What Is Being Done About Manipulation?

A Top Regulator:

"Our policy is to go after smaller traders

because they rollover easier"

The Law and Order Model

When a cop wants to get a criminal leader, he will look to get underlings to roll over. They are easier and have weaker protections. But the real goal is to go up the food chain to the boss. Regulators use the same methods of going after the lower lying fruit. However, these violators are solo operators and do not report to a "boss". In reality they are the big players' competition. And some are eating the "Big Guys' " lunches.

Path of Least Resistance

So the regulator goes after the easiest prey, the solo operator. And they are successful. But instead of getting closer to the bigger offenders, the regulator merely alerts other offenders to their prosecutorial tactics. Enter Michael Coscia.

Establishing Intent

The Coscia case was the first criminal conviction against an HFT spoofer under the new Dodd-Frank laws. Prosecuters succeeded because they got to the programmer. When a person manipulates a market manually, it is almost impossible to establish intent because you do not have access to the person's brain.

However in the Coscia case they had the next best thing, his programmer. The programmer is told what needs to be encoded. That is the intent laid bare. The case is made by accessing the trader's brain through his programmer.Result? A little fish who was beating the big fish "spoofing" Gold was gotten out of the way.

But the bigger players were shown the way to protect themselves if a case was ever pursued against them: Protect the Programmer. You will hear a lot more of "Sorry, that's proprietary information that we cannot disclose" if a regulator ever wants to depose a big firm's programmer.

Silver Being Spoofed by an Algorithm This Week- h/t Nanex.net

TBTF = Too Big to Exist

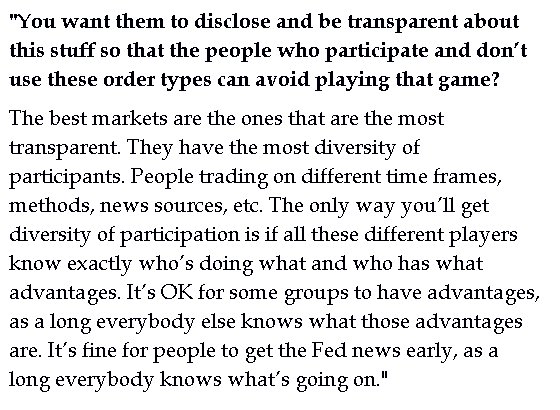

The Federal Government's policies post the 2007 crash have done nothing to reduce the concentration of systemic risk in our markets. They have in fact concentrated power in a smaller number of counterparties' hands. Price discovery is less reliable. Transparency of price is better, but less reliable. We like this statement made today on transparency, diversity in market participants and our growing systemic risk.

Exchanges Are the Answer

One positive we see is the vested interest theFederal Government has take in the US Exchanges. By encouraging trades on the exchanges, the gov't at least has a fair shot of seeing systemic risk now. The opacity of banking's OTC markets are a big problem. Maybe it is bad to have all your eggs in one basket. But if you really watch that basket closely, then at least you can see trouble coming rather than waiting for a bank to blow up and start a cascade of OTC defaults. Andas long as all the data "eggs" are transparent, then another 2007 event can be avoided.

The Egress

It ends when the TBTF banks need rescuing again. And then they become backed explicitly by the US Government. The Fed will be the marketmaker of last resort as a result of concentrating risk in the markets. The banks know this and are spending your tax dollars to subsidize their behavior. In the mean time, spoofing is a tax on the common investor, real liquidity is an illusion once you remove the Fed directed order flow, and healthy competition has been wiped out. People now confuse volume with liquidity. But the market is increasingly becoming non-continuously liquid, like a house or capital good. You can get out until you need to.get out.

Good Luck

Read more by Soren K.Group