Why is Silver so Strong?

Silver trades $20.33 last-6:18PM

In our post earlier today we gave an overview for the reasons we thought silver was rallying. Our observation was based on a trader's mentality. Traders, like poker players should be familiar with the odds, and also be familiar with the players opposite them. In a trader's case the player is invisible, but behavioural patterns emerge. From these we can at least assign a better idea of the why a market is doing what it does. By understanding the likely reasons, we can formulate our plan of action before the inflection point arrives. Essentially Bayesian probabiilty with a healthy fear of the market. The earlier article was HERE

This Never Happened

Likely Culprits

- Gold Silver Ratio- a relic of a time long ago, it is still used by technical traders and has merit.

- Long weekend- As in 1994 when Silver was manipulated by Phibro on a 4 day weekend, so now the holiday gives opportunity to those that know how to use market structure to their advantage.

- Short Squeeze- thats no crime, it's what happens when you are overleveraged and not looking at systemic portfolio risk

- China's Yuan hits a recod low- this signals that the competitive devaluation is in full force globally

1-Gold Silver Ratio

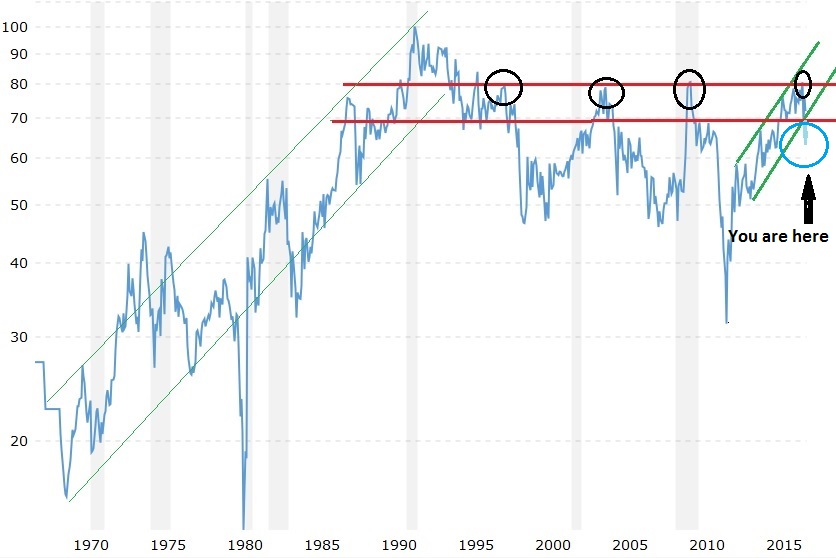

We hate admitting it but it matters. Anything that matters to others has to be factored into your calculus if you are going to trade. WE idnetified a long term 60-70 channel in last weeks Gold Silver Ratio Redux. Well here it is now, extrapolated to 66 from 80 pre brexit. Wow. this makes sense, given the steep rise i nteh ratio these past couple years as Silver was broken down after rallying to major hihghs then pulling the rug from the true believers.

2-Long Weekend

Our personal favorite. First what kind of nut buys silver to close his risk on a 4 day weekend during the most thin hours? Not many. But if that fund did, then G-d bless them. We dont think the short covering is over yet.

****RE SETTLEMENTS: Monday, 4 July CME Group will not derive or disseminate settlement prices for CME, CBOT, NYMEX or COMEX

that is because theyarent any new ones. your account will read unchanged. Here's our best guess how that factored in.

- Silver longs smelled blood in the water.

- A long weekend means that July 4th trading is not going count towards their account value. No matter where the market trades it will settle at Friday's price!

- Because banks are closed and they arent able to serve margin calls

- Because clients are off and figure they have an extra day to cover.

- What should have been a margin call given on Friday or today at latest on close, becomes a Tuesday problem.

- Silver longs dont need much to get market higher in this situation, and they do so OR

- Silver Shorts just want to get ready for the fireworks/barbecue and cover.

If last nights activity was longs adding contracts to make shorts feel even more pain, then Tuesday will be another rally, at least in the morning.

3-Short Squeeze

This is pretty straight forward. Funds are net long in both Gold and Silver. But if you were short silver without physical metal to back it up you are either a hedge fund, or a small speculator. and reading the COT report below, therer were some spec shorts to cover. Not a lot, but you dont need alot when you have a trigger like Brexit

- A weak hand is short- a small fund or a big fund using a lot of leverage will do nicely

- An event triggers systemic risk- Brexit is the start, but it is the Yuan devaulation that is the final catalyst.

- Your portolio takes a beating- but Silver is a very small portion of it, so you get to it last OR

- Your portfolio is doing well- but your high leverage combined with increased margin requirements force you to close positions to free up capital

- You are either woefully ignorant of how thin silver is, or you just arent that worried because the rest ofyour portfolio knocked it out of the park.

- You start lifting offers on screen, or worse, you call a bank that knows you are short and ask for a market for 4k contracts.- "Sales-Trader: "bad connection, can you call me back?"... pssst joe buy 500 for me NOW please

- you get killed on fills as mkt runs away and you dont care because

- your fund lost 10x that amount short Vix OR

- you made so much money long Gold you are happy to be out of the whole spread

Silver COT Report: Futures

Large Speculators

Commercial

Long

Short

Spreading

Long

Short

107,555

23,894

22,274

56,671

151,872

613

-2,805

3,948

835

6,100

Traders

100

54

40

41

45

Small Speculators

Open Interest

Total

Long

Short

211,396

Long

Short

24,896

13,356

186,500

198,040

382

-1,465

5,778

5,396

7,243

non reportable positions

Positions as of:

162

124

Tuesday, June 28, 2016

4-China Devalues the Yuan

The Brexit event was a big problem for the Chinese. Not only is their economy slowing, but Brexit potentially does serious damage to their relationship with the EU. the UK and China were getting all buddy-buddy on trade. That was China's route t obetter trade agreements and coordination of Central Bank machinations. the UK vote to leave forces the Chinces to devalue their currency more quickly. to understand why, one has to first accept that the whole world is racing to export its deflation to other countries. They do this by lowering their currency's value bext to other currencies. This will make their goods cheaper to foreign buyers etc. but if everyone is doing it and Central bankers are not cooperating (remember when the SNB just up and left the EU peg?). Welcome to the wild wild east. China has to devaue faster. Adn this freaked out shorts in dollar denominated assets.

Also note that the Gold and Oil purchases by China these last six months were at record rates. They bought commodities with a stronger Yuan. When they were done buying, They debased their currency. That is manipulation and all Central Banks do it. Is China buying Silver? Probably. Is it enough to make the market scream higher? Probably not. But if you are short Silver, and the Chinese are weakening their currency, guess who is next? The USA is.You cover your risk asap becasue QE is coming.

Chart courtesy of ZeroHedge

Silver and Gold rallied "as China's currency collapses to a record low since it began being published against a broad basket of majors..."

Tonght/ Tomorrow

We expect residual strength tomorrow, but are not married to it. Traders should be flat waiting for a scenario they like to play out. Our favorites are:

- market opens strong and closes weak- expect continuation downward,

- market opens strong and continues strong- expect continuation upward but watch for a COMEX margin hike

- market does neither- we'd sit back and watch

Good Luck

I will likely be off tomorrow, and won't be writing. There may be a couple things we see worth posting here. But I'll be back writing Thursday

- Soren K.

Sorenk@marketslant.com Any and all comunication will be treated as confidential

Read more by Soren K.Group