After Tumultuous November, December Brings Event Risk for Gold

- Soros and Druckenmiller recently sold their Gold positions

- the thesis behind their Gold ownership is still in place

- they likely found different ways to express their inflation opinions

- gold is likely to be the last to rally in a 1970's inflation environment.

- collectively, Icahn, Soros, and Druckenmiller are Long stocks, Short bonds and flat Gold

UPDATE 1:25

Jeffrey Christian on Gold's 2017 Outlook

Today Jeffrey Christian agreed with us, if for different reasons. Gold will rally during the Trump administration, but in an orderly fashion:

Christian on Kitco: However, over the next few years, prices will likely move higher given that President-elect Donald Trump is still a “big unknown.” “You don’t know which Trump is going to show up,” he said.

MarketSlant's 1970's theory from November 2nd:

It does not matter who is President. All "things" are going up as a function of inflation. Under Trump we agree with Alchemist the rally will be relatively orderly in a 1970's type play. We'd be long gold and short calls as a dividend. If Clinton wins, it will more likely move higher in "fits and starts" as it has for the last 3 years.

And we have stated since then that Gold will be last to rally. Bonds First, Gold Last to Inflation Party- 1970's Redux

Nice to be in smart company, even if the rationale is "Trump uncertainty," vs. 1970's inflation. Happy to be right for the wrong reasons.

Trading Points from a Fund's Risk Meeting Today

Soros and Druckenmiller Sell Gold

- November was a hairy month. Gold saw 2 large players exit their positions.

- Soros on the first sell-off

- Soros is known for manipulating the press, although he does not "lie".

- A classic example is when he proclaims he is “bearish stocks”. That doesn’t need mean he is short. It is almost a given he is bearish looking for a pull back to buy them. And if his words help facilitate that, then so be it. He is an elite- Caveat Emptor

- Soros just decides to sell and does so. he commonly wants his positions flat going into events and likes to step in on overdone markets in the direction of his bias. And he did that again in Gold.

- It is when his funds release actual 13-F's, 13-Ds and quarterly reports you get to know what he actually did and must reverse engineer the trade

- And it is when he is notoriously quiet that he is actually trading position, as he did in GLD

- GLD OI is down lowest since 2013. Combined with some oil ETFs being de-listed, is it possible that ETF products are dying?

- If so, is there some regulatory issue coming down the pipeline?

- could this in fact be somehow bullish for Gold vs "paper gold" - not likely yet

- Then Druckenmiller on the relief rally and spike on election day sells. smart man

- Their reasons are not transparent, although Druckenmiller did make a rather cryptic statement on his reason for the exit. He said “ The reason I was long Gold no longer exists"- What reason was that?

- The only rationale behind Druckenmiller’s statement we can see are that either

- BEARISH: He sees the Fed’s policy of accommodating inflation over, and that it will be a hindrance to Trump’s attempts to loosen the fiscal purse strings

- BETTER WAYS OF EXPRESSING OPINION: He saw lower lying fruit, in the form of shorting bonds as an expression of his inflationary opinion, and/or long equities.

- Icahn was a buyer of stocks. so taken together the truly smart money is long stocks (Icahn), short bonds (Druckenmiller), and flat gold (Paulson still long, but we do not think he is happy now)

- Druckenmiller's selling into a liquidity event makes us suspect he is not a fan of Gold's depth being too small for him to exit at will. Otherwise he'd have crowed about his bond position being closed too.

- D-Miller is not done with Gold. either he starts expressing it in miners, or physical delivery is on his list.

- D-Miller's position is what we already recommend in a 1970's inflationary environment. Gold is LAST to rally after stocks and natural resources. And the USD will be last to weaken. we should watch his next plays closely

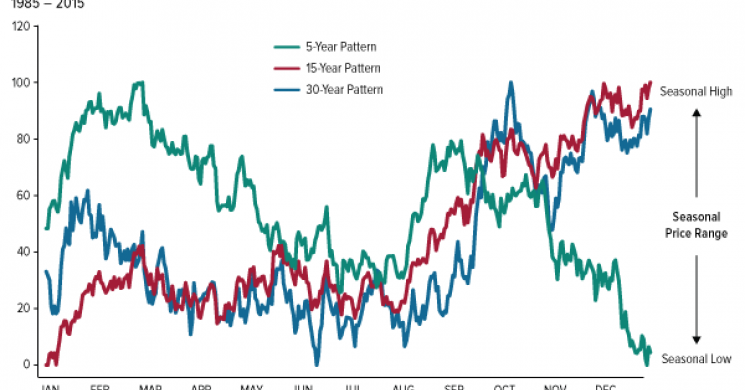

Evidence Suggests Soros and Druckenmiller Traded Gold Betting on a longTerm Seasonal Patterns to Dominate

But the shorter term patterns were more dominant this year. Tht's just what we see. And we will not be surprised if they are back buying in January

Soros and Druckenmiller bought and Sold Gold at the same time. Note the following from May 2015 when they both bought.

