Recap- Run from the bubbles little girl

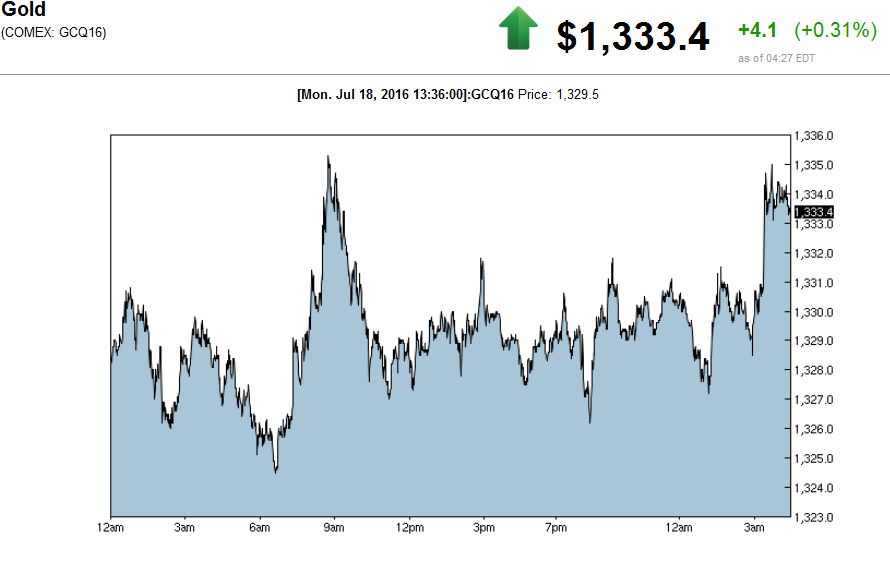

We and our colleagues at Echobay Partners feel stocks are pricing Central Bank stimulus to perfection. Human behavior is not perfect. And the only thing that truly trends is human expectations. The slightest disappointment will cause sell-offs. Cracks are beginning to show in the EU equity markets today. Stocks are off there. Gold is trading $1333.80 up 4.80 while Silver is unchanged to slightly lower at $20.03 last. Copper is slightly firmer. The Dollar is stronger most significantly against the GBP. Crude oil is unchanged and Nat Gas is up 3 cents. Nothing new added to the global turmoil that should be roiling markets. The IMF's LaGarde bizarrely stated that the Turkish Coup failure calmed markets. Headlines below the chart

Gold so far today-market rallies into London Fix

Headlines

- MORGAN STANLEY SAYS US BOND RATES GOING TO 1%:ZH

- EURO STOCKS RETREAT ON RATE CUT BETS ON AUD AND KIWI:BBERG

- GERMANY INVESTOR EXPECTATIONS AT -6.8% VSD +9.0 EXPECTED:ZH

- EU PERSISTENTLY VIOLATES ITS OWN DEBT RULES: BBERG

- ERDOGAN CONTINUES RETALIATION POST COUP ATTEMPT-pics of bound naked soldiers are circulating

- STIMULUS HOPES ONLY THING LIFTING NIKKEI- pic below

- CLINTON FOUNDATION IGNORED BEST PRACTICES- DAILY CALLER

- NINTENDO HAS DOUBLED IN PRICE SINCE POKEMON GO LAUNCH- various. Long antipsychotic meds and ER services

Rainy Day is here

-pic Blooomberg

Markets

Precious Metals

- Gold: 1333.60 +4.30

- Silver: 20.05 -0.025

- Gold vs Euro =4.75

- Gold vsJPY =422.15

- Gold vs GBP +6.94

Energy and industrials

- Copper 224.05 +0.35

- WTI 45.14 -0.10

- Nat Gas 2.75 +0.04

Equities

- FTSE down 0.50%

- DAX down 1.26%

- NIKKEI up 1.27%

- S&P2152 -6.50

- DOW 18425 -26.00

In Focus- written by Vincent Lanci of Echobay Partners

The risk in owning stocks is very asymetrical. We are out of our own positions and looking to buy options for a move lower

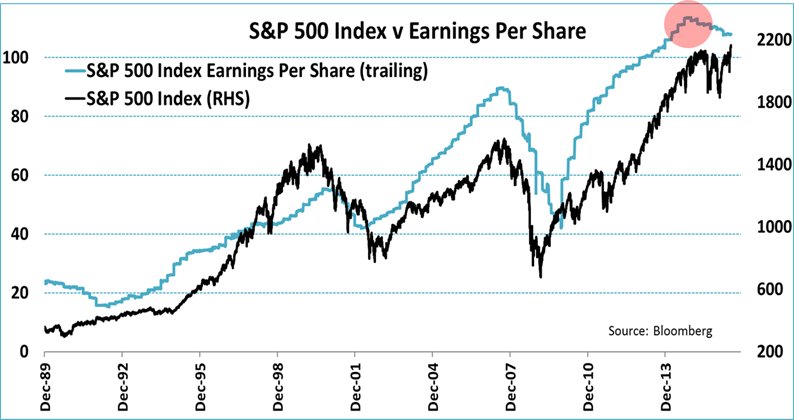

The danger is in being long stocks now.Central Bankers and IMF leaders are beginning to telegraph that no new stimulus is coming. In the least they are flying test balloons to gauge mkt reaction. We believe sadly that the Fed is using stock prices as its barometer to make decisions on rates. Instead of deciding what to do based on the economy, it does so based on stock prices. The economy and stock market are untethered.

