Are You Watching Closely?

In the movie The Prestige, the main character has a line he repeats before making his trademark red ball disappear. In one scene he educates a child using, more appropriately, a coin. The bonus of this moment is when the main character educates the child on magic and deception. "The secret impresses no one. The trick you use it for is everything," he says. Can you think of a better metaphor for the way our markets have been manipulated? Perhaps Oz's wizard behind the curtain is better. This movie however is also about how the "disappeared" money returns. And ultimately the re-appeared money is a fake. There is no magic. And that is why the process is enshrouded. The themes here are we see below:

- Sweden has history of pioneering change in money

- the situation is being weighed "carefully"

- again, the Central Bankers have a cure for the disease they have created- aka adding to complexity risk

Comments in [bold] below- SK

Sweden’s Riksbank eyes digital currency

The world’s oldest central bank — it was the first to issue paper banknotes in the 1660s — is launching a project to examine what a central bank-backed digital currency would look like and what challenges it would pose. It hopes to take a decision on whether to start issuing what it calls an ekrona in the next two years.

“This is as revolutionary as the paper note 300 years ago. What does it mean for monetary policy and financial stability? How do we design this: a rechargeable card, an app or another way?” Cecilia Skingsley, deputy governor at the Riksbank, told the Financial Times.

Norway, months ago:“Today, there is approximately 50 billion kroner in circulation and [the country’s central bank] Norges Bank can only account for 40 percent of its use. That means that 60 percent of money usage is outside of any control. We believe that is due to under-the-table money and laundering.” DNB Bank Executive Trond Bentestuen

Central banks around the world have only begun grappling [false, they are executing policy now-sk] with the potential benefits [ teaching the false controversy. minds are already made up-SK] and challenges arising from digital currencies [getting democracies to swap freedom for convenience] such as bitcoin in recent speeches from the likes of the Bank of England and the Bank of Canada. But a dramatic drop in Sweden in the use of cash [a situation created by bank policies-SK] — the amount of notes and coins in circulation has fallen by 40 per cent since 2009 — has forced the Riksbank’s hand. “We really have no one to look at when it comes to how to design it and what are the possible consequence … It’s not an option for us not do anything,” said Ms Skingsley. [doing nothing is never an option when job security is on the line. Ever give a perfect doc for a lawyer to read? He will find something wrong. otherwise, he's out of work-sk]

However, she stressed that the Riksbank saw a digital currency as complementary to notes and coins, not as a replacement. [like ATMs complimented Tellers-sk]- full article here

The MSM Has Been Co-opted already

Going Cashless Checklist

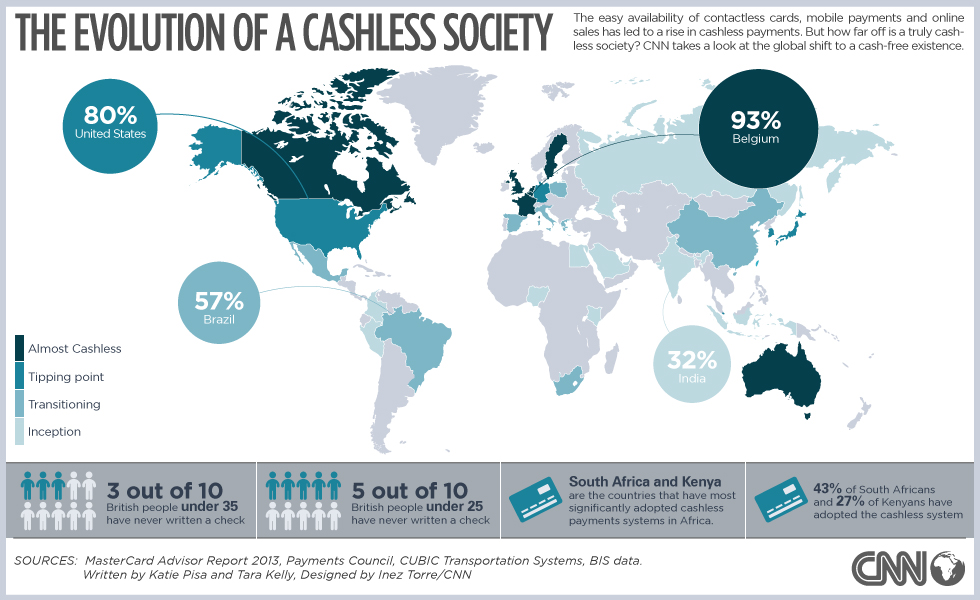

The following countries have begun "experimenting" with controlled releases of the cashless concept. The USA will be last in this regard, most likely because they must remove the "this note legal tender" statement from the bills.

India, CITI in Australia, Norway, Denmark, and Sweden (it's a done deal in our opinion)

The following trial balloons have gone up in the USA on the concept with no pushback

- Why You Should Pay Attention to the US War on Cash

- KC Fed paper on HOW to abolish cash-August 2016

- Rogoff and the Fed's plan to end cash here- September, 2016

FTA- Why you should pay attention to the War on Cash

The government’s crusade to restrict financial freedom is just beginning; as always, fear and propaganda will be used to condition the masses into submission. The personal responsibility needed to protect yourself from the inevitable changes in the system can be overwhelming, but without taking the proper steps, the current ruling class will make the decisions for you.

A cashless society is sold as a way to protect your identity, prevent crime, and create a safer world, but there is always a tradeoff. The only cashless model that can succeed is a decentralized one that can sustain itself without bailouts or manipulation. Banks and governments aren’t motivated by some noble vision for society; like all humans, self-interest is paramount. If their power monopoly is threatened by cash, free speech, drugs, or anything else, that threat will be demonized and attacked with no mercy. Although this technology based future has many unknowns, hopefully, the path we choose will create opportunities for entrepreneurs to make real progress against this financial oligarchy.

Electronic money will be sold to you as a convenience. But its purpose is to make all transactions go through the banking system. When there is no clearing time, then Banks will not have counterparty risk. All the risk will be borne by you the public. When your payment no longer has a 3 day wait on the other side, the banks have achieved real time clearing. Then they can just turn your card off if you fail to have digital funds in their house.

At that point any transaction not done with a bank as intermediary is black or brown market.- Soren K.

Are You Watching Closely?

Read more by Soren K.Group