If You are Bullish Gold, Buy Silver

Volatility is not risk if you understand bankroll management.

It is an opportunity to separate leveraged fools from their money- VBL

Summary

by Vince Lanci of Echobay Partners

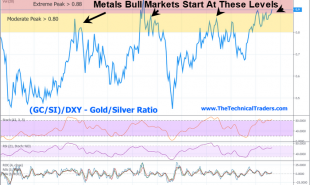

"If you are bullish gold, buy silver" is an axiom I'm fond of repeating. Silver is more volatile, which is why in the short term it over reacts relative to Gold. The converse is true. If you are bearish Gold, sell Silver. (Which is less successful if you don't understand the industrial component of Silver.) But I digress.

This axiom is a positive one for Silver people, but actually has its roots in cynicism and manipulation years ago. We find it helpful to drill down on concepts before adopting them.

We now believe that Silver is the way forward because there are big forces with too much to lose if it does not keep a reliable ratio with Gold. You must stomach the higher volatility is all that matters. We simply believe the "rule" no longer applies to Silver only as a function of its higher volatility. We believe it applies in the long term as an investment now.

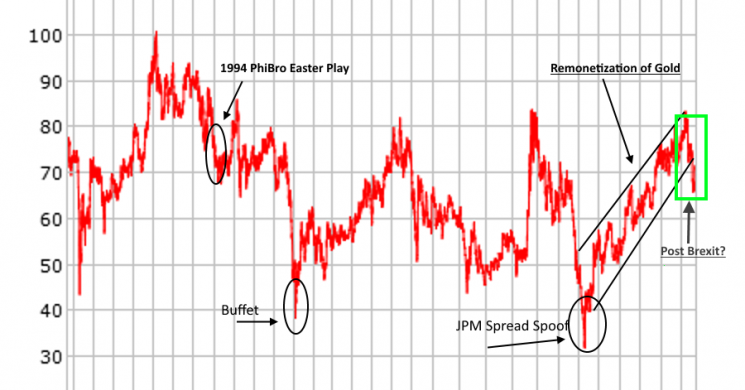

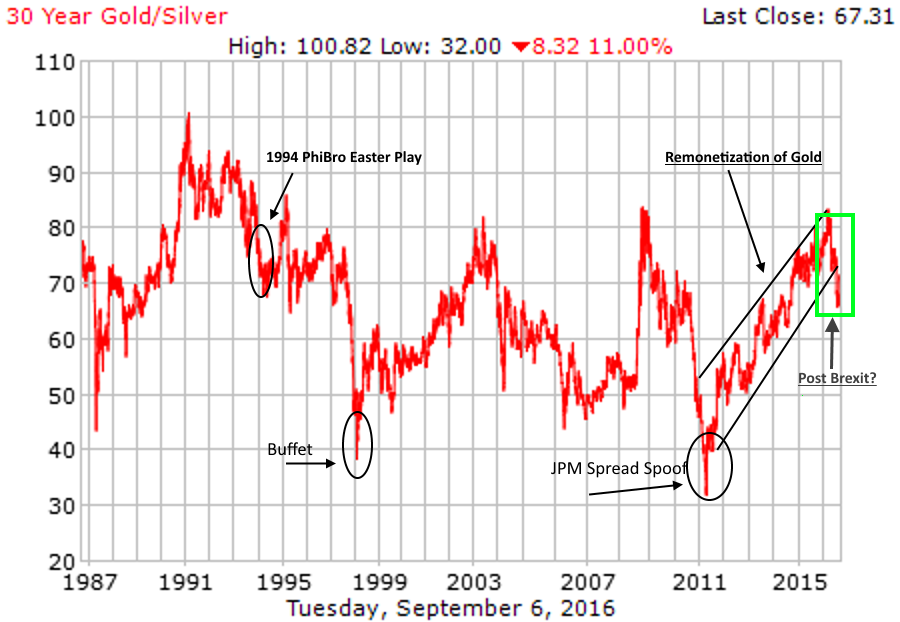

Why Did the Gold-Silver Ratio Collapse post Brexit?

This does not make sense, but it stares us in the face

Historical Gold/Silver Charts HERE

First lets look at the phrase's cynical roots in the context of how Bullion Dealers used to ( and still ) operate:

The 1990's: Buy Silver if you are Bullish Gold-and don't need your money

The root for this axiom is not in a love for Silver. It is how Bullion Banks herded clients into metals. In the 90's Silver was a broken market. PM investors hated it. Every day we heard the stories while Swiss Bank shoved Calls down our throats hedging their LATAM producer business.

Losers trade Silver:

- Hunt Bros were robbed. The Comex will cry foul and the gov't will force liquidation- no argument. they did it again to Buffet in 1997

- Silver is a waste product of nickel production now- Yup, pour acid on mined nickel and out pops Silver. Leech mining

- Film is dead- there is no use for Silver anymore.- Yup. I remember looking at potential silver uses like it replacing chlorine in swimming pools , rationalizing my long calls.. not good

Silver Was a Roach Motel

The result is Silver had a wider bid-offer on a huge contract not suited for retail. And finally, it had non-continuous liquidity, aka markets that flaked from 1 cent wide to 10 cents wide for no apparent reason. This last part killed me.

In Option Terms: If the volatility of volatility was large, then why was this market not leptokurtotic? Answer: it was capped and manipulated. We tested PDE , Jump diffusion and Monte Carlo models. Nothing came close. The stochastic proccesses of Vol offered a huge arb. But you couldnt get out. Silver was not a market then. You were either a "player" or a sap. It still may not be one now by that measure.