Helium and Promises. The MSM now broadcasts the Govt message- HOPE FOR DOPES?

The Fed is the marketmaker now

In short: if the S&P are trading at or below 2000, expect more easing. If the S&P is trading near or above 2200, expect nothing or a rate hike. All markets are pricing more stimulus:

- JAPAN- They have a hard promise of stimulus here. But a higher stock market could lessen the need right?

- UK- Brexit losses have all but been erased, yet the situation persists.

- EU- stocks have all but erased Brexit losses and are largely ignoring the Italian and Irish economic news.

- USA- where bad news is good, and good news is good.

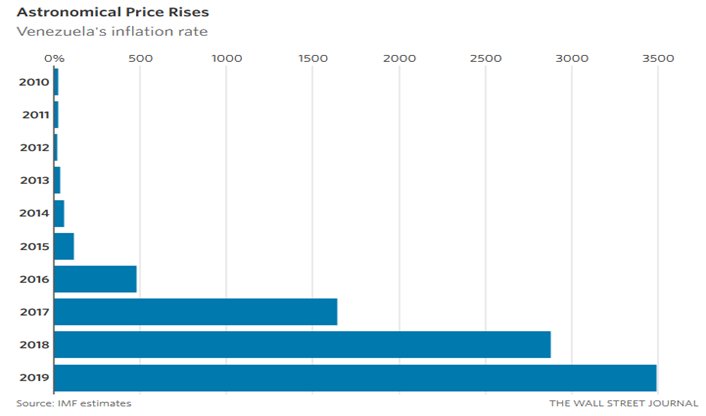

- Venezuela- is in the death throes of inflation. The western world will want to keep that quarantined

This is your brain on Stimulants

Our lizard brain says "If a market is reacting positively on bad news, beware. It will really rally on good news." Keep that axiom in the back of your head. It is still true All of radical Islam could become pacifists overnight, and the millions of Syrian refugees masking the terrorists moving into the EU could go home right? But we doubt that. In Contrast: The equity markets are priced entirely on the expectations of Central Banker assistance. They are pricing in "infinite punch bowl". The next 200 points in the Dow may be up. But the next 500 to 1000 we feel will be down. We fell strongly the risk is asymmetrically to the downside now. The market is saying "risk 1 to make 5 here". Stocks will be sorely disappointed on any shortfalls in expectation management with regards to easy money. We are in a Fed nanny state.

Bankers to World: You manipulate, we "manage"

- The chances of a rate hike are handicapped at 90% + in the US on the CME FedWatch tool.- despite the global turmoil, stocks are rallying. So pros are betting on a rate hike.

- The IMF is extolling the strong reaction on the Turkish coup- Turkey's future is chaotic as Erdogan makes a power grab. But it's all good today right?

- The UK did not cut rates last week despite Brexit woes- and says it will if needed. what if they don't cut?

- The headlines out of Japan are all based on hope for stimulus to raise stock prices- the Nikkei is pricing zen -like connectivity to its central bankers

- The S&P is trading at all time highs- for the fed to cut or maintain easy money now is to admit failure in its policies. Besides, it has no monetary room on the downside. Only fiscal QE remains. They need to reload their monetary gun for the next time they need it.

Earnings have rolled over. But stocks are on all time highs- whats a manipulative Govt to do?

The Supranationals will welcome a stock selloff.

The US Fed has no tools in its box left except for words. It cannot lower rates. If stocks go lower, it can only use words to talk markets back up as it did last week. When the words fail, it must work with the Treasury on a QE program. The cure for high prices is high prices. And the cure for high stimulus needs is high stimulus expectations. If the stock market does not selloff soon on the hints coming from global sources, the fed will outright say it to us. Then after a 200 pt SPX handle drop they will trot out the FOMC 4 horsemen again promising all is well. We are just being played because the public believes still that high stocks means good economy. The Fed knows better. High stocks means opiated masses that can be told " look at the stock market. It's not our fault you cant afford any."

The Trade For Us

Echobay uses a proprietary indicator that accurately predicts an increase in real volatility using implied vol as a part of its calculation. It does not predict direction. We rely on directional analysis outside our tools. But when the signal trips, we will buy hedged call-spreads on the SPX. This will make money in a sell off. And it will minimize losses in a rally from volatility changes. We don't recommend this for non professionals. Just buy puts if you agree. But think for yourself. Our time frame is 0-30 days. Our trigger is digital and only predicts violent movement. We just don't see 500 higher before 500 lower.

Gold

We also do not see this as necessarily beneficial to Gold. Margin calls make losers liquidate winners to cover losing positions too. But if Gold washes out with the stock market, that is a buying opportunity. We already have inflation... the good kind. The "bad" kind is under control as the Fed would have you believe. We dont believe they can steer money flows away from inflationary hedges much longer.

-Vincent Lanci for Echobay Partners, LLC -The opinion above is our own.

other reading

Life after the Gold Standard in charts

Fed to itself: we cant create jobs by spending money

- Soren K

Read more by Soren K.Group