Note: We were off yesterday and apologize for the Gap in coverage. We will be off Sunday and Monday next again. In the future we will arrange for coverage in our stead- Soren K.

Technical Macro: $1290 as a Line in the Sand, Not THE Line

Global Macro

A macro, longer term overview is needed now to determine if the bull market has indeed given up the ghost. To be sure there are plenty of reasons for Gold's selloff, legitimate and otherwise. The Fed's confidence it can raise rates and the USD 's reaction is extremely gutsy given the issues in Europe and Asia. It smells of a legitimate plan to smartly export deflation while it can, with a pretext implying that our economy is somewhat insulated from the Global chaos. We don't know that the US is protected, and still feel strongly that if there is no US crisis, the Fed will manufacture one at some point to legitimize even more asset purchases.

Fed is Selling High to the EU

In essence raising rates (or talking the USD up) while the EU is clamoring for more Dollars is a nice way to unload your nation's stock at higher prices. Given the Fed needs to reload its gun for the next crisis, as stated at Jackson Hole recently, now is a good time to do it. Other reasons we feel less sanguine about surrounding the selloff in Gold are related to irrational sales in Europe of anything Dollar denominated that banks can to raise dollars for liquidity and DB related counterparty risk.

They Must Reload their Gun at Some Point.

FTA Why Gold bulls Should Want a Rate Hike

"When shocks occur and the economic outlook changes, monetary policy needs to adjust. What we do know, however, is that we want a policy toolkit that will allow us to respond to a wide range of possible conditions." -Yellen

Note the last sentence. That is basically an admission that they have no bullets to use if there were another crisis. The only way to have anything in reserve for a crisis event is to reload the gun by raising rates.

We don't know that the US is as protected as it feels from the EU's issues, and still feel strongly that if there is no US crisis, the Fed will manufacture one at some point to legitimize even more asset purchases. But while we may fade the Fed's risk analysis and academic POV, we do not play into the whale at the table, even if he is a dumb one. We wait until he plays into us.

It Does Not Make Sense, Yet it Happens

Competitive devaluations are not going away, absolutely nothing has changed with regards to the EURO's long term chances of survival without fiscal and political unity in Europe. And yet Gold is taking on water. Conclusion, again: Fundamentals are dead, global macro is determined by Coordinated and Competitive Central Bank behavior, and t use reasonable arguments to rebut irrational behavior is not just Folly, it is capitulation. And to sit at that table with a loon and try to play against him assuming some sort of normal reasons for his behavior, is to lose to a guy who plays stupid with no risk. The Fed is playing with an infinite bank roll, you are not. You only stay in on high probability wins with a very low cap on money you will put into every pot/trade.

Technical Macro

Keeping it simple: After moves to the downside like we have seen, our focus tends towards Fibonacci Retracement Numbers (FRN) They often coincide with Elliot Wave areas as well and are less subjective.

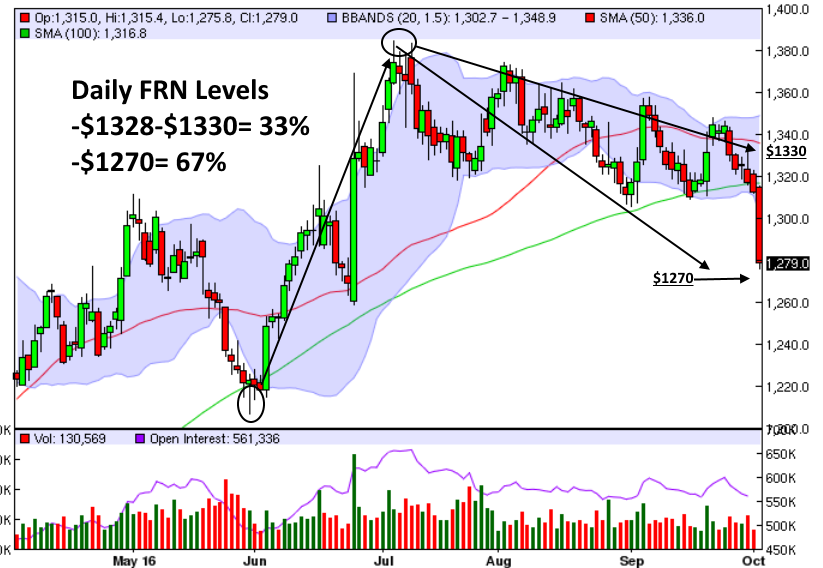

Gold Daily Dec 2016 Contract

By the Numbers on the way down

- $1290: based on models, this should have served as a swing trader’s low in a bull market ,but has not. This is damaging to the Bull market but not mortal

- $1270= the 67% FRN from the Daily $1214 low to the high of $1384 on the Z contract

- $1268= the 33% FRN from the Weekly $1046.20 low to the $1377.50 high

- $1155= the 67% FRN from the Weekly $1046.20 low to the $1377.50 high

Gold Weekly Continuation

Because the Daily 67% and the Weekly 33% FRNs are so close we are giving them added value. FRN's are clear and simple in defining them. However, they are closing price numbers. And as such, do not give you "trade" numbers that we like. So if it is 1:45 and we are trading $1262 on a Wednesday, do you get short/puke longs pre-close? That is entirely up to your "slippage" tolerances in execution.

By the Numbers on the way up

- See numbers above

- $1316

- $1328-$1330= 33% Daily FRN

- $1349

- $1377

Trading Conclusion:

Under $1290 hurts- we call it an amputation

Under $1270- would be like a comatose patient

Under $1155- R.i.P.

Investing Conclusion:

Big boys like CBs will be buyers at these levels and others. That does not mean they won't back off and let the market come to them. These are not your Daddy's Central Bankers. They are tactically much smarter. They should be now that they've enlisted major players as their execution services, not some G3 bureaucrat.

When to Spec Long

Given the choice, we would be sellers of rallies before being buyers of dips. There are trapped longs above. We can't help but wonder if they are big Funds that held on due to the holdings being insignificant in their overall portfolios. But what happens if the rest of their portfolio goes south? Close winners when you puke losers would be our guess.

As a spec looking to get long we look for a couple things to line up before considering:

- Climbing OI in dropping market

- New lows on the hourly not being confirmed by new RSI lows

- #2 above spreading to daily charts

- #3 happening on a weekly close

- Our VBS system telling us Volatility has finished consolidating

Then we start looking to spec long on a strong candle stick formation like a morning star, which gives a nice built in stop out. In short, we would rather buy strength than weakness on a trade. We buy weakness rather than strength on an investment.

Next up: We hope to give some insight into what we are doing now to cope and deal with a potential bear market as traders and investors. Also what we are reading to keep ourselves honest. Short version: We are investing in Silver, Trading Gold because of their volatility differences

Good Luck

Top Day: USD, Gold Eye Fed, Deficit Climbs $1.4 Trillion in 2016Can't we just drone this guy?- WikiLeaks Source

Soren K

Read more by Soren K.Group