4:40 There are now trapped shorts beneath the market and we like that. Check for a post tomorrow early for technicals and triggers for trades. We are traders and investors for clients. This isn't some academic piece.

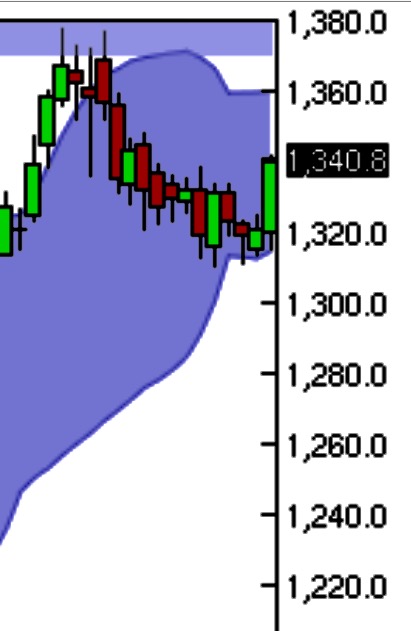

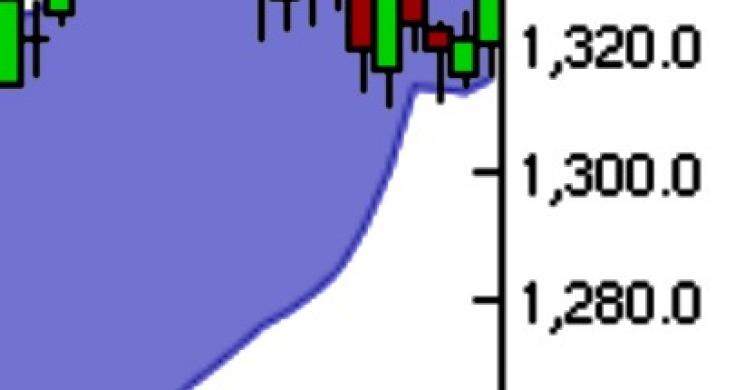

To our macro technicals: Gold had to hold above 1301 while OI decreases in order to rally again. Further, it had to pass today's test of possible disaster on a 1311 print. Not only did the yellow pet rock do this, shorts came into the market recently to add fuel to any rally.

Quick Analysis and a Bband signal update of the market reaction to the FOMC statement: BULLS rejoice.-Soren K.

- Gold remains on our radar and every day it does not breakout makes the eventual breakout that much more powerful

- post news behavior closes the downside risk greatly

- bbands are tightening in this rally. That is not a bad thing

- we are outside of Peter Hugs 1310-1328 range

- above around 1350 we expect lift off

- ideally we would like to see a 2 day stall in this 1340 area to let the market coil a bit more and not get overextended.

- Do not ignore the rule of a failed breakout- a reversal after a 1350 print can be a disaster.

Chart Comments: Note the bottom band contracting while the top is flat. If the rally continues, the top will slope upward and the bottom will slope downward. This indicates the range between the bands is likely to be broken quickly. We will do a follow up tomorrow if there is movement.

INVESTORS: breathe a sigh of relief

TRADERS: mourn the loss of that downside trade. Be ready for an upside one as a make up.

h/t kitco.com for the chart as am mobile now.

- no news is good news- both gold and bonds are saying that the FOMC statement is a lather-rinse- repeat set up.

- no new is bad news- stocks acted disappointingly post another kick of the can down the road last we saw

Conclusion: easy money and/or Fed jawboning is losing its ability to funnel money into the asset classes most cheered for. THE UNINTENDED CONSEQUENCES ARE BEGINNING TO BE BIGGER THAN THE DESIRED EFFECTS.

- Greenspan On the Gold Standard-1966

- DNC HUMOR: Hillary Haters Pissed- SK

- The Economic Costs of EU Terror- SK

To get caught up: Scroll down to "Summary" for original post.- Soren k.

____________________________________________________________________________________________________________________________

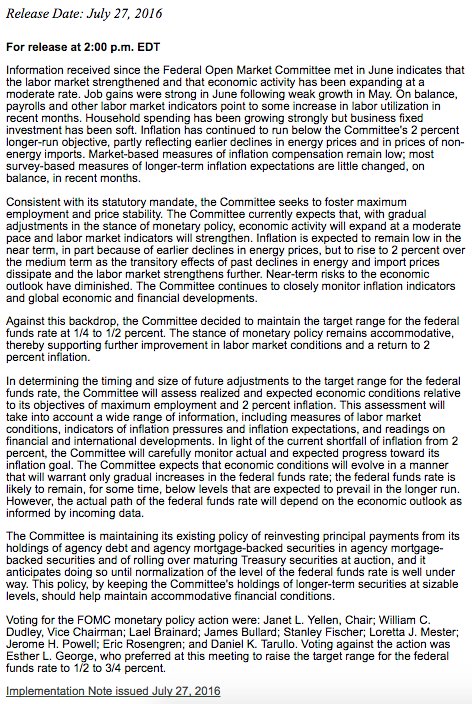

2:05 FIRST LOOK THROUGH OFFERS NO GOOD FUTURE CLUES. GOLD IS A LITTLE FIRMER AND THE FOMC DID WHAT WAS EXPECTED TODAY.

