Ron Paul and Jim Grant Want the Fed to Go Away

-by Soren K.

-contributions by V.Lanci

MUST WATCH-Ron Paul On Hillary&Trump: Both Useless for Fed Reform:

Since he first announced his desire to abolish the Federal Reserve system to Daniela Cambone of Kitco News in 2010 Congressman Ron Paul has been fighting an uphill battle.

Ron Paul Comes Out and Says it

“I don’t think the Federal Reserve should exist – it would be best for congress to exert their responsibilities and that is find out what they are doing”' said Paul. "It is an ominous amount of power they have to create money out of thin air and being the reserve currency of the world and be able to finance runaway spending whether it is for welfare or warfare; it seems so strange that we have been so complacent not to even look at the books.

Full article Kitco News Email: dcambone@kitco.com

Unwavering and Undaunted.

But Ron isn't Alone in the Fight for Fed Accountability

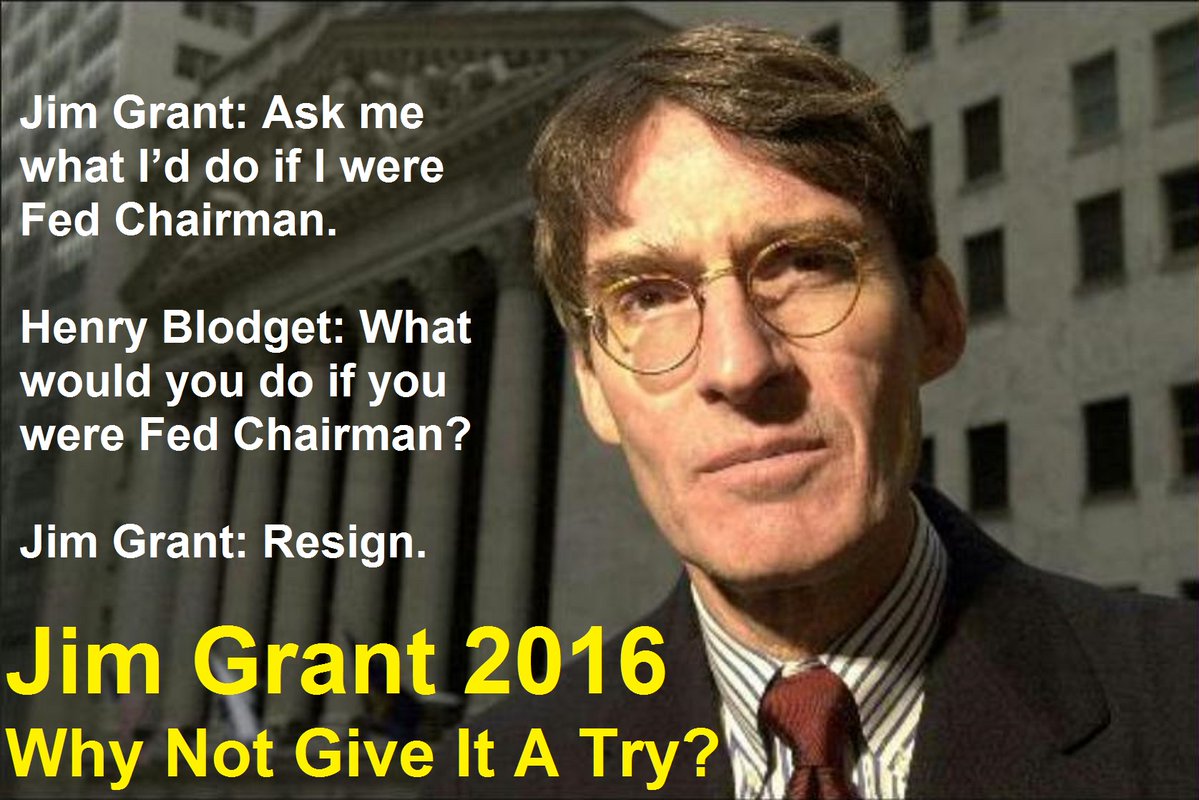

Who Does Ron Paul Endorse for Fed Chair?Although RP's intent is to disband the Federal Reserve and their brand of crony capitalism, he was asked who he would select as a Chairman of the Federal Reserve if he had to pick one. His answer was Jim Grant

Here is a Sept 7th Interview of Jim on the Fed

To Grant, central bankers’ policies around the world will make investors either “end in tears” or “laughter,” depending on how people position themselves.

