For Gold, The Game Remains the Same

Gold can drop or rally $400 and still be within its value range. Gold has a higher volatility than other assets because it has a smaller float. Nothing has changed for Gold except price. The World is still in the throes of a deflationary spiral. The behavior of Central Bankers should serve as the "tell". They are struggling with what to do next if QE does not work as they hoped. Price is not value. Value is average price over Time. Their solutions to complex problems is to add more complexity. Simplifying things and taking their medicine is not an option. Thus it will end badly-V.Lanci

Case in Point

Greenspan admits bubbles are difficult to see due to the complexity of human nature

The Solution to Greenspan's worries is more Complexity

The Good News is today's Fed stands on the shoulders of giants like Alan. We needn't worry anymore when a bubble bursts, for when they do the Fed can print money & bail-out the big banks, boosting asset prices and worsening inequality. Bubble problem solved!- vbl

h/t @rudyhavenstein

Recap of Today

- US: It would seem the next actionable juncture is the Fed hike which we believe is coming. Chances were in the 65% area before today's Jobs number for a December hike. Now under 50%

- FISCHER: PEOPLE AREN'T EXCITED ABOUT GROWTH PROSPECTS

- WSJ: JOBS NUMBER ENSURES NO HIKE IN NOV

- WSJ: DECEMBER NOT A SURE THING- Hilsenrath

- EU: Deutschebank went from saying it does not need more capitalization to saying it does in 48 hours.

- DEUTSCHE BANK AFFIRMED BY S&P; OUTLOOK REMAINS NEGATIVE

- Eurozone Should ‘Commit Realistically’ to Greece Debt Relief: AP

- UK: GBP Flash Crash likely explanation

- Someone pushed the mkt lower gunning for stops in a thin market

- HFTs jumped on and exacerbating things (complete with rumors of a "broken algo"

- Barrier Options were triggered ( creating shorts in the market who began covering)

- China: Focus is on Debts and non performing loans now as the economy slows

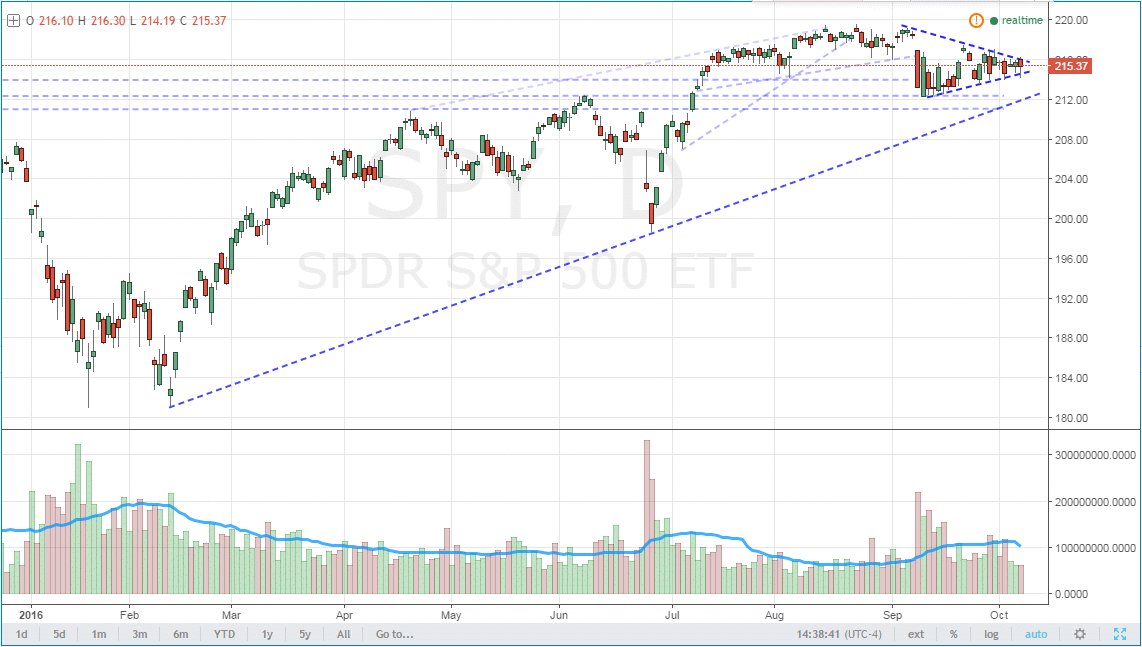

Jobs Number Didn't Do Much ot the S&P Either Way

But it played Havoc with Gold

Overview

by Soren K.

