GOLD TO DROP TO $200. - Wait, What?

There is a potential ban on import of gold into India. If this happens, there is a high probability of a one-day drop in gold that could reach $200- Arora Report

UPDATE: 12:47

Indian imports are a huge deal

On average, India imports about 700 tons of gold each year. This is an enormous quantity. An abrupt reduction in demand of this magnitude, if there is a ban on Indian imports, will be a major shock to the gold market.

What to do now

At the Arora Report, we caught the rumor of a potential ban very early on. We took this rumor seriously and incorporated it in our models that gave the sell signal in gold right after the U. S. presidential election. However, as a reputable firm with a large number of readers, and not wanting to fan the rumor, we did not publish it.

Even though the media in much of the Western world is mostly still oblivious to this major potential development ahead, we now feel comfortable publishing this for three reasons. First, the premium on gold being sold in India has jumped to $12 per ounce, the highest premium since November 2014. We see this jump in premium as tangible proof that the rumor is taking hold and affecting gold price.

Second, Indian Bullion & Jewellers Association has informed its members that they are hearing from certain circles of a potential ban on gold imports. Subsequent to our earlier information, this has now become public. Third, social media in Asia is abuzz with these rumors.

Coming Soon: More Volatility?

December will be a potentially eventful one for Gold. A Fed Hike is on the table for starters. We are concerned that even with a 100% chance of hike factored in, that Gold will sell off again post hike, as opposed to stablilize. Then there is Europe. Brexit, Frexit, Italy's referendum and so forth. All these risks to the EU and the EURO should buoy Gold, but they are not. Alarm bells are going off for us. Sure as a vote approaches, Gold may rally, but that is the "hot money" that we do not like. The casino types betting on Gold.

Then there is Russia. It has just bought more Gold at higher prices (again) than where we are now. Russia is an emerging market in many ways. Their CB tactics are not as experienced as the West. Think of France and England in the 1990's doing what Goldman recommended to them. That is Russia now.They are poor money managers, and have a history of default to boot. Selling Gold to raise cash is a risk there. Simply not buying is like selling given the market's dependency on their demand in recent years.

Russia's Most Recent Purchases are the most in 15 years and they bought the highs, again.

Our only hope for the next quarter is that the selloff is in part due to the world again thinking that central banks are effective.They may be in control, but they are not effective as they once were. This is why governments are moving to ban cash, limit on-demand Gold liquidity, and in general herd the public in denial of their contributions to the problems we face. Then the events of December will be potential eye openers and rekindle the original forces behind Gold's rise. for our part, we don't want to own Gold in a crisis. We want to own it in an inflationary situation. When Gold and the USD rise in a crisis, in the end, Gold sells off. For us, Gold and Silver are best in a slow and steady 1970's inflationary denial market. And that is what we believe is happening right now.

India is a Problem for Gold

"I cant think of any country where people have deposited their own money but cannot withdraw it. This alone is enough to condemn what has happened," former Indian PM Dr. Singh

Editor's Note: We can think of a country now. In fact, Cyprus also fit that bill Dr. Singh. in reality, Singh is in favor of cash banning, just not a fan of how it was executed.

Modi Mocks His Own Populace

In a dig at critics of the currency ban, Prime Minister Narendra Modi today said the corrupt were upset because they did not have "time to prepare." Implication of this is the complainers are corrupt. For the record, criminals would not be complaining. They'd be ducking their heads and moving money out through other means. it is the trusting masses that are complaining.

Cash Lost, Gold is All that Remains

To be sure, the removal of cash benefits Visa, Mastercard, and banks. That would leave Gold as the only competitor for portable wealth storage. And Gold was demonetized in 1971. But, starting in 2004, Gold began to be re-monetized and compete with other currencies.

But now, Governments want to do a "Bretton Woods" on Cash. That is, demonetize CURRENCY in favor of electronic money. And Gold will gain alternative interest if that happens. It is quite possible that reasons to not own Gold will then begin to manifest themselves as a result of Governments wanting it out of the way of their plans to finish globalizing markets. We've talked about it enough in previous posts.

Further, India is now potentially levying a tax on undeposited money.

Sources said the Indian government was keen to tax all unaccounted money deposited in bank accounts after it allowed the banned currency to be deposited in bank accounts during a 50-day window from November 10 to December 30. The Indian paper adds that there was no official briefing on what transpired in the meeting that was called at short notice as Parliament is in session, further suggesting that the Modi government is indeed panicking, and scrambling to come up with legislation on the fly to demonetize India's mostly-cash rich population.

There have been various statements on behalf of the government ever since the demonetisation scheme was announced on November 8, which has led to fears of the taxman coming down heavily on suspicious deposits that could be made to launder blackmoney.

Officials have even talked of a 30 per cent tax plus a 200 per cent penalty on top of a possible prosecution in cases where blackmoney holders took advantage of the 50-day window for depositing the banned currency.

Reportedly, in the government's scramble to sequester cash, they plan to bring an amendment to the Income Tax Act during the current winter session of Parliament to levy a tax that will be higher than 45 per cent tax and penalty charged on blackmoney disclosed in the one-time Income Disclosure Scheme that ended on September 30. As for those blackmoney holders who did not utilise the window, they would be charged a higher rate which could be close to 60 per cent that the foreign blackmoney holder had paid last year.

Full article HERE

Avoid Leveraged Gold Now- Keep Your Powder Dry

In light of the obvious trend in government behavior and the need for central planners to centralize (that's what they do), the attached marketwatch story citing India as the reason Gold sold off, and may touch $200 therefore has merit.