Full Interview HERE

Jim Grant on the Fed

Excerpt:Jim Grant recounts a Fed Founder's Regrets

"Willis was present at the creation of the Fed, he was one of the draftsmen of the Federal Reserve Act of 1913. Willis was also the first secretary of the Federal Reserve Board -- he knows this institution. He wrote a book in 1936, which was a lamentation about the low estate of Central Banking in America, the Fed had lost its way in 1936. It had opened its doors in 1914 and by 1936 it had eaten the forbidden fruit, it was in the business of guiding the economy, of managing the economy, of manipulating this aggregate and that, and Willis said: "For Pete's sake. You can't know that -- the GDP data are not reliable enough for you to do what you think you are doing." It's a wonderful tract against the tendency of the Fed to do what it has so lethally done to this economy in my opinion, which is to steer us, in the interest of raising the GDP it presses interest rates to zero, pouring out immense volumes of econometric studies in support of this dubious enterprise. Hey Fed: just attend to the dollar, that's it, no inflation, just do one thing! You've heard of mission creep, these guys are the mission creeps par excellence."

-Soren K.

But Why End the Fed?

What follows are examples and information culled from personal experience and public information written by Vince Lanci

The Fed Effect on Markets

Fed History in Short

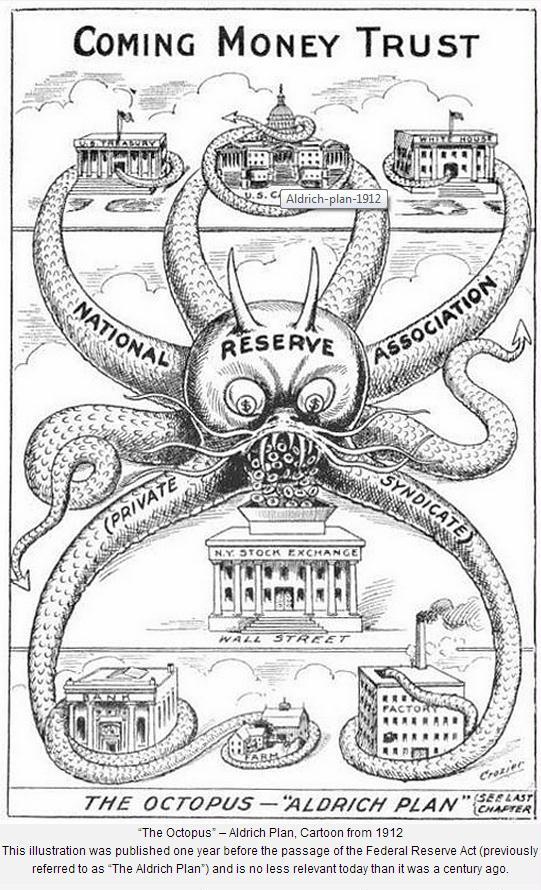

- The Federal Reserve Bank is a private institution created by Bankers after a market crash to "help".

- The Fed was comprised of Global Bankers who pledged their support to Woodrow Wilson in return for their new "Banking Trust"

- Since then, that Banking Trust has co-opted businesses, politicians, and turned the middle class into a consumer rather than a producer of value.

Government Cannot Regulate the Fed, It Can Only Abolish It

Attempts to regulate industry are thwarted at every turn. The Government reacts to crises. They are not proactive. Politicians desire to remain in office. Laws are passed that are already passe. And when a law is passed that has potential to do sweeping reform, it is passed blank. Graham Dodd was one such law. The Politicians, on the advice of Financiers,( who warned them it would take too long) passed it as a toothless law. The financiers in turn promised to "help" fill in the blanks afterwards.

