Today: Sell the Rumor, Buy the News in Gold

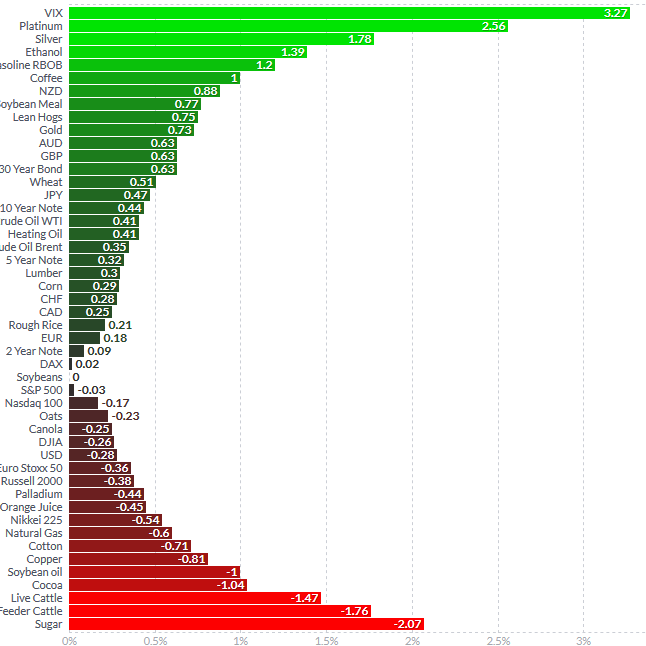

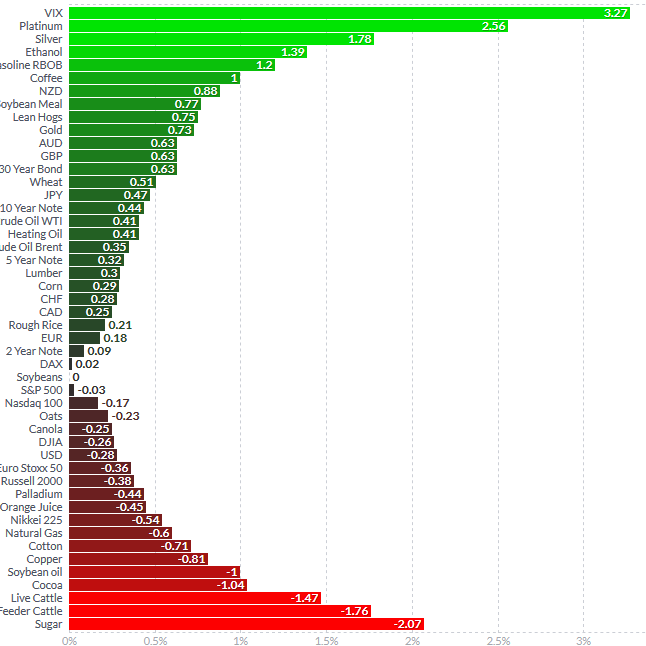

- Gold is up on revisions and having fully discounted the NFP and then some.

- Platinum is up on Auto Sales

- Silver, Copper see profit taking on Chinese curbs (UPDATE- Silver turns precious as day progresses)

- Gold had already discounted today's jobs figures and Dec 14 expected hike.

So, even though unemployment fell to 4.6, hourly wages down, NFP up less than expected, Gold sees short covering on back of first notice day over and number revisions down and big

- Open interest staying near lows 402250 suggests longs done- any move lower from here probably new shorts

- Silver, Copper seeing profit taking- likely from China curbs.