Whatever the reason, if Gold does drop it will be bought by Central Banks. In a massive Weak Hands to Strong Hands spoof, the 1% will have then pried the 99% of a large part of their gold. There is precedent. Volatility brings opportunity if you have the liquidity.

Our point here is: If you own Gold, we'd note leverage is very risky now. And make sure it is not viewed as part of your next 90 day's cash needs. This will also put you in a position to buy on extreme, and short lived moves in markets. We will continue to spec from the short side with tight stops, but are looking for a big washout to rotate out of stocks and into metals for our investment portfolios.

In an increasing interest rate environment, borrowing is dangerous for funds. Even if real rates are negative, leverage is going to continue to shrink at the Fund side. Combined with redemptions, that makes for impatient longs slow to embrace deleveraging adn panickingto justify fees. More bad trades.

Wait for Funds to be Short Gold in Levered Fashion, Then Buy it. Right now, there are still long and leveraged funds.

Gold and the Modi Effect

The following is not our own opinion on why Gold dumped on election night. We saw Druckenmiller and copycatters selling. And Druckenmiller sold a week after Soros his mentor. Why Druckenmiller sold is still largely unknown, but we feel it was opportunity related.

Nevertheless, what follows must be taken seriously. Even if the reason is wrong, the possibility of a precipitous fall is there. We see it as well. The daily charts are now infecting the monthly with their bearish sentiment. This is a recipe for a washout on the back of some catalyst, real or manufactured.- SK

India, not Trump, is the real reason behind the crash in gold prices- Arora Report

As MarketWatch reports, back in August 1971, President Nixon shocked the world by taking the dollar off the gold standard. The dollar had been on gold standard since Bretton Woods Agreement of 1944. The biggest bombshell for gold investors in 45 years since Nixon announcement may be ahead. That bombshell is a potential ban on import of gold into India. If this happens, there is a high probability of a one-day drop in gold that could reach $200.

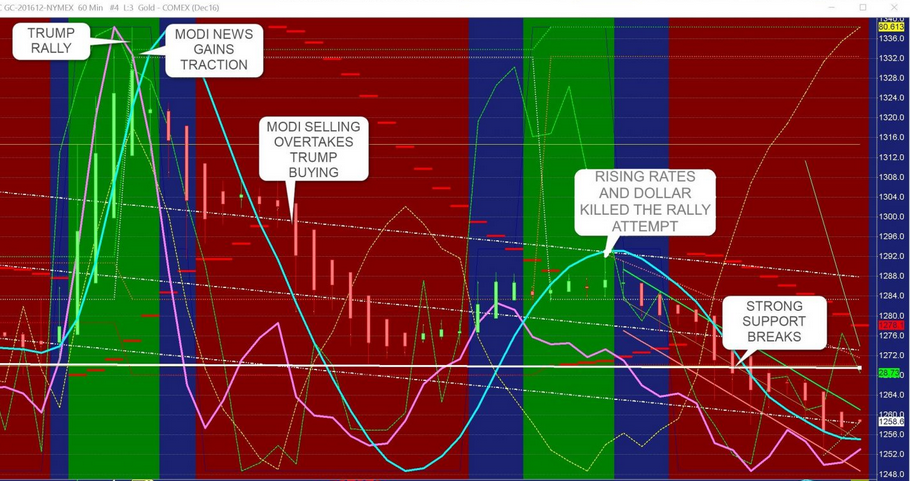

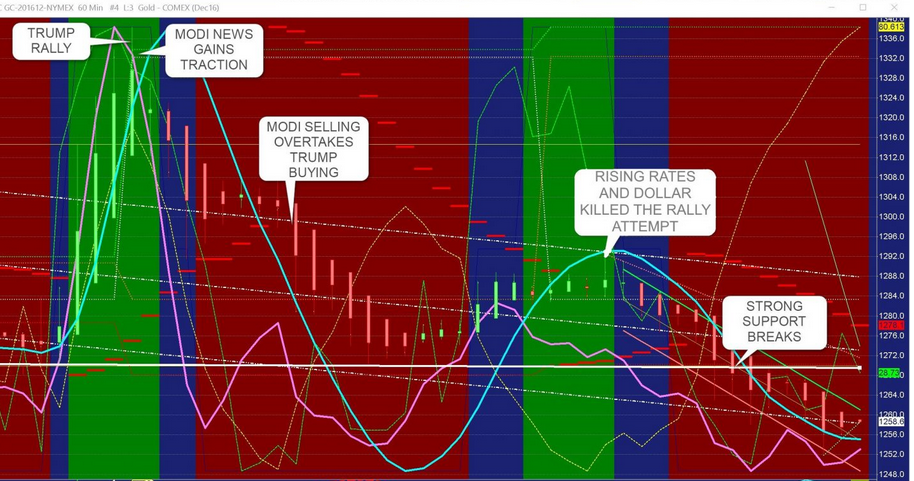

The chart shows how Modi selling overcame Trump buying...

In case you missed it. Cash is dead. Since August we've been warning of it. Next is Gold. If Arora is right, then a swoon to get the public to sell is just what the manipulators want.

Previous Articles on Cash's Demise

India, CITI in Australia, Norway, Denmark, and Sweden (it's a done deal in our opinion)

- Why You Should Pay Attention to the US War on Cash

- KC Fed paper on HOW to abolish cash-August 2016

- Rogoff and the Fed's plan to end cash here- September, 2016

Good Luck

Got Silver like JPM?

Read more by Soren K.Group