the BBands signal remains good. The event did not trigger the downside today.... to be continued

THATS ALL SHE WROTE

FOMC: 'NEAR-TERM RISKS' TO OUTLOOK 'HAVE DIMINISHED'FOMC: ECON EXPANDING AT MODERATE PACE, HOUSEHOLD STRONGFOMC: KC FED'S GEORGE DISSENTS, WANTS HIGHER RATES

FULL STATEMENT

1:51 WHAT TO WATCH FOR VIA THE WSJ:

1. How Do They Describe the Labor Market?2. How Are They Monitoring Global Developments?3. How Good Is Growth?4. How Do They Characterize Inflation?5. Will There Be Any Dissent?

iNTERPRETATION OF THE ABOVE IS FOR THE MARKET TO DECIDE- Soren K.

1:45

H/T Zerohedge

1:41- Negative interest rates explained by Spinal Tap Or If the FOMC were a rock band. GOOD LUCK FOLKS

1:35- Note the uptick in open interest over the last two days in selloffs. People are getting short going into the FOMC statement. Are they smart or stupid? If smart, then put on your tinfoil hat as something was leaked. If stupid, then just momentum funds who buy the highs and sell the lows all the time. We cannot know. We can only know that last minute players placed bets on Gold going lower. But note the pattern and look for it pre next meeting.

1:25 From Adam Fergusson's When Money Dies. The 2010 forward. This is the reality of our situation. We have nottaken our medicine when we were healthy enough to withstand the side effects. Now the cure will kill us. - Soren K.

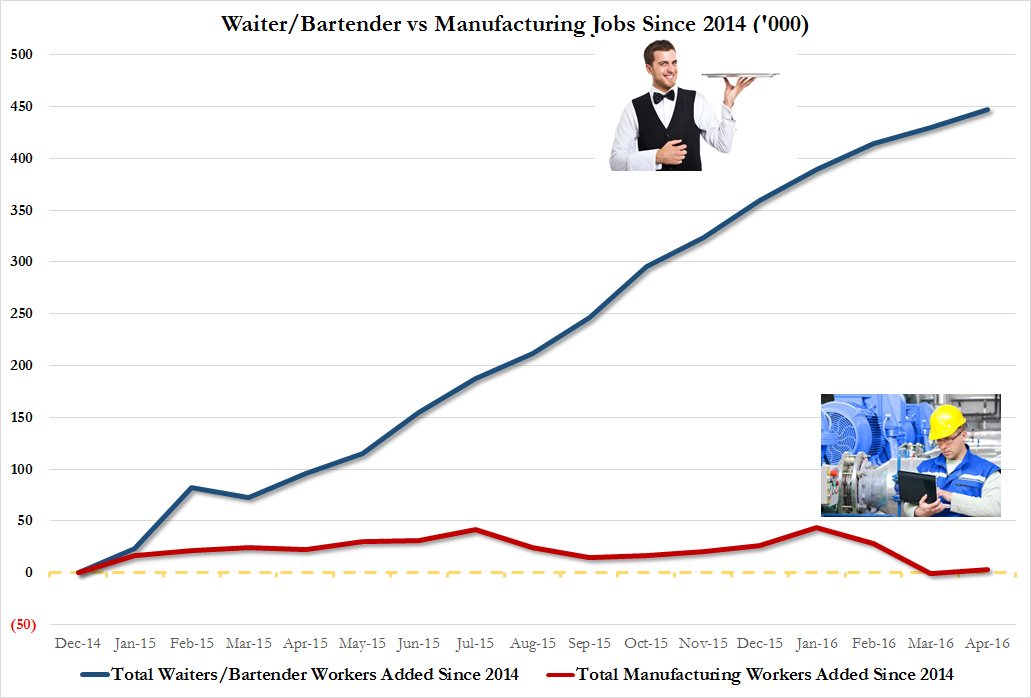

1:17 remember that we have added new jobs and that means all is well.- Yellen in 45 minutes

1:14 from the political side

1:11 a little Central banker humor while we wait

I'm going to be issuing 50-year debt at a -1% rate, but it's safe because it's backed by a baseball card collection. DM me for more info.

PRE FOMC UPDATE: The rally thus far today is not indicative of follow thru in and of itself. We would need to see the Bands widen in opposite directions.That is not happening now intraday. In fact the lower band is tightening indicating an even more trading range bound situation. Sensible given the lighter volumes and players waiting for FED comments. From here based solely on this indicator we can say confidently:

- 5 dollars higher does not mean $20 higher.

