Gold: Now What?

In January I provided an overview of the geopolitical catalysts that I believe will be important to keep an eye on.

I mentioned that elections in Germany and France would add to the political risks that the euro, a currency that is structurally flawed, faces.

The global war on cash will also play an important role in the how the dollar performs.

The ability of the Fed to make good on its promise to raise rates in 2017 will provide headwinds for precious metals prices. The sooner we get that out of the way, the better.

While the European Central Bank and the Bank of Japan continue running aggressive quantitative-easing programs, the Federal Reserve has promised three hikes in 2017.

We can debate whether the economy is strong enough to justify three rate hikes this year, but after Friday’s jobs numbers, which showed 235,000 new jobs added, there’s already a new debate as to whether four rate hikes might be justified.

If the major stock indices continue to establish new highs — and they will — there will be many calling for an accelerated schedule of hikes to contain asset bubbles.

Every rate hike will lead to a surging dollar — even from today’s levels — that will catch many off guard.

How high could the dollar go in 2017?

Some context is important. Below is a chart from macrotrends.net of historical data showing the broad price-adjusted U.S. dollar index published by the Federal Reserve.

The index is adjusted for the aggregated home inflation rates of all included currencies.

The price adjustment is especially important with our Asian and South American trading partners due to their significant inflation episodes of the 80s and 90s.

That surging dollar will limit gold’s rise in the first part of 2017.

Interestingly, there was a report out of Europe that European Central Bank policy makers are considering their ability to tighten before a bond-buying program comes to an end.

The official line out of Europe is that Draghi’s accommodative policies are reaching their limits due to the pickup in global growth.

I suspect that the change of heart is also due to fear of future rate hikes in the U.S. leading to the capital flight out of Europe into the dollar. Both scenarios will take some shine off of gold for a few months.

I’ve repeatedly stated that the major U.S. stock indices, the dollar, and gold will make new highs simultaneously... but not yet.

My hope for 2016 was that we closed below last year’s closing of $1,060 per ounce. For technical reasons it was important to close beneath that in order to get the momentum necessary for the next leg up. That didn’t happen.

In the 1970s, we saw a near-50% decline from $195 in 1974 to $103 in 1976 before gold headed for the $800s in early 1980.

If we get a similar pullback from the all-time closing high — near the $1,900 level — that puts us around $950.

I wanted to see that low in 2016. The failure of gold to break out coupled with the fact that gold didn’t completely break down below that $1,060 level tells me we will see weakness.

Weakness that will persist until we break that level and then — and only then — will I believe that we’re in the midst of the breakout rally everyone thought this latest two-month rally was.

Couple that with my prediction about the dollar and it’s pretty clear there is another $150-$200 to the downside in gold this year

I don’t discount the possibility of breaking the $1,000 level for gold and seeing silver back at the $14.00/oz level.

Now the good news. We’ve just experienced a similar decline from the $1,370 level to the $1,130 level, we threw in tax-gain/loss selling at the end of 2016 and yet the best juniors rebounded very well once tax-loss selling was over.

Juniors with catalysts and the cash to get through 2017 will perform well because the bottom line is that the mid-tiers and majors are failing to replace their reserves and that failure will lead to successful exploration companies being able to demand a premium for discoveries.

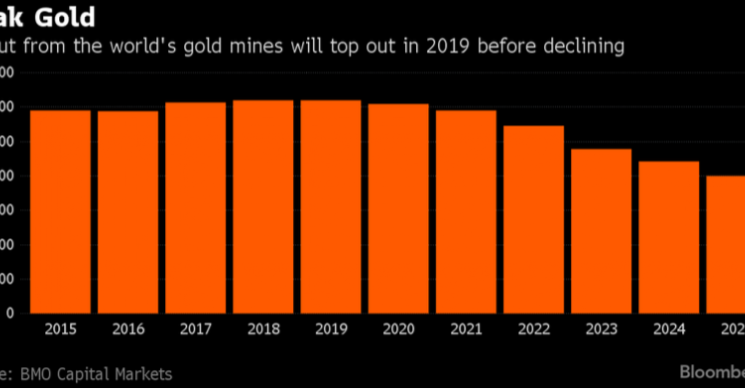

Bloomberg recently published a piece called “Gold Miners Are Running Out of Metal: Five Charts Explaining Why.”

It outlined that the amount of gold discovered in 2015 was down 85% compared to 2006.

It showed the effect the recent bear market in metals prices has had on miners and capital expenditure spending. The industry went from approximately $4 billion in 2012 to approximately $2 billion in the first half of 2016.

Reserves for major gold miners are the lowest in a decade. They need to replace reserves or they’ll cease being producers.

Lastly, the article showed that output from the world’s top gold mines will peak in 2019.

The combination of a stronger dollar and a weaker gold price — in the short-mid term — will provide some once-in-a-generation opportunities to add the best producers and explorers.

Getting the best entry points is critical to maximizing the profits and minimizing the risk.

We’re about to get another one, maybe the last one before an epic run. It’s never fun to go through a consolidation period unless you’re holding and buying the best names.

Let the fun begin.

Read more by Soren K.Group