Self promotion:

Fast Facts Before Tonight's Debate- Live Stream here at 9PM ET

--------------------------------------------------------------------------------------------------------

- Gold and Silver are diverging this morning

- Silver shorts are likely to determine the next big move in both metals

- Gold OI up in rally, Silver up in selloff

Summary

Silver Squeeze may be setting up, again

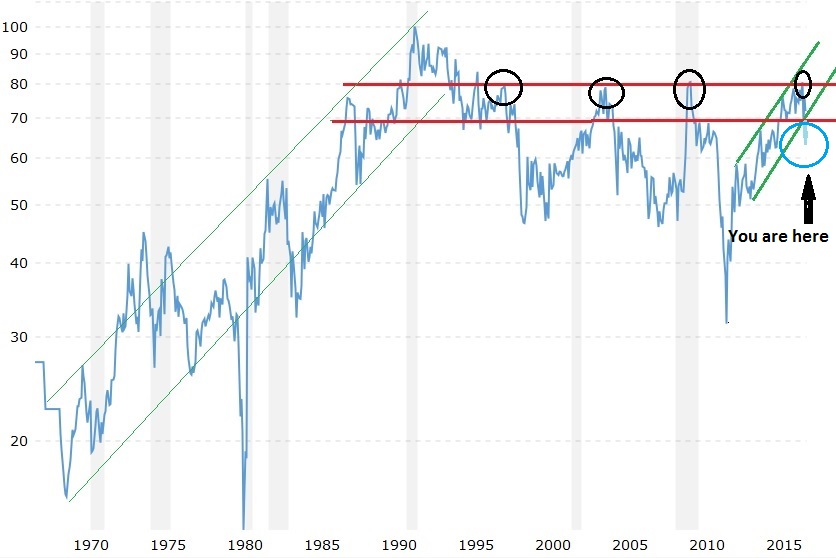

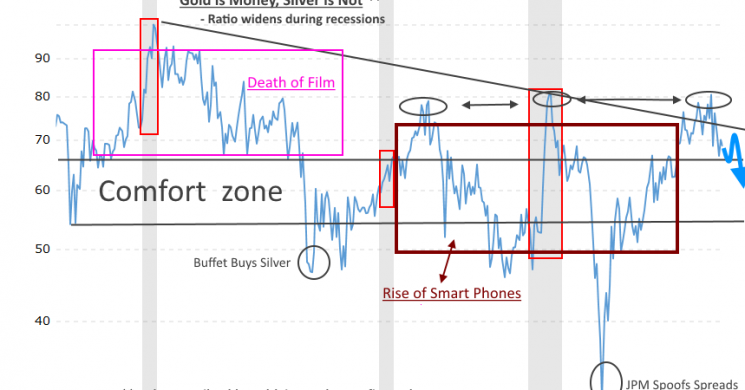

By Vince Lanci | We think that EU worries are keeping a bid under Gold while Chinese economic worries are dragging Silver down with Copper and Platinum. This is essentially the Gold Silver Ratio moving due to recessionary fears (cover graph). In fact we also believe funds and EU banks are again putting the trade on long Gold, short Silver like pre Brexit. As a reminder, the whip post Brexit that the silver shorts experienced was wicked. And while Gold outperformed briefly, Silver actually gained value vs Gold when the dust settled. No predictions, just noting that the pattern is on our radar On top of Germany's biggest bank's troubles, the UK's Tess is moving toward's a hard Brexit via article 50. The ingredients are in the pot for a repeat Silver Squeeze. Let's see if heat is applied.

The logic is simple if you are a European bank with concerns. This is partly what we feel happened during Brexit:

- You do not want Precious metals exposure

- But you seek a safe haven during a crisis

- You buy Gold because it is money

- Sell Silver because of its industrial uses and recessionary tendencies

- You make money at first- Brexit beginning

- Then you realize that Silver is a liquidity trap for shorts as well.

- Panic ensues as you lift legs on the spread

From the July 4th Post: What's Next For Silver

We hate admitting it but it matters. Anything that matters to others has to be factored into your calculus if you are going to trade. We identified a long term 60-70 channel in last weeks Gold Silver Ratio Redux. Well here it is now, extrapolated to 66 from 80 pre brexit. Wow. this makes sense, given the steep rise in the ratio these past couple years as Silver was broken down after rallying to major hihghs then pulling the rug from the true believers.

Full article HERE

GOLD is Strong

Deutsche Bank Worries ( And UK Hard Brexit) are preventing Gold from 'behaving". Futures should be Bull-flagging, but apparently Gold is growing up now

DEC GOLD Resist: 134490, 1350-1352 ST Trend: Sdwys/Up(134110) Supprt: 1334-1332, 132990, 1325* Obj: 135050 TRP: 1325.00Comment: Last Wednesday’s outside bull reversal marks a short term turnaround out of the recent selloffand alerts for a larger emerging bull climb, initially to 135050 and potential to drive to 1370-1380. Beprepared for minor consolidation inside the upper half of Wednesday’s rally. Only a close under 1325* voidsthe upturn.

last time we saw this

- Silver Short Squeeze Alert? 7/1/16

- Silver Surges to $21 overnight 7/4/16

- What's Next for Silver 7/4/16

SILVER is Soft

Less Chinese activity and recession fears are keeping a lid on it, and likely encouraging shorts to enter the market based on OI.

DEC SILVER Resist: 2011+/-, 20365, 2100+/- ST Trend: Sdwys/Up(19775) Supprt: 1954, 19495-19475* Obj: 20365 TRP: 1947.5Comment: Last Wednesday’s outside bull reversal marks a short term turnaround out of the recent selloffand alerts for a larger emerging bull climb, initially to 20365 and potential to drive near 2100. Be preparedfor minor consolidation inside the upper edges of last Wednesday’s rally. Only a close under 19475* voidsthe upturn.

Ratio During Brexit- but you just said Silver wasn't money!?!?!

-vbl

cbar

Read more by Soren K.Group