- More importantly it means the chances of a wash out are lowered today.

- if the mkt touches below 1311 LATE in the day we will not fade it.

- If Gold prints 1340 we are healthily range bound still if not traded on close

- 1350 would augur for another $20 higher at least if late in the day.

- if nothing happens, then the spring coils more for the next day.

Our advice if you are looking at this situation is keep your powder dry. The market may not make its move until an hour post Fed. if that were to happen the trade would be missed. And we wait for another day. Unless the market prints $1311 or $1350 we do not care as traders.- GOOD LUCK- Soren K.

interactive chart here

---------------------------------------------------------------------------------------------

Summary

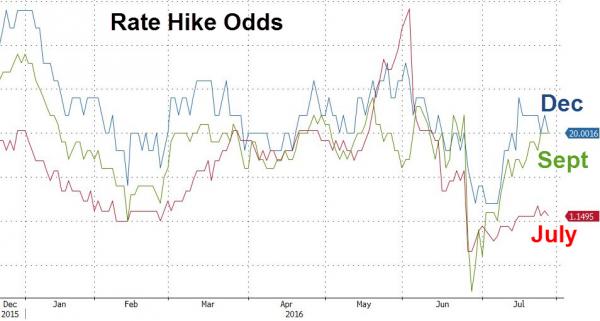

Oil was weaker today from its own fundamentals and from the anxiety the Fed will announce a rate raise soon. The Bond market had a weak auction also reflecting FOMC fears. Stocks were mixed. Precious metals were slightly higher which is a surprise given the way Bonds and Oil behaved. Japan's markets reacted poorly to details of its stimulus package being leaked and was down 1.45% on the day. The USD was mixed against all global currencies with the exception of the Yen, where it weakened also as a reaction to the poorly received stimulus info. The FOMC meets tomorrow with little expectations of a rate change in the near future. But traders will be looking for signs of a raising bias going out through September.

Headlines

- BOJ OFFICIALS SAID TO BE LEANING MORE TOWARD EASING: NIKKEI- after the market sold off on your little leak test I'd say smart call

- Caterpillar Says This Should Be Last Quarter of Energy Declines: BBG- stick to selling tractors and avoid being commodity gurus boys

- 5YR BOND AUCTION LOWEST BID TO COVER SINCE 2009- ZH- this plays into our monthly Bond chart analysis yesterday

- Some FOMC officials expected to resume push for interest-rate hike- BBG- gutsy move guys

- FOMC may lack sufficient consensus to send a clear signal- BBG- or it may not... how can we know anything? please hold me.

Reality Check: Smoke and Mirrors by Yellen and Co.