Silver was indeed a roach motel in the 90's. If J. Aron (GS) owned the gold mkt, Republic and HSBC owned the Silver market. And good luck getting an exit price when you needed one. For you energy traders: Ever have to trade Heating Oil without Morgan Stanley or BP involved? Same idea.

But George Soros and PhiBro (Andy Hall) changed that in 1994. Then Warren Buffet and PhiBro (Andy Hall) showed the way in 1997. More on that below.

The Mechanics of Silver Manipulation- Short Con

- When Gold rallies it did so from origin interest or from Banks releasing recommendations to its "special" clients

- Silver could lag in early stages of any Gold rally, as it did often in the 90's.

- Bullion banks had pent up precious metals demand on its books. But Gold had already run up

- The Banks would often say, " Silver is the better value here, we like it and are long"

- And that was the end of the rally

How Does Buying Silver Kill Gold Rallies?

Think of Silver as the cheapest means at the time to get PM exposure. As hedge fund money allocated to Gold, Silver was left behind initially. What follows was witnessed almost monthly. We watched from our option trading pits as the real life events that determined RSI and stochastics played out in front of us.

Here is how it used to play out typically:

- Big Money Funds Buy Gold

- Origin Order Flow Buys Weakness: So the Paul Tudor Jones' of the world would get long Gold and some of that flow was handled by the Bullion arms of US Banks

- Information would leak. Sometimes by the buyer, sometimes by the Bank, usually by both

- Gold rallied before (Banks buy) during (Tudor buys), and after (see below) the order is filled

- Tier 2 Funds Enter

- Either Banks would get a call from the tag-along funds or the banks would call them with a "tip"- "pssst, Tudor is buying"

- The Chesapeakes would buy less than Tudor. and the execution was likely less than perfect- but they beat the vwap!

- Banks also start to sell some of their own longs to the Tier 2 Players to lock in their flow trading profits

- Momo funds enter

- At this point, momentum signals would go off and trend chasing funds would start to buy strength, enter Trout and others

- But during these days Gold priced supply, not demand. (Market Profile) Which means there were no trends, just price discovery for readily available supply to hit the market

- The Kiss of Death- Buy Silver

- Now you have all sorts of undercapitalized over-leveraged players looking to get in

- They can't afford to buy Gold to get proper exposure for their capital

- The Banks oblige them: "Buy silver, it is undervalued on a relative basis"

- phone clerks used to snicker and announce to the floor "Trout is buying, game over"

- And that was the top. For there was no retail to sell to.

Silver Educates a Reluctant Chartist

So when my colleague at JPM used to say, Buy Silver if you are bullish Gold, he was right. But he also always followed it with, "But it's a quick trade, don't take it home." So I started watching the RSI and Stochastics as a non-believer in technical analysis. I had befriended Mike Caricato (Badge LUCK), who was a technical mentor to me. We swapped technical learning for option stuff. His nickname was "Lucky". But he was just good. Between he and my backer and best friend Chris Barone** (CBAR) I learned to respect technical analysis as a charting of the flow I watched.

And the JPM guy was right. In fact, Silver itself was an RSI non-confirmation signal of Gold's overbought status at the time. Less money invested, moved more than Gold that day. And a sign that any fund that had PM money to invest was done allocating. Next up, Banks gunned the stops below left on their books by their clients. Tudor? He was long gone by then.

Short Silver becomes a crowded trade

At some point the pendulum had swung too far the other way. Miners were hedging production not yet mined to stay in business. They relied on the ability to borrow above ground Silver in HSBC, Republic etc vaults to make delivery if they had to. Funds did not take delivery, instead always rolling to the next month and getting killed on the contango. During this time I took delivery once on a few contracts to see if the contango would snap. It didn't until after my FCM forced me to retender. It did work later on. But the Silver prophets were George Soros, and Warren Buffet.

Why Did Soros and Buffet Play Silver and not Gold?

- Central Banks did not own Silver

- In 1994, it was widely held that Soros started his accumulation in Gold and was told "stop" by the Fed- so he turned to Silver with PhiBro

- Warren Buffet after rescuing PhiBro and its parent company in 1994 makes his own play on Silver. Based from what we saw on Silver miners sloppy cash flow mgt. The Gov't requested he not take delivery. He obliged, lending the miners who did not have Silver to deliver back to them at a 40% cost for a year based on the bacwardation.

Today: Buy Silver if you are Bullish Gold

Because Gold will be:

- Confiscated where it can be.-When China Confiscates Gold- Get Silver like JPM

- Taxed where possible.- LATAM countries

- So called Physical ETFs flaking on requests for bullion as in the Xetra-Gold fund case.- do you want a free toaster instead?

- Prohibited from being stored in JPM safety deposit boxes- a CYA in case a Gold count is taken?

as of April 2015, JPMorgan Chase sent a letter to all renters of safe deposit boxes, specifying a new agreement that they must sign if they wish to continue to rent a safe deposit box. It includes this key phrase:“Contents of the box: You agree not to store any cash or coins other than those found to have a collectible value.”

- Silver will not be Confiscated

- And the major longs in Silver will do what they can to keep a stable ratio between the 2 metals so that if Gold ever becomes Gov't domain only, and a ratio is fixed for Silver at that time, (or not), the data will back it up.

Why not Platinum?

By all means, PGM's fit the bill. But they are very soft and actually lose mass overtime just by being handled. Hence they aren't used in coins.What's the exit strategy?

A Former NYMEX Trader Explains "The Mechanics Of Silver Manipulation- ZH

“If You Are Bullish Gold, Buy Silver” (for different reasons then)– Kitco

Twitter: Vince Lanci @vlancipictures

Good Luck

** brother and mentor and optimist. You are missed

Read more by Soren K.Group