Summary

The FOMC meets today at 2pm ET with little expectations of a rate change. There is no press conference following today's announcement either. Analysts will look at the statement for hints of future rate direction. Gold is little changed as traders await the Fed statement. Switzerland turns exporter of Gold to the US.Japan announced a larger stimulus plan last night in response to the poor reaction to the leaked trial balloon it let out yesterday. Deutsche Bank is ground zero for what ails Europe's banks. The Nikkei rose overnight in reaction to the new improved stimulus package. But Chinese shares plummeted on domestic economic worries.- Soren K.

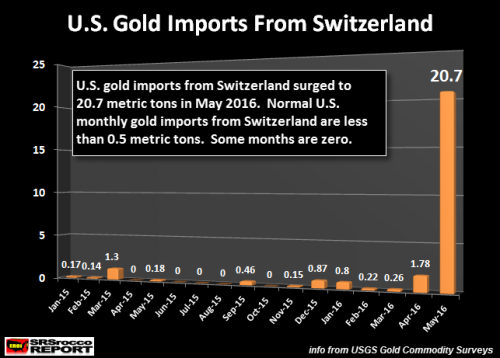

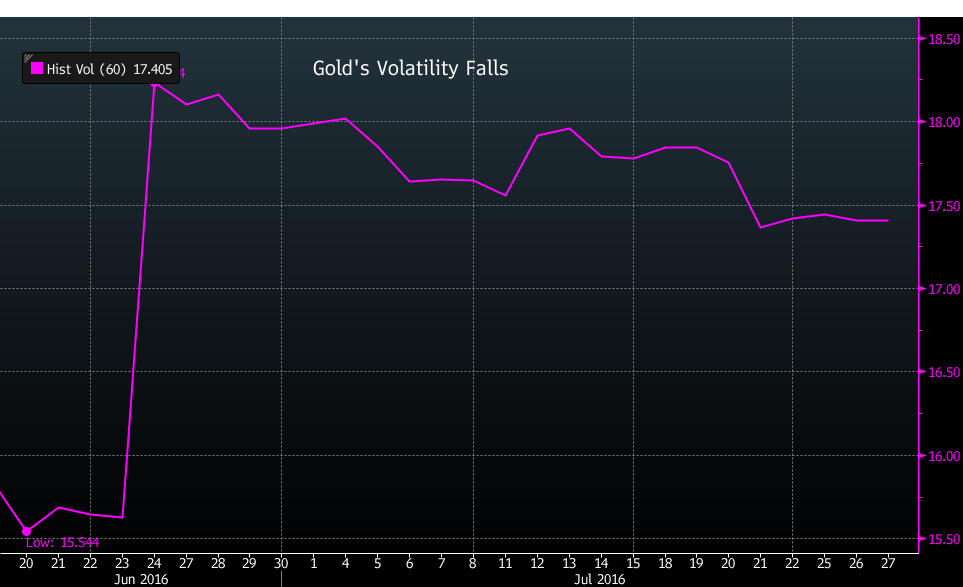

The scale of this chart is deceiving. Should read: "Gold Vol stabilizes at higher levels post Brexit".

Headlines

- Gold volatility falls as market waits for U.S. rate decision: BBERG- What to watch for from Gold today here

