Jobs, Rate Hikes, and Oil's Market Correction Warning

It wasn’t just that Friday’s February new jobs came in at 235,000 versus expectations of 188,000 that raised the eyebrows of economist bean counters. Something more important is happening. We are already seeing a change in the profile of the first President Trump jobs report. And much of the change is due to the insistence by Trump in getting rid of the Obamacare penalties and mandates that have kept many small companies under 50 full-time employees and loaded up with part-time employees.

By getting rid of the penalties levied against small companies and individuals depending on whether they had company-provided insurance or self-insured policies or a certain number of employees, owners of small companies are betting that they can now start shedding their worst part-time employees and keep the best part-time employees and crank up their hours worked. And I would suggest these same employees are glad to have the extra hours and potential overtime hours rather than holding down multiple part-time jobs.

That’s it — already, this month’s jobs report shows that a much greater percentage of jobs are trending from part-time to full-time. And this is exactly what President Trump was counting on. Companies are betting that they can now allow many more of their employees to work far more than 30 hours a week without worrying about the financial impact of having them considered full-time employees. And whether a company has 50 employees or 65 employees will also no longer matter and will not force these smaller companies to face the heavy cost of an employer provided health care plan.

Jobs Report Final Nail for Rate Hike

On Friday’s better than expected jobs report, the stock market gapped up at the opening in celebration — then stumbled all day long after that, even going into the red for a bit before closing slightly up for the day. Clearly, trading animal spirits want to keep the Trump rally going, while more introspective speculators realize that we are surely going to see another interest rate hike when the FOMC meetings are held this week — and almost every time three interest rate hikes have occurred in the past we have seen equity markets stumble.

On the other hand, we are likely to see the Federal Reserve’s dealer banks continue to support the markets before and after their FOMC meetings this week. This is typically always done to make the public feel that the Fed’s actions are essentially neutral when it comes to the financial markets. But following the FOMC meetings where rate hikes have occurred we frequently see a strategic switch in trend by the dealer banks, who are responsible for the majority of trading volumes these days. Truthfully, it is almost like the banks have agreed together on how many hours / days to support the markets and exactly which hour / day to hold off on support and then race to take up bets on the downside. Of course, this is illegal — but the dealer banks seem to pull this off over and over again. But somehow, no one ever lays charge that the banks are in collusion to have the retail / public absorb the most “pain” when markets change direction.

Crude Oil Warning

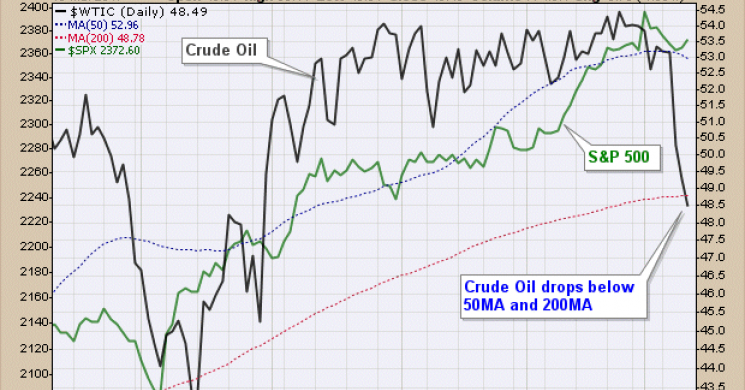

Left out of most financial discussions this week was the precipitous drop in crude oil prices. The week started with crude oil prices above $53 a barrel and above its 50-day moving average (50MA) and its 200-day moving average (200MA). By Friday’s close, crude oil prices had dropped almost 10% in only five days and ended the week below its 50MA and below its 200MA.

Read more by Soren K.Group