We Were Wrong- CME Isn't the Only Stock That Benefits From Rising Rates

Last week we explained how exchanges like CME with interest rate products were an inflationary hedge. Enter DB1, a key EU exchange for bond trading. Keep in mind that people run exchanges, and therefore they have management risk. They also have regulatory risk. They are no substitute for inert yellow and white metals that can't lie, cheat, and steal. But they are in our opinion a necessary component of a portfolio seeking to hedge against inflationary risks. Metals, Exchanges, TiPs (sort of), businesses with inelastic demand for their products are all part of a good plan to preserve your wealth's buying power. Which stocks you pick is up to you.

Seriously, these are simple, easy ways to protect yourself. Stop reading the 'END OF THE WORLD' nonsense that wants you to click and buy Gold on the spot. And you should consider that the info offered here is free, and "you get what you pay for", which is valid. It is also why our group writes under pseudonyms, considering we have exchange valuation experience and clients in the area (not CME or DB1)

We write this stuff to plant seeds for you to do your own work. And it is fun for us. Never do what we do blindly. But seek what we seek: sensible economic decision rationales. If you want deeper ideas or tactical insights, that isn't free. -Soren K.

Exchange NewsWire

Feburary 16, 2017

http://erdesk.com/newswire.html

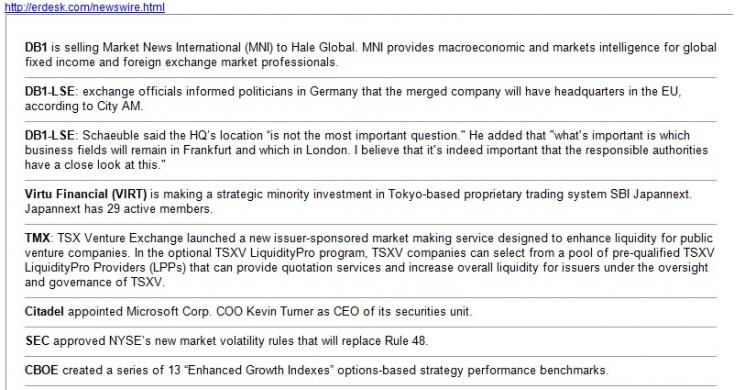

DB1 adjusted 4Q16 EPS rose 25% y/y to €0.97. Adjusted results exclude one-time items such as merger related costs. Net revenues increased 12% y/y to EUR 619 mn with Eurex revenues up 14%. Clearstream revenues up 13%, Xetra revenues down 4%, Market data and services revenues up 11% and net interest revenues up 55%. Adjusted operating costs increased 3% to €343m. DB1 will increase the annual dividend by €0.10 to €2.35 per share.

ENX shareholders approved LCH Clearnet acquisition. Transaction is contingent on completion of merger of DB1 a LSE. Reported by Reuters

HKEX will introduce its planned RMB currency options on Monday, 20 March 2017.

SGX starts a public consultation on whether a dual class share (DCS) structure, where certain shares have higher voting rights than others, should be introduced and if so, what safeguards should be considered.

DB1 CEO, Carsten Kengeter, denies charges of insider trading amidst an investigation. Reported by The Trade

Bursa Malaysia will do changes in its organizational structure with the goal of improving performance, efficiencies and become more competitive in its regional marketplace.

SEBI is evaluating plans to allow commodity brokers and stock brokers to operate under the same umbrella company, according to Business Standard

BSE SME platform receives 200 draft prospectuses for IPOs. Reported by Business Standard

NEX: EBS BrokerTec selected Nasdaq’s SMARTS surveillance technology for its US treasuries, FX and repo markets.

NEX: EBS and BrokerTec revenues increased 15% on a constant currency basis during the fiscal third quarter ended December 31.

Citadel Securities has hired James Edwards in a FICC sales and relationship management role.

Sign up for ERDesk's Newswire HERE

-no popups, no spam, no nonsense.- Soren K.

Read more by Soren K.Group