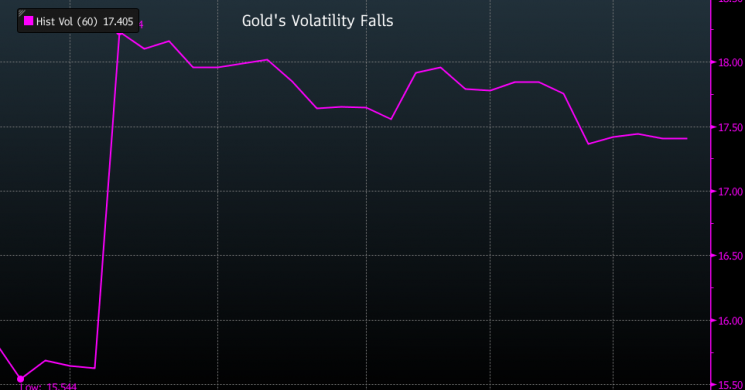

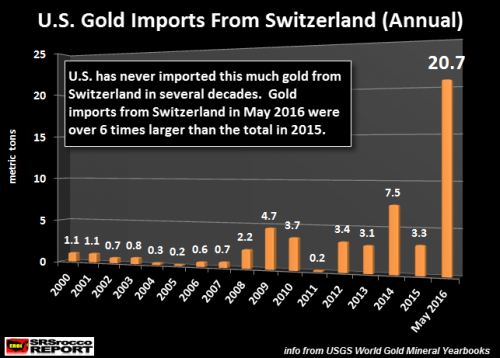

- Gold Imports from Switzerland soar in May- what is going on here?

- Japan central bank may spend $265 billion to boost economy- Nikkei rallies another 1.5% .Yen does not drink Kool-Aid. We're with the Yen on this one

- Gold ETF holdings fell 4.4 metric tons to 1,996.2 tons on Tuesday, lowest level since July 1.- not surprising given the lower OI in futures

- Musk Says Tesla May Need ‘Modest’ Capital Raise for Model 3: BBG- modest means $10BB more taxpayer money

- Musk Says He’s ‘Frustrated’ by Media Coverage of Autopilot:ZH- Now he feels our pain with his whole business structure

- BP says second-quarter refining margins drop to 6-year low: BBERG- Gasoline demand is down . Oil's downside isn't over

- OIL BULL CASE IS AS COMPELLING AS BEAR CASE: GOLDMAN'S CURRIE- Analyst gets paid anyway.

- Deutsche Bank Profit Plunges 98%, Worst Is Yet To Come- When DB recommends an EU bank bailout they'll be first in line

- MBA Mortgage Applications Fell 11.2% Last Week- Raise rates

Technical Brief- We are getting so bearish Bonds it is scary. These are not our numbers, but confirm our own analysis

Bonds- The market signals a short term topping selloff, but last week’s retracement selloffs hit the17006* target. A close under 17006* alerts for a larger top that will send selloffs back to 168-. Near termtrade is still trying to rebound off 17006* and shift to friendly trade. A close over 17205 is near term friendly.However, a close over 17225* is needed for a sustained recovery phase.

Gold- The market remains in a near term peaking retracement, targeting a drop to 130130* support. Adrop under Monday’s low could propel selloffs. Any minor recovery should hang in sideways congestion inthe 1320’s. Only a close over 133650* rekindles bull forces for another run at 138060* weekly resistance.

Imports of Gold INTO the USA?

US imports of Gold as Brexit approached Soared in May.

Potential Drivers

From SRSrocco Report:Something motivated this huge trend change in normal gold movements to Switzerland. Moreover, total U.S. gold imports in may shot up to 50 metric tons, almost double the 26.5 mt figure in April. In addition, total U.S. gold exports hit a low May as only 20.2 mt were shipped to foreign countries. Total U.S. gold exports Jan-May 2016 of 139 mt are down 28% compared to 195 mt exported during the same period in 2015.So what’s going on here? Why the declining U.S. gold exports or surging gold imports from Switzerland? Are foreign countries demand less gold?? I doubt it. Or how about the massive increase in supposed gold flows into the Global Gold ETFs & Funds?? While there is no way of knowing how much gold these Gold ETFs & Funds hold, something seriously changed in May as the Swiss exported more gold to the U.S. in one month than they have every year for several decades.

Our take on reasons for the change: we intend to do a little digging into this later this week.

- Accumulation by wealthy Americans avoiding transparency?- unlikely as Americans long gold seek to store it outside the US . Canada and Australia preferred

- The US stockpiling in anticipation of an IMF SDR that includes Gold in it?- not crazy. that's all we''ll say for now.

- There will be some sort of partial backing of the USD by Gold in the future?- sounds crazy, but do you think they'd tell us before or after they accumulated?

- Aliens- as per the History channel

Most importantly: watch for future stats to see if this is some onetime event or the beginning of a trend

Recommended Reading:

How Gold analysts hide their incompetency- Goldzilla

Good Luck

Read more by Soren K.Group