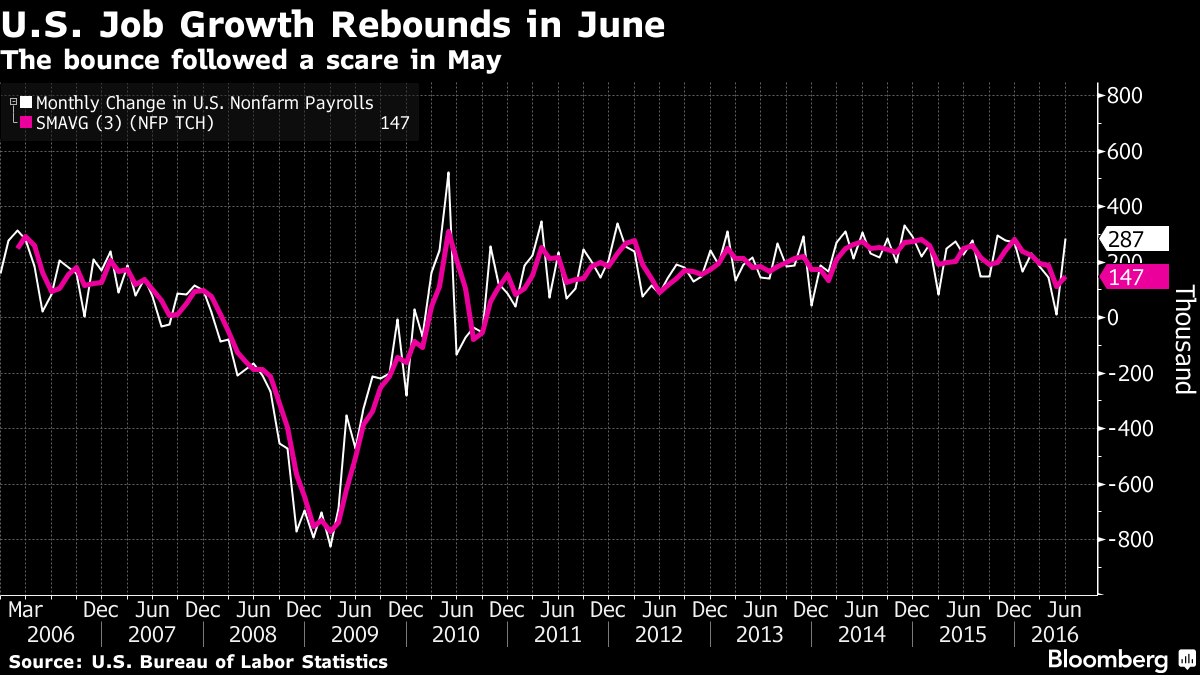

FOMC Hawks will cite this as reason to raise rates

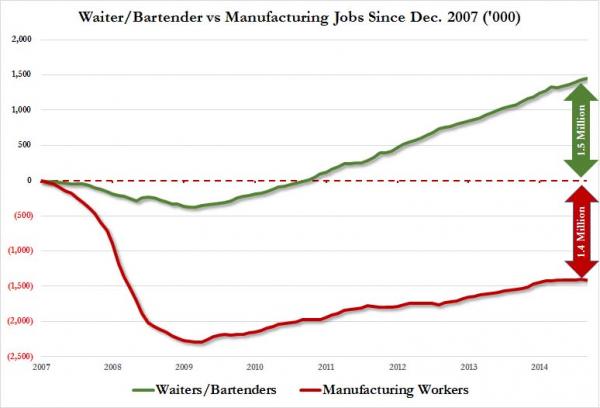

We prefer to look more at stats like this when it comes to jobs

h/t zerohedge

Market Focus

Gold

"Gold continues to trade in a tight range ahead of tomorrow’s Fed announcement and further policy moves expected by the BOJ, at the end of the week. ..Markets are thin and a breakout from gold’s recent range of $1,310-$1,328 is imminent."- Peter Hug. Full article HERE

After reading Peter Hug's opinion that Gold was ready to move soon, we took a look at a tried and true measure of future market movement, Bollinger Bands. BBands are used many ways. For us they are a handicapper of future market volatility. We do not use them to predict direction. They are best used to tell you that if a market does move, whether to go with it or expect the momentum to fade. Right now they are telling us whichever way the market starts to slip, it will keep going.

More specifically:

- The chances of a $20 move in the next 3 days is very high.

- The trend will be determined by both BBands getting wider in opposite directions as the market moves

- When 2 above happens, expect follow through in the direction headed.

- Right now the Bands are at a level of tightness that gives us the alert to expect a move from a so-called coiled position.

- It is infinitely easier for Gold to trigger the BBand momentum signal lower than to trigger it higher from our current position.

Vernacular aside, it means that if Gold dips below 1311 late in the day tomorrow, do not "hope" it will bounce. Expect it to close on its lows. If it closes on the lows, expect a gap lower the next day and brace yourself for a washout of another $20 or more. The trade is to risk $8.50 to make $17.00 from the short side. Anything beyond that is gravy (or being a pig) depending on your own risk style.

The Trade:

- flat here

- short on a 1311 print late in the day with a stop-loss at the previous day's close. ( using $1319.5 in this example)

- Take the position home if it closes in the money with expectations of covering at $1294.00

- trail stop out lower as market drops.

The Reversal Signal

If Gold pierces 1311 and goes back to unchanged, the likelihood of follow through higher is very large with the selloff serving as a slingshot according to the BBand signal.

The Problem is Bias

Most Gold bulls cannot stomach the idea of shorting something they feel is fundamentally undervalued. We get that. But this here is a trade, not an investment. And if you are objective enough and spend as much time watching this market as we do, you should have an instinct for when it is going to go down. Don't fight that by "hoping" it doesn't. Hope and denial are opposite sides of the same coin. Do not ignore those feelings crowding out your objectivity. You can be bullish long term and bearish short term.

The Other Problem

We have said several times here that as long as Gold remains above the 1301 area as OI decreases we are comfortable. That hasn't changed. In fact this indicator confirms it. It is telling us IF gold goes to 1301 that it is unlikely to hold given the BBand expanding volatility signal. So we would be short looking to cover in the 1301 area now maybe. But not so aggressive looking to spec a long in the area now. We would look to get long if the market held that area for a couple days or pierced it and came roaring back through it late in the week.The bottom line is, we agree with Peter. Our indicator says the faster move will be lower. But using his prices, a piercing of either side of his $1310-$1328 range should not be faded.

***Also Today***

- Greenspan On the Gold Standard-1966

- Will the Gold Bull Market Resume After the Summer Correction?- Frank Holmes

- DNC HUMOR: Hillary Haters Pissed- SK

- The Economic Costs of EU Terror- SK

- Soren K.

Read more by Soren K.Group