Trump Releases the Dollar Hounds (3 days)

Last night the WSJ published an excerpt from its Friday interview with Donald Trump. The key market drivers were his dollar statements, and his dismissal of Paul Ryan's BAT idea. Both weakened the USD and drove up Gold. Note that until last night Trump was pro a strong dollar and gave indications he was pro the Border Adjustment Tax.

On tap are 3 Fed speakers as George Gero reminds us below as well.

On the Strong Dollar

- The dollar was too strong and hindering US companies from selling their goods overseas

- China's own currency debasement was in his view, part of the problem

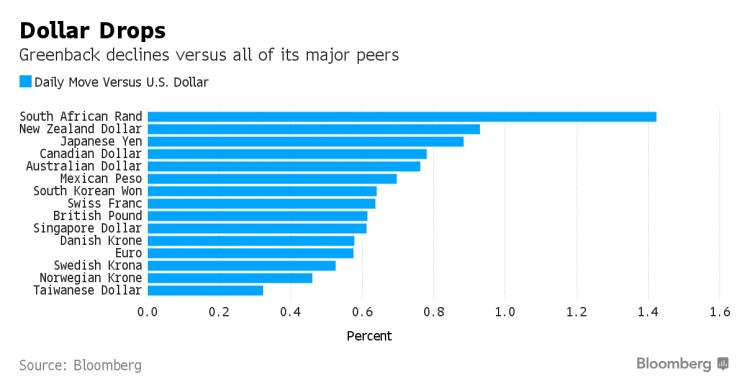

The result, The Dollar sold off against most major currencies and Gold (itself a currency) rallied last night.

h/t zerohedge

Gold Rallied

Silver More So

interactive charts here

George Gero's A.M. Notes

Gold up about 6 pct this year in one month

3 FED speakers on tap today

Could see volatility but gold doing well in spite of recent headwinds due to asset allocators adding to positions for the new year.

Ratios: Gold-silver at 71.30, Gold-plat at 209.70, plat-pall at 237.25.

Look for London-NY arbs starting soon.

- Gold futures open interest at 459435, they were 404029 in 12/28/16 that tells the story of the price increase.

- Copper 254028, up from 228446 end of last year.

- Silver 169153, was 164142

- Options expire 1/26/due to short week, now 1,037892, were 925643.[seeing new OI in April so far-sk]

- Now with price over 1200 [in headlines- SK] which made news and [more-sk] asset allocators taking notice

- Brexit worries, election worries in Europe, France, Germany, inflation and currency worries in Turkey, Venezuela,India.

- Look for continued volatility and later higher prices after option expiration.

Courtesy:

A.George Gero

Managing Director, RBC Wealth Management

Gold Captured? Not So Much

Soren Group contributor Vince Lanci had this to say on the USD in a recent interview with Kitco news:

“It will remain strong because Trump said so,” he said. “Gold floats around $1,100. It is captured. I don't see any strong move.”

Well it looks like Gold has escaped and Trump opened the cage to a weak dollar.

To be fair, Vince also said this in the same interview:

“The key to gold now is the relentless U.S. dollar,” he said. However, according to Lanci, there are two ways the greenback could lose momentum, which would bode well for gold next year. For one, any type of surprise or black swan move by Donald Trump. “Complete policy reversal to make America great by weakening the dollar as part of manufacturing push,” he explained.

But its not a black swan if you foresee it now, is it Vince? Finally he said:

“Follow Trump on Twitter, trade accordingly.”

Maybe he should have paid for that WSJ subscription instead?

There is no large OI in options this expiry to pin us. Trump-ageddon is in 3 days, and the Feb/ April spread has been increasing in a rallying market. All of these are indications that the easiest path is higher for Gold given the proper policy nudge.

Trump on the Border Adjustment Tax (BAT)

- He's outright against it as a "too complex" way to lower corporate taxes

- His preference for Corporations remains tax rate cuts.- Your real estate mill rates are about to go up- SK

He describes his problem with BAT rather lucidly

“Under the border adjustment concept, if somebody is making a motorcycle or a plane in our country, they’re getting a credit for the plane they make before they send it over to wherever it’s going,”..And you don’t need that plus lower taxes and everything else. And it’s too complicated. They get credit on some parts and not other parts. Where was the part made? I don’t want that. I just want it nice and simple.”

[That doesn't mean the alternative will have any different effect on the US middle class consumer and worker. The paths are varied, but the end will be the same. The end game will be inflation to the US citizen- Soren K.]

But What is the BAT?

- It's a key part of the GOP House corporate tax plan. BAT was their counter idea to Trump's proposed import tariffs and a Paul Ryan baby.

- BAT puts forth that we should tax imports while exempting U.S. business revenues on exported goods from corporate taxes

- Any industry that imports raw materials for manufacture of goods it sells domestically does not like it

The BAT Problem

There is debate on BAT at many levels. The main macro criticism is that it would drive the USD even higher. Certain types of industries hate the idea, like energy refining which depends so much on imported oil. At the forefront of the criticism of BAT is Koch Industries which uses imported oil for the manufacture of refined products. BAT would likely cause an increase in USD strength and at the same time encourage exports of finished goods for the tax break. Good for the selling company, bad for the American consumer.

[ Any cost increase to companies like Koch will be passed on to the US consumer in the form of higher prices. That is, if they don't just cut deals domestic oil sources. in which case, they will still raise prices citing the tax on imports anyway - Soren K ]

Winners and Losers with BAT

In a BAT scenario there are 3 consequences for 3 participants

- Producers of finished goods are paid to sell them overseas

- Foreign producers of the same goods are pressured to lower prices and/or seek protective import tariffs on US imports

- US consumers get domestic inflation on 2 fronts:

- Prices for finished goods made in America go up to offset the higher tax of selling domestically

- Prices of imported goods go up for various reasons like inflation of raw materials, trade barriers (tax on import cars), tariffs etc.

An example is when Argentina taxed farmers on sales of crops to keep inflation down. So the farmers just started exporting their crops. Then when the Argentine Government slapped a 40% tax on exported crops, the Farmers threatened to stopped growing and won.

[ Who do you think will bear the brunt of government interventions once corporations like Koch lobby, whine, and punish a "populist" president?- Soren K.]

Good Luck

Read more by Soren K.Group