We reached out to a couple people in our circle for some color on recent events.

For now, any rally in Gold now will be met with selling. Trapped money above is looking to get out. Any rally during this phase of the market is going to be met with sellers front running other sellers. It is logical given the speed with which Gold collapsed this week. The trapped longs have to clear the market. Do not hope for a V-shaped bottom. Be suspicious if there is one. The purpose of this collage of opinions is to let you hear it from others. Nothing has changed.

Gold May Have a $50 Move Coming: Trade Idea

UPDATE: Before we start, the week ended on some good news for Gold. We got a non-confirmation on the RSI. We had hoped for this in our previous post today. This means a long trade is safe to put on right now with a stop out of 1242 print or a 1248 settle. From an oversold position, if $1250 holds, a rally to $1300 before selling back off is not unreasonable.

1- The Quotable Rickards

We did not speak with Best selling Author Jim Rickards. But he has been blunt of late on his twitter account and we couldn't help notice his macro view was similar to our own, if much better explained. We sense an increased confidence that things are unfolding as he has been calling for all along. The Yuan's addition to the SDR being the most recent milestone he has discussed. Perhaps this is the beginning of the War on Gold he has alluded to. It may not be a political war yet, but it certainly is shaking out believers. But that has not shaken his own beliefs.

On Fed Intention: Aim is to raise rates so they can cut in next recession, but do so without causing a recession is tricky business. (Our Aug 26 post concurs)

Comment on Recent Market Action: An inflation endgame can still have a deflation detour. I focus on the endgame.

On Central Banker Fear of Deflation:The stronger the deflation, the harder government works to cause inflation.

Deflationary pressures are worse than We Know- The whole world is heading to zero in fits and starts. Deflation is like a vortex out there.

On Gold's Purchasing Power Increasing- No, it will have the same purchasing power. Everything else will have 90% less purchasing power.

On The Failure of QE- QE is just one tool in the toolkit. There are many others like SDRs.

Fed Rate Hike chances- They can and they will. The only analytic issue is: when are conditions right?

Follow Jim on twitter: @JamesGRickards

2- The Ramblings of an FX trader at a Major Bank Who is scared to death

We edited and tried to organize the comments more cohesively from emails and I.M.s today. Pardon the typos adn frequent use of CAPS- Soren

Overview

Something is really changing here- and I do not know what.. but the end game is STILL INFLATION. DEFLATION WILL NOT BE TOLERATED BY CBs (the EU less happy about inflation, but is on board)

How we are getting there is a bunch of moving parts that may not be moving linearly, but are not contradicting my “Inflation or Bust” theory

Background

1.In August- the BOJ says it will taper its purchase of its own bonds to steepen the yield curve and help its banks make money again

a.What so many funds were hoping for happens!

b. And then the JBGs start to rise back up after the selloff? - were just too many shorts playing the bet and now covering

c. Japan is happy- weaker yen, stocks up etc.

2.SDR adds Yuan- should have little immediate effect on USD- but marks a new era not easily undone

3.DB crisis starts VERY IMPORTANT FOR GOLD

a. Previous EU Crises were Bullish for Gold: -BREXIT, Greece, Italian bank worries, the USD and Gold benefitted

b. EU firms seek to hedge DB risk by swapping EUs for USD- but not Gold this time

4.USD climbs on fed hike talk and EU dollar demand- should be net neutral for Gold

5.FED continues to talk strong dollar- completely ignoring the EU issue

a.Conclusion- there will be a hike to reload their gun

b. they need it before next crisis

c.There will be another crisis- possibly instigated by their next hike

6.Gold goes down- makes sense so far… but not that much!

a.Likely a Forced Fund Liquidation was the Culprit and others got stopped out- leverage

b.Banks ran them in too

What Has Changed Other Than Price

Circumstantially? Nothing

- Deflation fears are bigger than ever, especially with China slowing down

- Gold Got crushed, its “safe-haven” status earned in past EU crises severely damaged- is exactly what the CBs need to accumulate more

