Even though the job numbers printed lower than was expected (160k versus 200k), it seems to us that more attention should be paid to wage growth, which came in at 2.5% year over year. For the last five years, average hourly earnings growth has been more or less flat, averaging 2.1% year-over-year, but has averaged 2.5% since last December.

This is more important than most people realize since increased wages should lead to;

- More consumer spending

- More business profits

- More tax revenues

- Less government borrowing

- Positive data for the FED to use as justification for a rate hike

That last point, will have a positive effect on the Dollar, and a negative on equities. We doubt that the FED will raise rates in June, but it could raise as early as July.

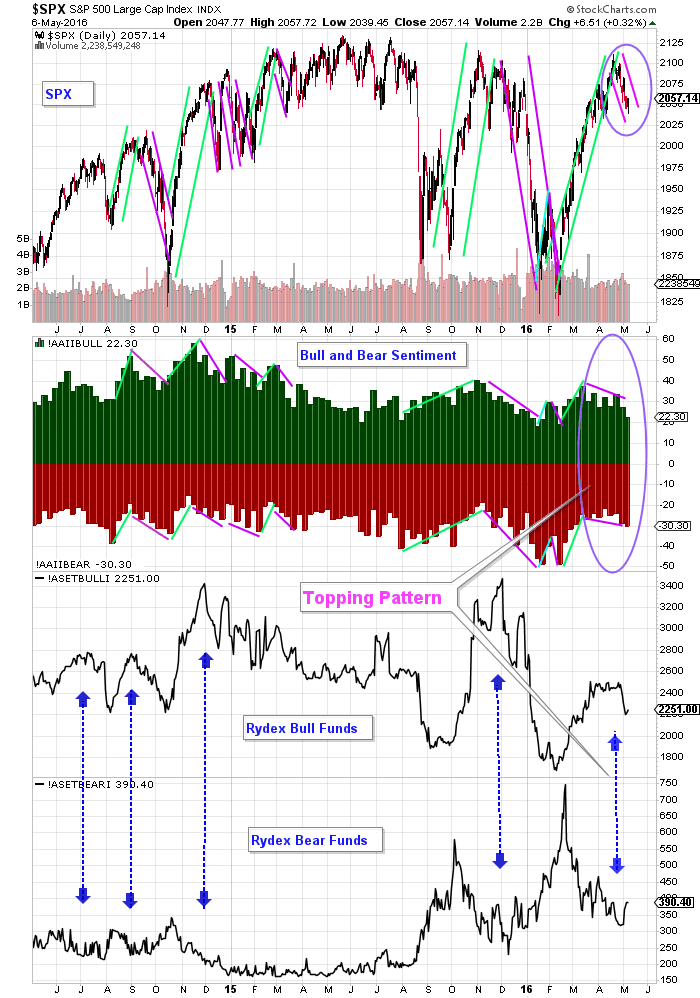

Last week we pointed out that the S&P 500 seemed to be forming a near-term top. Part of our reasoning comes from the fact that over the last two years there have been seven near-term tops that formed on the S&P. In all seven cases, there was a spike-up in the Bull Sentiment (pink arrows), and a spike-down in the Bear sentiment (Blue arrows) which preceded the tops themselves by between one and six weeks. Also in every case, the Bull Sentiment went down (pink circle), and the Bear Sentiment went up (blue circle) at the S&P maxima. The graph below shows how the recent high from two weeks ago (blue rectangle) fits as a near-term top.

The Rydex Assets are also signaling a topping pattern that confirms the Bull and Bear Sentiment signal (see the chart below). There is still, however, a serious possibility that the 2100 level will be retested before the downtrend continues. The fact that the S&P managed to close above the unchanged mark for the year and its 50 sma/ema, tells us that there is still some buying left, although not enough to make new all-time highs.

There are no guarantees that history will repeat itself, but historically based probabilities is all we have to guide us.

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.

Read more by ANGTraders