contributor to Hillary Clinton's campaign

Our Take: These things never end well. SA will agree to a Freeze in production, but will not give up marketshare it has grabbed over the past year. If Iran and other Opec countries continue to complain, they will suffer. The Aramco nuclear option is to turn the pump up to "11", and letting oil free fall. Their cost of production is lowest among OPEC nations and their technology best at scaling up and back.

If oil went to $20 for an extended period of time, Iran could be destabilized. Venezuela will be worse S.A. has other things to consider, like ISIS and their own country's stability. But with Shale oil technology advancing more, ISIS deriving income from the sale of oil, and Iran just being a pain in the ass: we are not sellers of $11.00 puts in oil. Russia would also suffer greatly. The Shia (IRAN) and Sunni (SAUDI) sectarian divide is growing as well

Lastly, a precipitous drop in oil prices would kill Russian and other demand for Gold as their currency reserves will dry up limiting their purchases. Some Gold may even be sold.

Pre-election production cuts? Not a Chance

BOE Will Ease (probably)

- Wednesday, BOE Governor Shafik said more easing on the table

Our Take: the BOE must ease if it wishes to compete in trade post a BREXIT. And if an EU secession does not happen, the BGP will have to reach parity with the EURO. A BOE ease will also make more EU QE possible.

Well's Fargo Has issues

- Chief Executive Officer John Stumpf will forgo more than $41 million of stock and salary hoping they let him stay.

- Senator Elizabeth Warren demanded he resign for “gutless leadership” after he blamed abuses on low-wage employees

Our Take: anyone who thinks this is isolated at Wells Fargo is on drugs. It can be summed up in one phrase:

" Employees are incentivized to game the market". Better stated here by Kling

From Kling's Law of Banking Capital

Regulatory systems break down because the financial sector is dynamic. Financial institutions seek to maximize returns on investment, subject to regulatory constraints. As time goes on, they develop techniques and innovations that produce greater returns but which can also undermine the intent of the regulations.

This is a normal, human response to attempts to influence behavior. Any CEO who designs an incentive bonus system for the company's sales force knows that over time employees will learn how to “game” the system. SK- Or be fired.

From the Sept 9th post Ron Paul: Neither Hillary nor Trump will fix the Fed

Even better stated here yesterday by Dr. Paul:

There will undoubtedly be more calls for stricter regulation, notwithstanding the fact that regulators failed to detect this fraud, just as they have failed to detect every fraud and financial crisis in history. And who will suffer? Why, the average account-holder of course.

Ron Paul Asks: Who's the Bigger Fraud, Wells Fargo or the Fed?

Good Luck

-SK

Read more by Soren K.Group