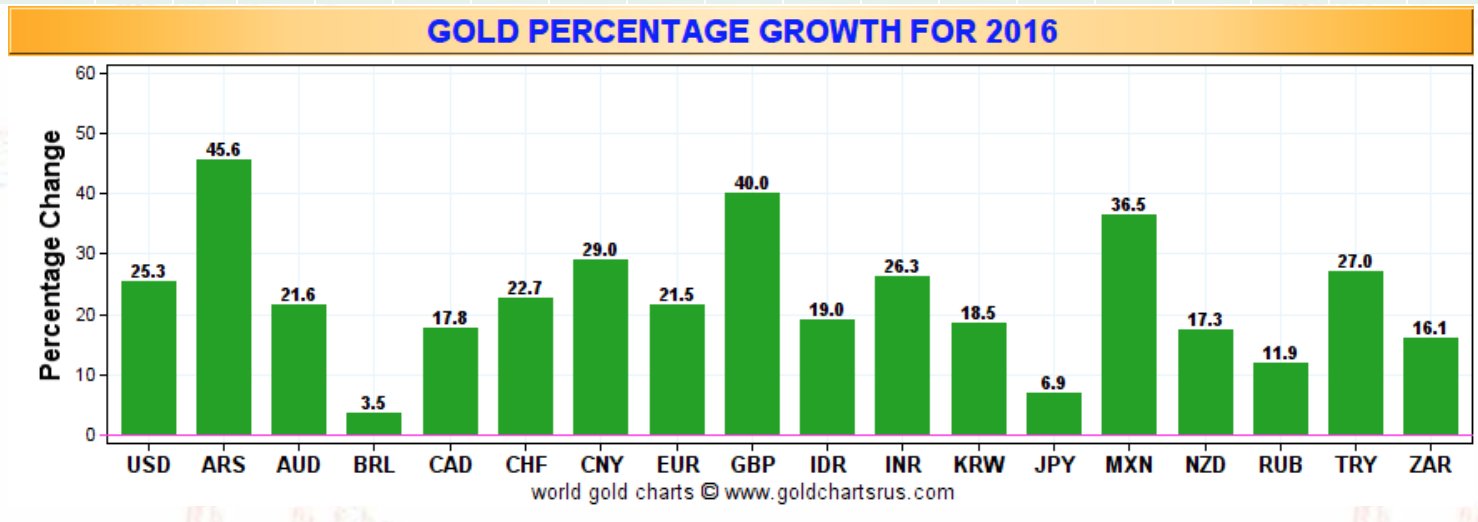

- Gold had been up against every currency this year- this was not a USD thing it was a “Gold” thing- Gold was becoming money again, adn the CB'ers can't let that stand

Gold Right Before the Fall- Nope, can't have that.

Confidence in QE as a Tool is Waning

US Stimulus 2008-2016

- Fannie/Freddie:$7T

- Federal deficits:$10T

- State/Local deficits:$3T

- QE: $4.7T Total $24.7T

= 156k Sept 2016 Jobs - Success?

- QE has not worked as planned by Central Bankers-deflation is still the thing they fear most and is out there

- QE is showing signs of being reduced as a policy tool in Japan- a sign that deflation is conquered and inflation is in check? No, circumstances have not changed- something else is coming

- But the EU is threatening to buy everything with QE now- DRAGHI TODAY: IF WARRANTED, WE WILL ACT BY USING ALL THE INSTRUMENTS AVAILABLE WITHIN OUR MANDATE

What's Next if QE Doesn’t Work?

- More QE- see Draghi above

- Fiscal stimulus- spend money on infrastructure

- Helicopter money- bypassing banks and giving money directly to people in the hopes they spend it

- Permanent Debt Monetization – what they are doing now, but never intending to stop doing it, has the effect of making government debt more like equity

Permanent Debt Monetization- If government bonds that have come due are held by the central bank, the central bank will return any funds paid to it back to the treasury. Thus, the treasury may 'borrow' money without EVER needing to repay it

- SDRs- One World, One Money is coming

- Can add gold to it- but they wont, undermines the goal.

- Can demand it be used in international trade- they might

- Do not even contain the currencies that back them- Fiat on fiat??

- They are assets that contain the "right" to call the currencies listed- ETFs for Gold?

"If I were a country in the SDR, I’d be stockpiling Gold just in case the SDR plan fails"

Based on these headlines, Can you argue with him?

On Gold and the Coming Inflation

- In the end- gold will retain its buying power

- The markets will do their best to shake out the weak longs first (now maybe).