The Fed Backs the Laws that are

- Lobyist Written

- Crony Politician Passed

- Gamed by the Corps. who pay the Lobbyists

Rules are gamed because Corporations are quick to adapt to new rules in pursuit of their mandate to make money. And government is reactive, not proactive, always fixing the last crisis. This is in no small part to keep their jobs.

From Kling's Law of Banking Capital

Regulatory systems break down because the financial sector is dynamic. Financial institutions seek to maximize returns on investment, subject to regulatory constraints. As time goes on, they develop techniques and innovations that produce greater returns but which can also undermine the intent of the regulations.

This is a normal, human response to attempts to influence behavior. Any CEO who designs an incentive bonus system for the company's sales force knows that over time employees will learn how to “game” the system. SK- Or be fired.

Examples: Politicians Enable Corporations, Who then Contribute to Politicians

Enron, El Paso Exploit Deregulation: Traders profit, get paid, become consultants and executives.

That was a screw up of partial deregulation. The Government deregulated Natural Gas prices at the whole sale and producer level, but did not deregulate it at the consumer level. The result was Enron, El Paso, and every firm that had access to the Texas panhandle pipelines to just turn it off when they wanted to. (VBL: Traders at these firms actually got paid bonuses on unrealized profits and left before the positions were liquidated. At least one became an Executive at an Energy Exchange.) Meanwhile California was forced to pay up for Nat Gas. But they could not pass those higher costs onto consumers. What could they do, put slots on appliances? California actually had sold its Natural gas to other states. Result was rolling brownouts and Gray Davis' political death.

Connecticut Governor Malloy is a Clinton Player

-Governor Malloy of Ct. is a large fundraiser for the Clintons- Fact

-Malloy foolishly let GE leave CT.- Fact

-He is part of the insurance problems in CT.- look it up

-Malloy pays extortion money to Bridgewater to stay afterwards- a rose by any other name

-Malloy is a leading candidate for a powerful Cabinet position when Hillary is elected- prediction, deep background source

A Prediction:

-Malloy leaves CT a wreck- soon enough

-That money paid to Bridgewater is a chit to be called when Malloy needs money- on information and belief

-Malloy has designs on the Whitehouse after Hillary- business associate describing Malloy's ambitions to me

-Meanwhile Ray Dalio just bought himself a cheap call on the White House- that's how I'd play it

Here are Some Observations From Others on how the Fed "Helps" us

h/t @RudyHavenstein

It seems silly now, but in 1912 some nuts thought the Fed would become an all-powerful Wall Street/Bank/Gov't cartel.

Fed Pals: In the dictionary, next to the word "Complicit"

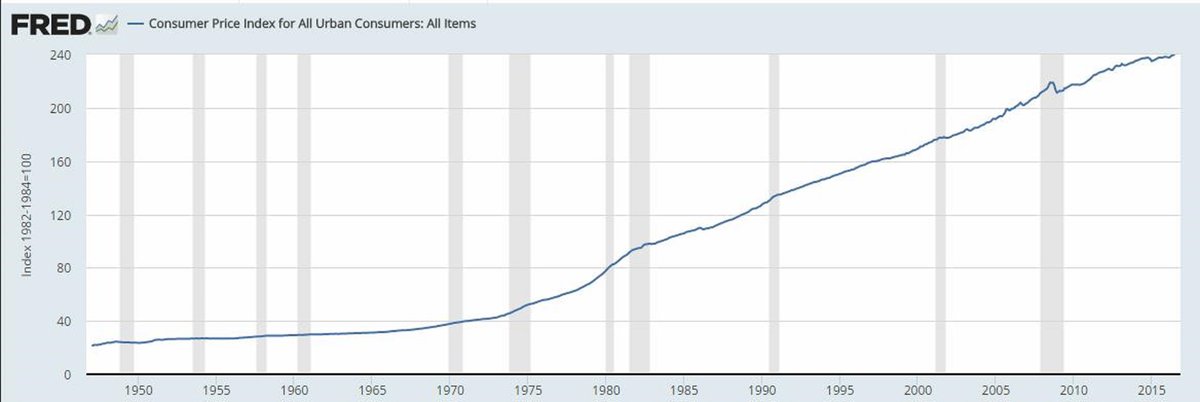

Please, Fed apparatchiks, stop the deflation!