First it was Stan Druckenmiller, now it’s George Soros. Following billionaire former hedge fund manager Druckenmiller’s announcement that gold was his family office fund’s largest currency allocation, we learned this week that Druckenmiller's old boss, billionaire investor George Soros, purchased a $264 million stake in Barrick Gold, the world’s largest gold producer, after liquidating $3.5 billion in U.S.-listed stocks. Additionally, he disclosed owning call options on a gold ETF.

h/t Frank Holmes Therefore we shouldn't be surpised when they both sold. That is 1 seller's mindset, not 2.

December Expiration

- weak currencies are becoming inflationary, and ironically not supportive of those countries stock markets- cash liquidity is issue?

- Roll over Dec-Feb gold at 300, down from 360,over 50% complete, rest puked today

- Gold-silver ratio at 73.25,gold-plat at 275.30- function of

- "base metal nat resource leaders" thesis,

- new spread contracts,

- China binge, devalue, and dump action

- Options on gold futures were 1,325102, up from 1,167802 on October 10 preexpiration yesterday

- Lots of puts below 1200, calls at 1250 or higher went off board yesterday.

- suggests some pinning activity and bullion dealers short puts?

- now that massive expiry over, mkt will swing lower on light volumes after z/g roll is done

- look for oversold spots for buy and sell quick trades

- RSi suggests, barring an exogenous event, the trend will continue

- Seasonality also implies a tired market, with a caveat

2017 Asset Allocation

- New year brings new asset allocation recommendations, and that is what spurred the market rally at beginning of 2016

- Those frontrunning expectations of a repeat of 2016 will get long, the question is the quality of their fore-knowledge of investment allocations.

- Investment recommendations are often internally leaked prior to being sent out. This gives the prop side of banks to position themselves long in anticipation of the expected incoming demand. The trick will be to see if buyers are “dumb” specs or bank side prop desks-

- tap market contacts for flow origin info

- December is laden with much event risk.

December is Wild

- Volatility of volatility will be large. "leptokurtosis, garch models, fat tails...

- implies black swans.. but if we see them, then not black at all

- the black swan is nothing happening in mkt at all in December

- flatlining on lack of interest, and idiotic impulse traders reacting to events like kids grabbing gum at supermarket cashier

- implies fits and starts. straddles a sale, wings a buy= sell iron flies?

- The Italian referendum, Brexit news, the expected Fed Hike, Sharia laws permitted gold speculation and investment in the muslim world hang over market.

- if Fed hike is 100% assured, then the asymmetrical play is to buy hedged call spreads right before fed if stocks sell off.

- then if fed doesn't hike, all good, if they do, risk is semi mitigated.

- Gold expression sell put spreads and walk away if mkt is under 1200

- India gold ban rumors. expected as banned cash and banned gold part of same concept- central planners centralize. they herd like border collies and control.

- bitcoin is a joke. china use spikes now, but CME essentially is going to own it. it will be coopted by central planners

- GS and other banks dropping out of Blockchain support. GS likely typical "brain sick" going to build their own.

- remember the GS offer to buy nymex? then the creation of ICE? lol

Russian Wild Card

- Russians gold purchases are a concern, as they came before Trump’s election.

- We feel they are possibly in the same boat as many emerging markets, short on currency and long on resources not being bought.

- If China’s recent appetite for Russian Gold does not continue, then beware.

- Russia could turn seller, as an example of poor front running of demand.

- We’d welcome that as poorcentral Bank decisions mark end of trends frequently in Gold... Like UK in 1999

- there arent too many stupid CB's left. Russia is likely one of the most intellectually challenged as a function of their isolation and paranoia

- witness the gold russia bought in october. how are they now? lol

- Russia essentially controls its mining industry, why even buy Gold unless you have to. Unless they pre-sold their purchases.

- long china and short Russia on the trading savvy chart.

Conclusions

- flat December, EU brexit-like votes may not bode well for Gold at first. or worse, may cause pile-ins and selloffs to raise USD.

- is USD and Gold rise in this EU disintegration environment, the Gold will back off first

- watch for percolations in buy side and who is buying

- China jawboning Yuan to stop the drop. if happens, base metals will rally again

- Gold is money and will be better in EU disintegration

- emerging mkts will puke gold for cash, dollar demand etc

- watch for private deals where countries like Ecuador sell gold to GS

- soros D-miller are jsut allocating better. the stage is set.

- GDX may be the buy of a lifetime in next stock selloff

- buy silver over gold on spread expansion.. otherwise just buy copper on dips

- a ratehike will be just what the doctor ordered for future excuse for QE or worse (better forGold) unsterilized helicipter money.

- GDP is more likely to go negative after a nelection than before it. A hike will ensure that

Good luck

Read more by Soren K.Group