- When inflation hits, all Forex will drop vs the Gold

- If deflation hits first- gold will get killed, but stocks will get killed worse

- This will bring the necessary inflation afterwards

Final Word: "You gotta be nuts to not start investing in gold/silver a little at a time like this"

3-DeutscheBank on Stopping Deflation

These guys were clearly setting the table for their own needs. But, they were right in the sense that the current QE is not enough. Here is Deutsche Bank's elevator pitch for why helicopter money should be next:

- We have evolved to the point where familiarity with QE breeds acceptance, while unfamiliar ‘helicopter money’ policy, unfairly breeds contempt.

- Compared with the scale of QE liquidity dropped into financial institutions, piling up in the form of excess reserves, the exante and expost calibration of Helicopter money can be considered almost surgical. Helicopter money legacy issues are miniscule compared with the QE overhang of liquidity in the system, and a costly and bloated Central bank balance sheet, which is so difficult to reverse.

- QE forces a substitution into riskier assets, which is another way of saying it inflates and distorts the price of risky and less risky assets, with implications for all balance sheets, and inter-temporal economic decisions. Helicopter money is less likely to distort every asset price in the economy, when compared with deliberate financial repressive policies like QE and negative rates.

- One of the big criticisms of helicopter money is that it is open to political abuse and that the coordination of fiscal and monetary policy, threatens Central Bank independence. This is less of a worry if there is a clear institutional framework whereby the Central Bank has the final say on whether to participate in any helicopter scheme or not, and they can ‘right size’ the stimulus.

- If one has to be cautious about Helicopter money it is less about whether it can be successful, and more about how in these times of excessive demand management, any effective tool is apt to be used to the point of abuse.

- Helicopter policy that successfully supports growth (with contemporaneous rightward shifts of the IS and LM curve) inclusive of favorable multiplier effects, will likely temporarily drive nominal interest rates higher, and the question for real interest rates (that with nominal rates is a key FX driver) is whether inflation expectations rise more rapidly than nominal rates.

- Carefully calibrated and contained Helicopter actions, by an independent and historically credible Central Bank (not an oxymoron), would likely have a contained impact on inflation expectations. This is especially true, if Helicopter money is pursued in emergency deflationary circumstances. As such, any initial kneejerk selling of a currency when a G10 country pursues a measured Helicopter solution that is befitting of its large disinflationary output gap, is likely to be a medium-term buy the currency dip opportunity.

- Because Helicopter money is less directed at using currency weakness as a core transmission mechanism than QE or particularly negative rates, Helicopter money should be more, rather than less acceptable to an international community worried about currency wars.

4-Finally, Our Own Assessment from Aug 26th still Holds

Updated comments in italics

We are not sure and are never married to the order of events. Being able to create tangents within a framework of concepts is easiest and keeps our thought process least biased.

- Japan will start the ball rolling. Stocks and Gold will rally there in yen terms. Japan started this global deflationary cycle. They should be the first out of it.- happened, but not enough

- China will have to further accelerate its Yuan depreciation against the USD. Remember their reaction to the Brexit vote? China potentially lost a favorable link to the EU via its relationship with the UK- They did this. and are feeling more recessionary pressures now. It isn't enough. Now that they are in the SDR, expect more decoupling to fight deflationary pressures

- The UK and EU will also then consider more QE and helicopter money. Their reasons will be different, but their actions will be the same. For the EU it will be to rescue Italian banks. For the UK, it will be to help their exporting commerce.- ok, call it Italian and DB crisis, and Greece, and Spain. Expect a push for united fiscal policy if that doesnt work. The UK did lower rates post their Brexit analysis, and will do it again. ironically to stop the GBP from going lower

- There will be a "whiff" of inflation but no-one will pay much attention- Stagflation is what they are calling it so far. higher medical and rental costs but no economic growth

- The US will be forced to capitulate on its own Fiscal stimulus citing the damage done to our economy by a strong dollar etc.- not until the US has finished exporting its own deflation it seems, and loading its gun

- Stocks, bonds and Gold will rally with Stocks outperforming everything in what should be a massive blowoff top for them and Bonds- if deflationary collapse happens first, all will fall (maybe even bonds). Gold will fall more as people clamor for liquidity in dollar form. but then the CBs will buy everything except Gold. Stocks, bonds will rally as they short their own currencies adn replace them with stock and bond holdings. Then Gold goes up as Bonds go down

Good Luck

Read more by Soren K.Group