Summary- Chip away at the Dollar

The G-20 meeting and photo-op was worth noting in that Russia and China seemed like winners. The US and UK came out losers. The Yuan will be admitted to the SDR basket of currencies in October. On the back of that China is going to market SDR bonds with the Yuan in them to its citizens in an attempt to kickstart the Yuan as a global currency. Russia is inserting itself into Iran's oil dealings. Not discussed were the increasing gold holdings at the big 4 Central Banks. And it won't be until it is too late. Bottom line is leaders left the summit seeing more moves to weaken the USD on every front. And the markets reacted accordingly. We sense a little leak in the boat they are all sitting in. That leak is betrayed in USD, Gold, and Silver pricing today. What happens tomorrow may reverse today's activity as patience returns, but today matters a lot to us. That's how we see it. Soren K.

In Focus

Global Stock Markets

written by @anilvohra69 emphasis ours

It is a matter of time horizon. In near term, Bears made no gains in market weak patch. Technicals swinging bullish again. Meanwhile, volumes have dropped sharply. It is important not to read too much into illiquid eerily calm markets. I think it is a coiled spring which I think will go lower and higher. In the medium term, the economy is slowing. The mean outlook is for a recession beginning in a year. The Bear case would be for it begin with the inauguration of the new POTUS. The Bull case is to postpone the recession till mid 2018. I see no case for QE till at least one year after we enter a recession.The possible exception is Japan which has been in a recession for 25 years and tried everything, all with no luck.

We cannot disagree with anything said above. Note he "sees no case for QE" for now. That does not mean he is saying there will be no QE. Because who can predict what the Fed will do, fundamentals be damned- SK

Anil @anilvohra69 on Twitter, is a Retired UBS Rates Options trader steeped in global cash flows, Financial and Technical Analysis. We recommend following him for regular reality checks using charts and observations. He is a source of objective analysis and has no axe to grind from what we see.

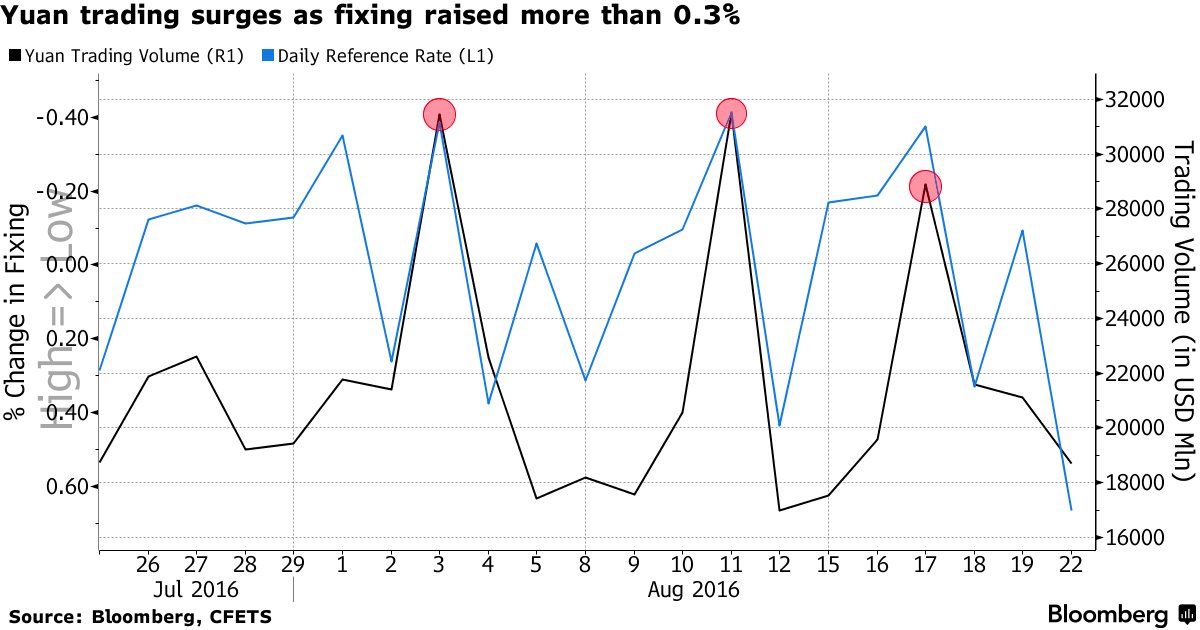

The Yuan Is not Permitted to Rally.

When the Yuan rallies, especially after a fix lower, note that it is met with high volume sell-offs. - SK

Silver Sees Daylight- Gold Hits the Hole Behind it

Yesterday we showed using a tool you will be seeing more of. According to it Silver had a 70% chance of moving sideways or rallying from "here". This tool has been dead on in precious metals and especially Silver since we started looking at it during Brexit. So here is yesterday's chart.

And here we are today. it is important to note we did not trade off of this signal. While this tool gives risk reward parameters, our VBS signals work well in that way. But the next our VBS hits up it will be checked against the data generated by the model above. We are increasingly suspicious of Silver as undervalued based on our research into JPM's Silver holdings as shown in their recent 13f. Hopefully we can substantiate our intuition soon. And NO, we are not saying they are manipulating price lower.- SK

Yesterday

- Gold Technicals: Bull, Bear, and Red Flags - how the next leg could play out.