- Platinum helped by auto sales

H/T George Gero

Follow on Twitter: @futuresgeorge

Of Note

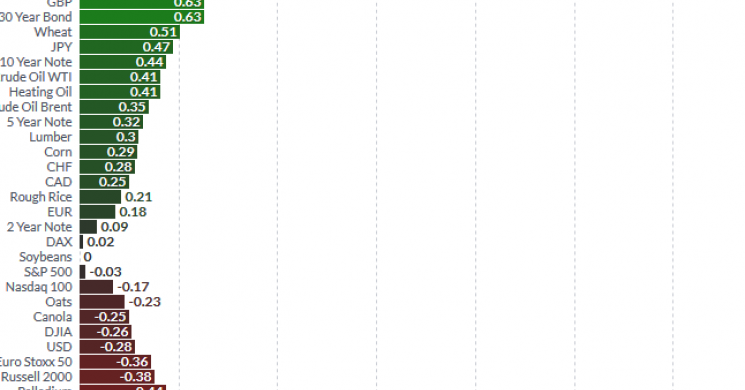

- Oil up 10.86% this week - Rising OI in rally sugggests new longs piled in at faster rate than shorts covered.

- Gold rollover is almost complete- most active contract moves towards Expiry

- Energy Asset Allocations- across the board increases in Energy OI indicate new asset allocations for 2017 are starting

- Soybeans Buck Trend- Grains all down but only Soy OI rising; puts it on radar for possible bottoming action

**Preliminary OI DataPrevious DayPrevious DayAggregateAggregateAggregatePrice ChangePrice Change Trade Date 12/01/2016**ChangePCT ChangeOI ChangeOIOI Change WeeklyWeeklyPCT WeeklyCMECorn-6.00-1.72%9,1641,243,046-53,686-15.75-4.40%CMESoybeans-2.50-0.24%-5,604721,62126,854-16.25-1.55%CMESoybean Meal-5.60-1.76%-4,028357,783-15,666-10.40-3.22%CMESoybean Oil0.862.32%6,290429,410-3,6280.912.46%BMDBMD Palm6.000.20%-3188,298-4,50947.001.55%CMEWheat (SRW)-7.25-1.80%551448,815-18,277-24.00-5.72%CMEWheat (HRW)-7.25-1.77%5,574249,462-3,791-26.50-6.17%CMERough Rice0.0150.15%17712,5254320.0950.99%CMEOats3.001.41%427,210-925-1.25-0.58%EOPMilling Wheat-2.25-1.35%-3,789255,769-13,832-5.50-3.24%EOPMTF Corn-0.50-0.30%5525,476465-2.50-1.50%EOPRapeseed3.000.74%-93698,025-1969.252.30% Agriculture 7,4934,037,440-86,759 CMELive Cattle-0.575-0.51%1,552292,5155,050-0.825-0.74%CMELean Hogs-1.150-2.08%-1,039216,336-7,375-2.675-4.71%CMEFeeder Cattle-0.650-0.51%44145,5741,1990.5500.43% Livestock 954554,425-1,126

CMECrude1.623.28%20,3382,094,35683,1675.0010.86%CMEBrent Last Day2.104.05%642109,7194,5505.7011.82%CMEHeating Oil7.164.54%4,752396,760-1,88416.1710.88%CMERBOB6.454.35%13,351381,5756,57317.0912.42%ICEEUBrent2.104.05%2822,273,56338,1785.7011.82%ICEEUCrude1.623.28%18,653553,52039,0195.0010.86%ICEEUGas Oil25.005.53%-1,506835,21711,80240.759.34%CMEEthanol (DL)0.0000.00%635,601-420.0221.42%CMEEthanol (CU)0.0050.30%-41258,332-1010.0402.49%CMENatural Gas 0.1534.56%20,7421,176,50322,6510.3039.46% Energy 76,9057,885,146203,913

CMEGold-4.500-0.38%1,150402,250-13,337-11.60-0.98%CMESilver0.0240.15%1,234160,480-5,694-0.048-0.29%CMEPlatinum1.4000.15%23169,0131,7333.000.33%CMEPalladium-20.950-2.71%66927,3239508.801.18%CMECopper1.0000.38%4,927239,7139,731-3.85-1.44% Metals 8,211898,779-6,617

Some Data Courtesy of RBC Capital Markets

Read more by Soren K.Group