Corn is down almost 60% in 4 years, as are Kellog's Corn Flakes prices... Check that, CEO earnings are higher.

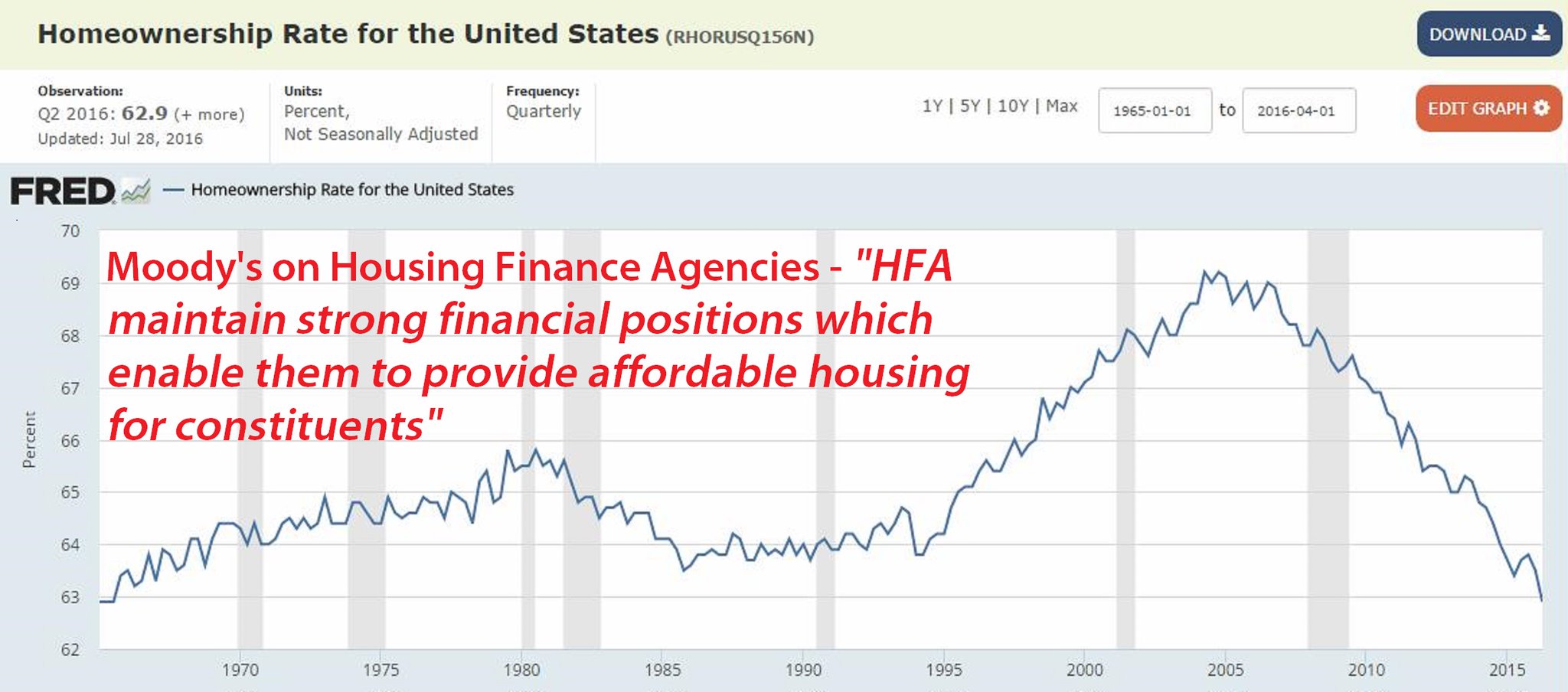

Moody's on Housing Finance Agencies - HFA maintain strong financial positions which enable them to provide affordable housing for constituents.. About that

Abolish the Fed

Follow Vince on twitter: @VlanciPictures

Read more by Soren K.Group