Here are Some Technicals for Silver Today

DEC SILVER Resist: 1970, 19985* ST Trend: Sdwys/Up(1952) Supprt: 19215, 1901, 1887* Obj: 19985 TRP: 1887.0Comment: Friday’s rally triggers a bull upturn and calls for short term rallies to reach for retracementresistance at 19985*. Stable action over the downturn level around 1950+ should encourage direct followthrough rallies. A close over 19985* is bullish. Expect dips to find support along the upper edges of recentcongestion. A close under 1887* is needed for a reversing turnaround.

interactive chart HERE

Global News

AUSTRALIA’S ECONOMIC STRENGTH SUPPORTS AAA RATING:MOODY’S

CHINA TO CONTINUE TO MOVE TO MARKET-ORIENTED EXCHANGE RATE- As it de dollarizes its reserves and accumulates Gold for the New SDR

KURODA: I DON’T SHARE VIEW THAT THERE IS LIMIT TO MON. EASING- nirp to give way to imaginary numbers next?

OBAMA CXLS MET WITH PHILLIPINE PRES WHO CALLED HIM AN S.O.B.-safe space unavailable for comment

N. KOREA FIRES 3 BALLISTIC MISSILES OVER EASTERN SEAS: YONHAP

RUSSIA, SAUDI ARABIA TO SET UP WORKING GROUP TO MONITOR OIL MARKET, TO ENSURE STABILITY - Oil sells off

IRAN CAN RAISE OIL OUTPUT TO 5M B/D IN 2-3 YEARS: NIOC- ARAMCO can double its ouput in 10 minutes at a $9 cost, do you want to go there?

CHINA SETS YUAN FIXING AT 6.6873 VS 6.6727 DAY EARLIER- Yuan will accererate decoupling for Brexit, and Japanese QE

Art Berman: Oil Is Heading then much higher:ZH- as will stocks and Gold after fed hikes, then initiates QE4

Market News

Don't be so quick to dismiss 'meaningful' Saudi-Russia oil deal: RBC- we aren't. we like to watch algo's front run each other on headlines like FREEZE

Oil slips toward $47 as hopes for producer action wane:RTRS- fundy's do not matter. SA needs ot keep its market share to keep national stability.

S&P 500: Brace For A Big Upmove: Seeking Alpha OPED- we feel that is true, after a sell off

Dow Jones, S&P 500 Futures Little Changed on Labour Day- ignore light volume. what mattered was USD reaction and Jap stocks

The WatchList

PRICECHANGE% CHG GC=F1,336.10+9.40+0.71% SI=F19.63+0.26+1.36% PL=F1,089.90+27.70+2.61% HG=F2.09+0.01+0.63% NG=F2.76-0.03-1.00% CL=F44.97+0.53+1.19% GLD126.57+1.28+1.02% USO10.24+0.18+1.79%

On MarketSlant

- Gold Technicals: Bull, Bear, and Red Flags

- The G20 Photo-Op Says A Lot

- Update-5: Is Gold Delivery Being Stalled by Deutsche Bank?

- Jobs Disappoint- Gold Jumps

Global Markets

Shanghai 3,090.71+18.62 (0.61%)Nikkei 225 17,081.98+44.35 (0.26%)Hang Seng Index 23,787.68+138.13 (0.58%)TSEC 9,181.85+91.72 (1.01%)FTSE 100 6,862.31-17.11 (-0.25%)EURO STOXX 50 3,084.83+7.17 (0.23%)CAC 40 4,549.37+8.29 (0.18%)Currencies

EUR/USD1.1164+0.0014 (0.12%)USD/JPY103.2835-0.2240 (-0.22%)GBP/USD1.3331+0.0020 (0.15%)USD/CAD1.2896-0.0035 (-0.27%)USD/HKD7.7553+0.0001 (0.00%)USD/CNY6.6810+0.0050 (0.07%)AUD/USD0.7632+0.0041 (0.54%)Economic Calendar

DateTime (ET)StatisticForActualBriefing ForecastMarket ExpectsPriorRevised FromSep 610:00 AMISM ServicesAug-54.254.755.5-Sep 77:00 AMMBA Mortgage Index09/03-NANA2.8%-Sep 710:00 AMJOLTS - Job OpeningsJuly-NANA5.624M-Sep 710:30 AMCrude Inventories09/03-NANA2.276M-Sep 72:00 PMFed's Beige BookSep-NANANA-Sep 88:30 AMInitial Claims09/03-265K265K263K-Sep 88:30 AMContinuing Claims08/27-NANA2159K-Sep 810:30 AMNatural Gas Inventories09/03-NANA51 bcf-Sep 811:00 AMCrude Inventories09/03-NANA2.276M-Sep 83:00 PMConsumer CreditJul-$14.6B$16.0B$12.3B-Sep 910:00 AMWholesale InventoriesJul-0.1%0.0%0.3%-

Some thoughts on Rate Hikes, QE and the End Game

Insider's Walkthrough on Trump, Fed Alchemy, Gold, Silver, and DebtIf Gold Eats its Dinner- it Gets a QE4 TreatWhy Gold Bulls Should Want a Rate Hike- Analysis

Good Luck

Read more by Soren K.Group